China: Expect a long march

We think the authorities will increase fiscal stimulus, as well as cut interest rates and the reserve requirement ratio (RRR) to support growth, in what is becoming a difficult environment for Chinese companies in the trade and technology sectors

China-US tensions have spread beyond trade

China-US trade tensions deteriorated quickly after President Xi requested dignity in the trade talks, and both sides increased tariffs on each other. The US raised tariffs from 10% to 25% on the existing $200 billion goods, and China has increased tariff rates to 10% to 25% on $60 billion goods imported from the US.

Away from trade, US added Huawei, the Chinese pioneer in 5G, into its ‘entity list’, which deters US companies from buying and selling goods and services with Huawei. The Chinese government reacted by creating its ‘unreliable entity list’ and may reduce exports of rare earths. Further, the Chinese government interviewed multinational companies that have businesses in China. The tension between the two countries has extended from trade, technology to broader-based businesses.

President Xi calls this increase in tensions the ‘new long march’. In early June, China signalled that it will increase its fiscal and monetary stimulus to support the economy during this new long march.

China is expanding infrastructure investment further

On fiscal stimulus, the government has issued a document that encourages the issuance of local government special bonds to fund infrastructure projects, and it also welcomes financial institutions to invest in those instruments. The planned amount of issuance is around two trillion yuan. With the help of financial institutions, this amount can be leveraged to around two times, according to our estimates. That means infrastructure investments could increase to around four trillion yuan.

Together with tax and fee cuts of another two trillion yuan, the fiscal stimulus package may total six trillion yuan.

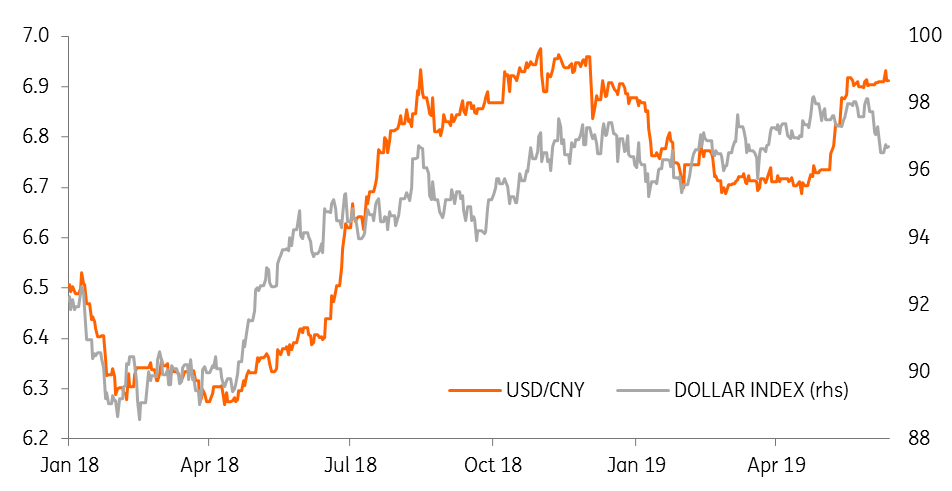

USD/CNY has diverted from the dollar but yet to pass 7.0

China is prepared to cut interest rates and the reserve requirement ratio

On monetary easing, the PBoC governor, Yi Gang, has claimed that the central bank has many tools to inject liquidity in the market. These include cuts in interest rates and reserve requirement ratio (RRR).

Combining fiscal and monetary easing capacity, China should be able to withstand a long pause in the trade negotiations while maintaining GDP growth above 6%, which will largely be stimulus-driven, unlike normal growth driven by business activities determined by market forces.

Yi Gang also mentioned briefly that no particular level of the USD/CNY is more important than other levels, signalling that the 7 handle of the USD/CNY is not a boundary set by the PBoC. But we still don’t believe the PBoC will take the big risk to allow USD/CNY to pass the 7.0 handle. Last year, the PBoC didn’t allow the USD/CNY to pass 7.0, because the central bank worried that it would create market chaos. Today, with the background of a trade and technology war, the central bank may be even more cautious not to let the exchange rate create chaos in other asset markets. Moreover, as we show in the chart, a depreciation of the yuan has no positive impact on trade.

Yuan depreciation hasn't helped trade

We have revised our FX forecasts

As a result, we have revised the USD/CNY and USD/CNH exchange rates to 6.90 by the end of 2019. We also believe the central bank will cut 7D policy rate twice, each time by 5bps, with cuts the targeted as well as broad-based RRR by two times each.

We maintain our GDP forecasts at 6.2%YoY in 2Q19 and 6.3% for 2019, as we believe that the tough stance on trade will be balanced by stimulus measures.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

June monthly updateDownload

Download article

14 June 2019

What’s happening in Australia and the rest of the world? This bundle contains 10 Articles