China: Upbeat on activity data

We are optimistic on China's retail sales, industrial production and investment activities in April. We are not particularly worried about the impact of trade tensions on China's growth, as these concerns will most likely speed up investment in the country, which could offset potential losses on exports and related activities

Retail sales growth to be robust

We expect China's retail sales growth to be 10.0% in April, slightly softer than 10.1% in March, supported by higher energy prices, healthcare services, clothing and catering. In other words, we expect consumption to be robust.

And there is little reason to think this will change in the coming months. Though trade tensions are escalating, and we do not see the risks going away any time soon, consumption is unlikely to be affected if the trade threat does not affect the job market.

In fact, we believe that China could increase workers in high-tech sectors. That means demand for labour could shift from manufacturing to R&D. This could even support average wage growth and therefore spending.

Investment growth to come from real estate, but R&D will play a bigger role

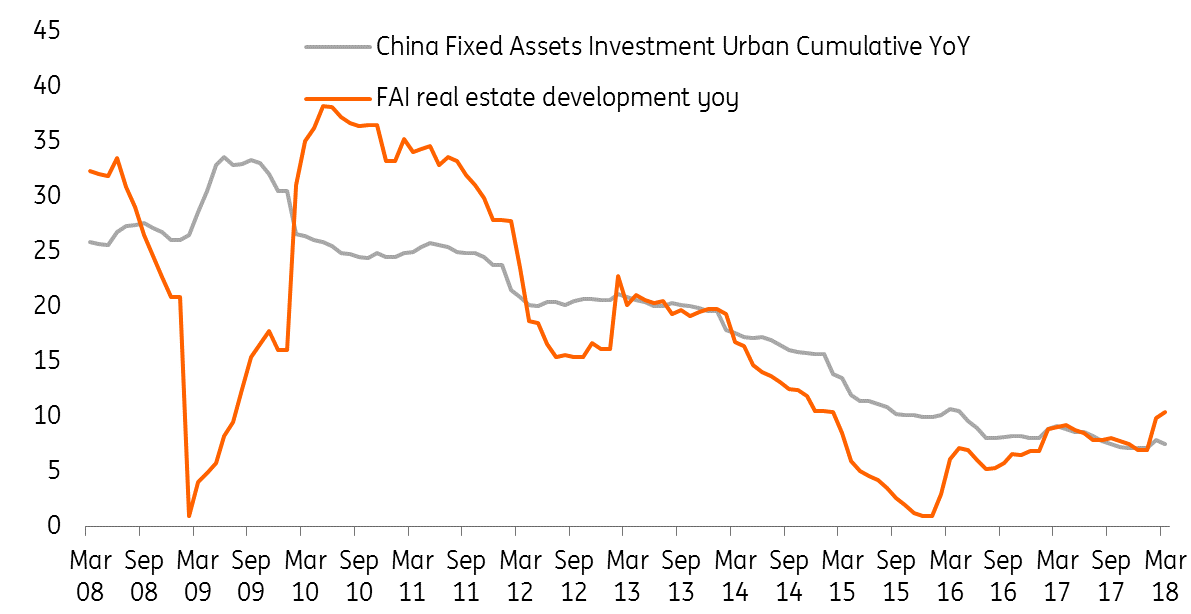

The property market is hotting up again, and we expect this to support fixed asset investment growth of 7.7%YoY in April from 7.5% in March. It will mostly be residential and retail properties that have supported the market.

In the coming months, investments in R&D in high-tech manufacturing will boost fixed asset investments in China. This will continue until the country has reached a stage when it can produce its own high-quality semiconductors and smartphone operating system. That could mean a few years of high investment growth in these areas.

Real estate supporting investment growth

Industrial production growth back to normal

After a short month in March, April's industrial production should resume to normal capacity, and due to a low base last year, we expect industrial production to grow a bit faster at 6.3%YoY in April compared to 6.0% in March.

Trade tensions have not yet had a material effect on industrial production in April. But we believe that some businesses may begin to consider moving some production lines out of the mainland. The good news for China is that this takes time. So the immediate effect on manufacturing in the coming months should be negligible.

But the complicated supply chain could create uncertainty in production and investment activities. Decisions may be delayed if businesses take a "wait and see" approach. When decisions are delayed, production activities will also be delayed.

Fortunately, China is finding ways to be become self-sustained in high-tech areas faster than planned (the plan has been by 2025). This could support some production activities.

Investments are likely to offset the potential loss of net exports and related activities from escalating trade tensions. Therefore we keep GDP growth forecast unchanged at 6.8% for 2018.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 May 2018

Good MornING Asia - 14 May 2018 This bundle contains 5 Articles