China: Growth aids trade battle

Stronger-than-expected Chinese growth, coupled with fiscal and monetary firepower, will help authorities in trade negotiations as the tariff battle goes up a notch

Stronger growth will help China, but trade isn't the only factor in US talks

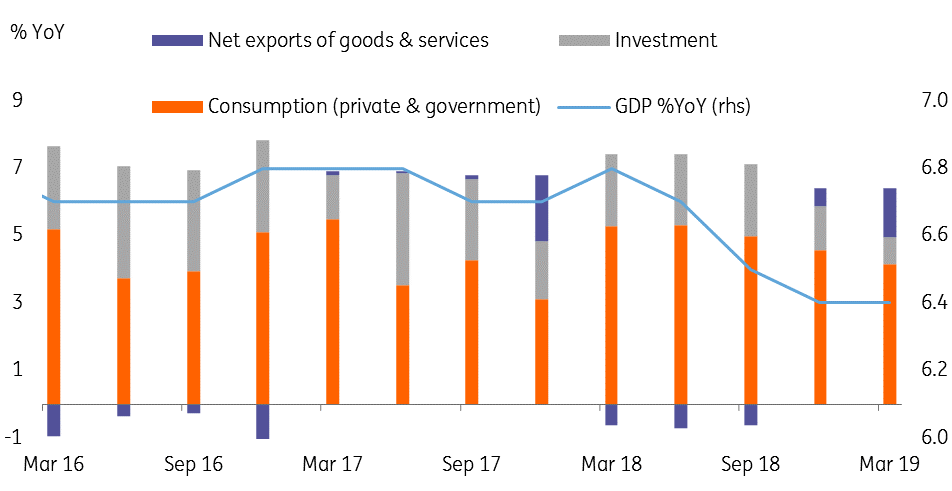

Last month, we noted that China has enjoyed a recovery created by fiscal stimulus and monetary easing. This was demonstrated by the recent GDP figures, where first-quarter growth matched the 6.4% YoY pace seen in 4Q18. Stronger-than-expected economic growth should provide the Chinese government with extra chips when it comes to renegotiating the terms of a draft trade deal with the US.

For China, the cost of confronting the US is more broad-based than trade

The latest turning point in the trade negotiations appears to have been triggered by disagreements over a reciprocal penalty system. But for China, the cost of confronting the US is more broad-based than trade. The US, along with some of its allies, have aired concern over the use of Chinese-made 5G equipment. Equally, tensions have risen in the South China Sea. If China successfully renegotiates, then it has the potential to reduce some of these risks.

If China renegotiates successfully then the potential risks on 5G exports and geopolitical tension around the South China Sea will be reduced.

But let’s not forget, China’s negotiation chips come from fiscal stimulus and monetary easing. Domestic consumption, as reflected in retail sales, is not as bright as it seems. China may need even more fiscal stimulus and monetary easing to support a possible long-running renegotiation.

Chinese GDP is supported by “consumption” from government

Recent actions show willingness of government to easy policy further

On the same day that the US revealed China has started renegotiating, the Chinese central bank, PBoC, restructured the system of required reserve ratios for small agricultural commercial banks. Though the extra liquidity released is a small drop of CNY280 billion out of an M2 money supply of CNY188,941 billion, it is a symbolic move that shows the willingness of the Chinese government to ease even further.

We keep our forecast for USD/CNY and USD/CNH at 6.75. But we have revised the 2Q and 3Q forecasts to 6.75 and 6.80 from 6.85. A big yuan depreciation when the trade war escalates could easily send an incorrect signal to the market that there are risks of capital flight. We have therefore kept our forecasts of USDCNY and USDCNH in a narrow range. We also keep GDP forecasts at 6.2%YoY in 2Q19 and 6.3% for 2019.

This article forms part of our Monthly Economic Update which you can find here

Consumers have been careful when it comes to spending

Tags

May Monthly UpdateDownload

Download article

10 May 2019

Good MornING Asia - 13 May 2019 This bundle contains 4 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).