China’s economy is not in a Great Decline but a Great Transition

China's near-term challenges and long-term uncertainties are plentiful, but the widespread pessimism towards the Chinese economy and markets feels excessive. We think the country's in a necessary transition rather than in any long-term decline. Understanding the challenges and timescale is key for investors

China's economy has reached an important crossroads

China's economy has reached an important crossroads after undergoing one of the most impressive growth miracles of modern history. In rapidly moving financial markets, participants are understandably focused on short-term trends and developments. But it's crucial to sometimes take a step back and look at a longer time horizon when it comes to formulating a big-picture strategy, not least in terms of asset allocation.

The short-term challenges facing China are well documented and are discussed extensively; the real estate sector, weak confidence, and local government debt are the three major issues that usually first come to mind. These are serious concerns for the shorter-term outlook and markets often judge policy by whether there is tangible progress on these fronts.

The market has settled into a state of excessive pessimism

But we think the market has settled into a state of excessive pessimism. And that's understandable given the numerous doom and gloom media articles on firms reducing their China market exposure or exiting altogether. However, it is important to look at how the economy arrived at the situation today and what needs to be done in the long term to ensure sustained growth.

A significant part of the policy focus is on ensuring the economy transitions in a direction which will allow for sustained long-term development. Chinese markets have been discussing the development of “new productive forces”, coined by President Xi as a guiding theme for this economic transition.

Why China needs to transition its economy: growth drivers of the past are fading

The key factors behind China’s growth miracle are, to varying extents, losing steam.

We identify six key drivers behind the growth miracle over the past three decades:

- Economic reform and opening

- Industrialisation

- Urbanisation

- Globalisation

- Demographic dividend

- Increased use of leverage

Economic reform and opening up

Arguably the most important driver of the past few decades, China’s economic transition from a closed state-planned economy toward a more open and market-driven one, was a major force for growth via foreign and private sector investment and trade.

However, the easiest reforms and opening up procedures may already be over. Further measures including State Owned Enterprise (SOE) reforms, RMB currency internationalisation, and market liberalisation will impact various special interests and can have spillover effects on existing policy levers. As such, the next stages of reform and opening up will be more challenging.

Industrialisation

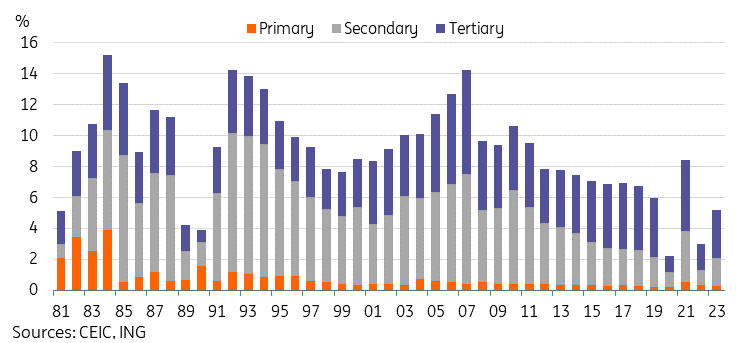

Industrialisation drove massive growth as China became the World’s Factory. The secondary industry driven by manufacturing and construction was the primary driver of GDP for much of the 1980s through to the early 2010s.

However, the industrialisation process is now more or less complete, and China’s manufacturing industry has matured, the era of rapid growth has concluded, and now many industries are facing an overcapacity problem.

The tertiary industry's contribution to growth overtook the secondary industry in 2014 and has led growth since.

Contribution to GDP growth by industry

Urbanisation

China underwent the fastest pace of urbanisation in human history in the past several decades, going from under 20% urbanisation in 1980 to 66% by the end of 2023. This process drove huge growth in economic productivity and created new demand for housing, infrastructure, and services.

There is now extensive debate on whether China has already reached peak urbanisation, but most would agree that, at the very least, its pace will be slowing from now on.

Indeed, policymakers have primarily pushed the theme of "people-focused new urbanisation", which is centred on increasing the quality rather than the speed of urbanisation and includes urban-to-urban migration rather than only migration from rural to urban areas.

China's urbanisation is slowing

Globalisation

China was one of the biggest beneficiaries of increased globalisation in the late 20th to early 21st century. It became the world’s largest exporter and benefited from foreign investment and technology transfers.

However, in the last decade, the rise of populism and anti-globalisation sentiment raises the question of whether we have already moved past “peak globalisation.” The Covid pandemic also further accelerated this process as have geopolitical tensions, causing China-specific headwinds such as trade tariffs and sanctions.

In a pessimistic outlook, we could see further decoupling or the more politically palatable “de-risking” from China.

However, even in a more optimistic outlook where global cooperation resumes, China’s stage of development compared to past decades means that the best days of globalisation as a growth driver are behind us; technology transfers and investment flows are now much more bi-directional.

Global trade growth and China's share of it have both fallen in the last few years

Demographic dividend

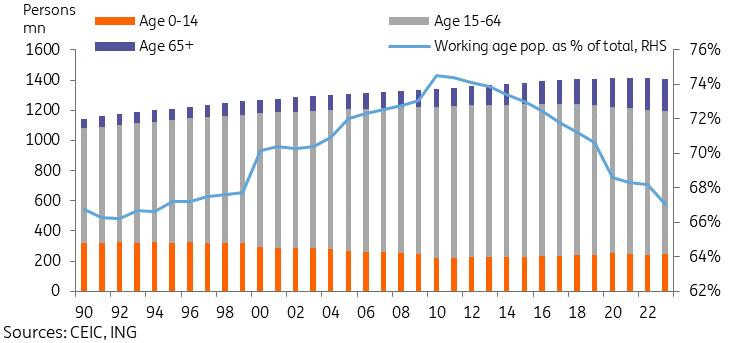

China benefited from a cheap, large, and youthful labour force during its growth miracle. A combination of the One Child Policy of 1979-2015, as well as socioeconomic and cultural shifts, led to lower birth rates and an ageing population.

Additionally, China is now facing the middle-income trap as wages are no longer the most competitive. Southeast Asian economies have already attracted some manufacturing reshoring due to more competitive labour costs.

Despite losing some competitiveness on the low-end "cheap labour", there is still an ample supply of cost-competitive and hard-working white-collar workers. Many Chinese firms in competitive industries featured a famous "996" work culture - 9am to 9pm, 6 days a week, which is in part made possible by an imbalance between the supply of highly educated youth and the availability of higher paying quality employment opportunities.

China's working age population is declining as the population ages

Increased use of leverage

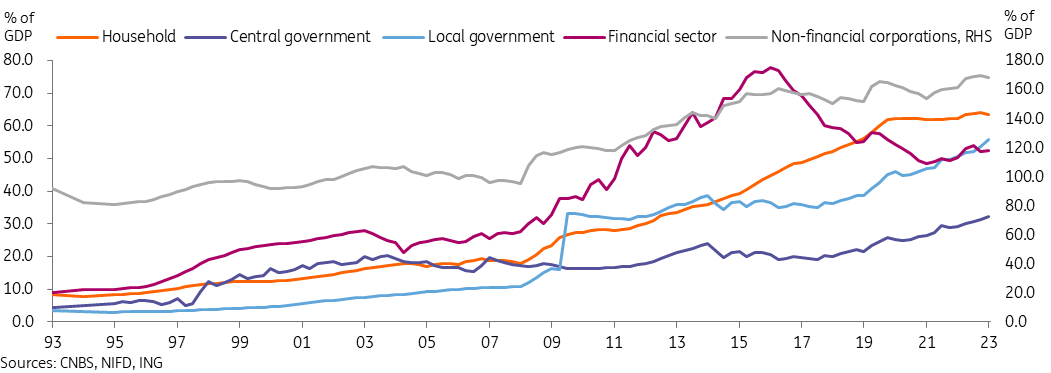

A major part of rapid growth was the liberalisation of the financial system, which allowed for a significant increase in debt, both in bond issuance and loans.

The 2009 “bazooka” stimulus of some 4-trillion RMB was an example of such leverage. As a result of heightened leverage, investment was a major contributor to growth. This leverage ratio stabilised around the mid-2010s as deleveraging took priority but rose again during the pandemic.

Taking on more debt in the near term is a suboptimal but manageable option, but the question of long-term debt sustainability means that the rapid growth of leverage, which helped drive growth in the past decades, is unlikely to continue. Furthermore, the "low-hanging fruits" of leverage-fuelled growth, namely large-scale property and transportation infrastructure projects, are largely gone at this point.

China leverage ratios have surged in past decades

Out with the old, in with the new?

As these key growth catalysts weaken, many stakeholders of the old economy have become pessimistic. Some believe that China is—or soon will be—undergoing a period of “Japanisation,” where the economy falls into a Lost Decade thanks to an asset price bust and confidence trap.

China must look to new areas for growth

China must look to new areas for growth if it is to move into the next stage of its development. We are currently in the process of a major economic transition from “growth at all costs” to “high-quality growth.” Policymakers have placed great importance on unlocking “new productive forces”, which is a necessary step to facilitate a larger economic transition.

This is not just lip service; the so-called "new economy" has significantly outpaced headline GDP growth in recent years. Between 2017 and 2023, the new economy grew by an average of 10.2% per year, far faster than the 5.5% average GDP growth.

The new economy will be the growth engine of the future

The Great Transition: moving toward higher quality growth

Many market participants tend to tune out when the discussion of policy direction shifts to the long term, but this is of major importance for deciding whether China will plateau or successfully move to the next stage of development.

In our view, the transition toward high-quality growth can be siloed into four key categories:

- Transition toward a consumption-driven growth model

- Transition up the value-added ladder

- Transition toward greener growth

- Transition toward a digitalised economy

Transition toward a consumption-driven growth model

One common factor for almost all of the world’s leading economies is that they are driven by consumption. With a population of 1.4 billion, fully unlocking China's consumer potential would catapult its economy into the next stage.

We believe there are several keys to unlocking the consumer potential in China:

- Increase consumer spending power. In the long term, this will primarily be done by maintaining a stable job market and encouraging higher wage growth. In the short term, tax rebates and subsidies can stimulate overall consumption or direct consumption toward specific sectors. For example, this year’s Two Sessions prioritised the “trade-in” theme, which could benefit spending on household appliances.

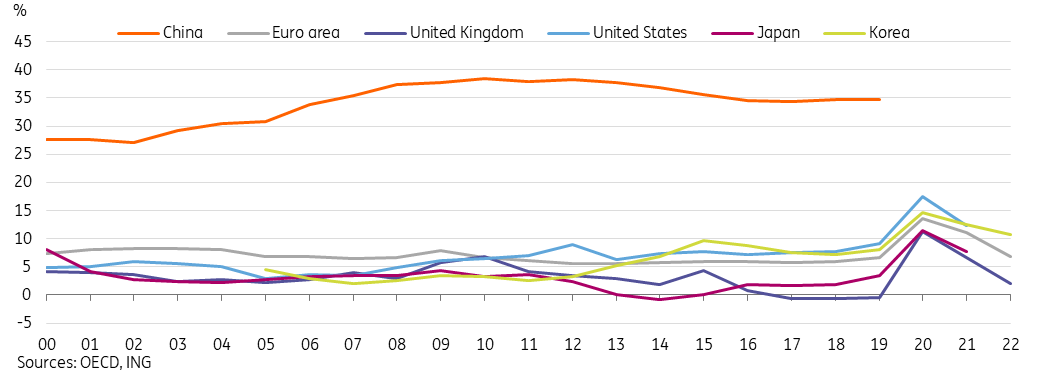

- Reduce the structurally high savings rate. China’s savings rate is very high compared to many countries. According to OECD data, China’s savings rate was around 35% of disposable income, well above other major economies which were between 7-13%. Improving the social safety net and bolstering consumer confidence could free some of these savings up for consumption.

Comparison of household savings as % of household disposable income by country

Transition up the value-added ladder

When most people think of “Made in China,” their first instinctive association is likely along the lines of low-cost, mass-manufactured goods. This is due to decades of dominating the low-end manufacturing industry due to various key advantages.

We split these advantages into two groups of three. The first three factors are clearly fading, reducing China’s competitiveness in low-end manufacturing. This activity has been gradually shifting toward other emerging markets.

- Low-cost but high-quality labour. Self-explanatory, a high-quality but low-cost workforce allowed companies to reduce input costs significantly without negatively impacting the quality of the end-product.

- Lax environmental regulations. Limited penalties for pollution reduced costs for factories for much of the late 20th to early 21st century.

- Technology transfers from foreign investment. In exchange for opening up the Chinese market for foreign investment, many deals included a technology transfer clause, which vastly accelerated the pace of development.

However, the next three factors remain very much relevant, and set the foundation for China to compete in high-end manufacturing.

- Use of industrial policy. This allows for strategic resource allocation and high-speed development of select industries.

- The world’s most complete manufacturing and logistics infrastructure. For many industries, China is not reliant on external supply chains for production. This reduces vulnerability to various factors such as exchange rate fluctuations and tariffs and, in general, allows for a high level of competitiveness.

- Massive domestic market. This allows for economies of scale and self-contained ecosystems and is the pillar of domestic circulation.

This transition up the value-added ladder is not without precedent. Many economies which successfully transitioned up the value-added ladder, such as Japan, also originally were focused on low-end manufacturing. Success in at least one major strategic sector would likely be sufficient to ensure this transition is successful.

Evolution of China's export structure

Huge progress has been made in moving up the value-added chain, though there is more work to be done

Transition toward greener growth

A consequence in every case of rapid industrialisation since the 18th century industrial revolution has been heavy pollution. China was no exception, and things came to a head in the early 2010s when heavy smog and PM 2.5 pollution started causing major respiratory illnesses nationwide. Since then, a clear and consistent policy priority has been on greener growth in the second half of the 2010s. This focus has paid clear dividends as pollution levels and carbon intensity of growth have dropped sharply over the past decade.

There are two major long-term goals for greener growth

There are two major long-term policy goals in terms of green growth: reaching Peak Carbon by 2030 and full carbon neutralisation by 2060.

The World Bank estimates this goal would require USD 14-17tn of new green infrastructure and technology investments. We believe that green infrastructure, while likely having a lower multiplier effect than traditional real estate or infrastructure investment, will nonetheless remain an area where Chinese fiscal policy can have productive investment.

China’s green development efforts have typically received praise, but one of the pointed criticisms pointed to China’s industrial policies resulting in overcapacity and dumping of exports to the global markets, eventually resulting in industry consolidation and large scale company failures. The example many point to is the solar industry in the 2010s, and there is discussion on whether the NEV industry of today is headed down the same route. Criticisms tend to centre on whether or not Chinese policy affects fair competition, and on the companies that end up failing along the way.

In our view, this critique misses the forest for the trees, as the approach remains effective from a big-picture perspective in making the country competitive in the key industries of the future.

China's carbon intensity has dropped at an unprecedented pace

Transition toward a digitalised economy

China’s digitalisation has occurred at a breakneck pace and now has the second largest “digital economy”, as defined by the China Academy for Information and Communications Technology. China’s e-payments and e-commerce industries are among the world’s finest and most efficient. Relatively recent innovations, including livestream e-commerce, have quickly created new areas of growth.

Improving the tech sector has been a strategic focus for a long time, but just as select Chinese companies began being competitive on a global level, there have been more measures targeting Chinese tech. The developments of the past few years have highlighted a need for technological self-sufficiency. Semiconductors and AI will likely be sectors where China will push for self-sufficiency and global competitiveness.

China is already competitive in various aspects of the digital economy. In particular, it is probably the country most adept at the “copy and refine” model, where companies improve upon an existing product or technology. However, to take the next step, China must focus on achieving “breakthrough innovations.” This is easier said than done.

How does China's digital economy stack up?

Key advantages and challenges for China's economic transition

Major economic transitions are always difficult to implement. China has unique advantages for this process but also unique challenges.

- Strong influence of the state on the economy. The unique aspect of the Chinese economy is the level of influence the state has on the economy, and an ability for long-term strategic focus instead of needing to cater to short-term cycles. On the one hand, this allows for strategic resource allocation and avoidance of free market bad equilibrium results. On the other hand, this places a heavy responsibility on the state to steer the economy in the right direction, and a state-led economy often has more areas of inefficiency. From the perspective of facilitating economic transitions, this is, in net, an advantage.

- A challenging external environment. A general backdrop of de-globalisation, as well as China-specific strategic competition, “de-risking”, and geopolitical friction, create additional barriers to economic transitions. Countries seeking to move up the value-added ladder naturally face competition and resistance from those already occupying the market, but this pushback against China has been and is expected to continue to be stronger than what smaller countries may experience.

- Benefit of hindsight. Extensive studies have been done on Japan’s Lost Decade, as well as the middle income trap. Policymakers are aware of factors that may have led to success or failure in other economies, though each economy’s situation is different, and it is uncertain which lessons that policymakers may ultimately derive from other countries’ experiences.

Will China's economic transition succeed?

We remain optimistic that China can successfully transition its economy, though it will take some time. The foundations and strategic directions for this transition have been set, and great progress has already been made in key areas for the future. Near-term challenges and long-term uncertainties are plentiful, but the widespread pessimism toward the Chinese economy and markets feels excessive.

In recent history, markets have already been underweight China relative to its importance to the global economy, as uncertainty over various economic and political factors plays a major role in investors’ asset allocation decisions.

However, even if we adopt a conservative growth outlook, this underweighting only looks to be more serious moving forward, and tail risk is discussed far more often in China than in almost any other market. We are advocates of maintaining a balanced perspective in an environment that can often easily get swayed to either extreme based on the latest development.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article