China’s economic outlook for the second half of 2022

This article examines recent economic developments in China and policy implications on the economy for the second half of the year

Domestic economy impacted by Covid measures and infrastructure investments from the government

China's nominal GDP reached $17.5 trillion in 2021, a growth rate of 8.1%. We expect a slower GDP growth rate in 2022 due to very tight Covid measures in the second quarter of this year.

The short-term outlook is based on the possibility of more Covid-19 lockdowns, the increasing tension between China and the US and its allies regarding world politics, which could turn out to be international trade issues, and the Fed’s rate hikes.

China is becoming more willing to accept single-digit Covid cases and is reopening schools and restaurants. The government announced the decision to shorten the isolation period for positive Covid cases and adjust the frequency of Covid tests according to the risk of infection, which is a more flexible policy than back in early June 2022. However, the risk of lockdowns still exists, even though the probability is lower than in early June as the government has adopted weekly covid tests in many cities.

Consumer market

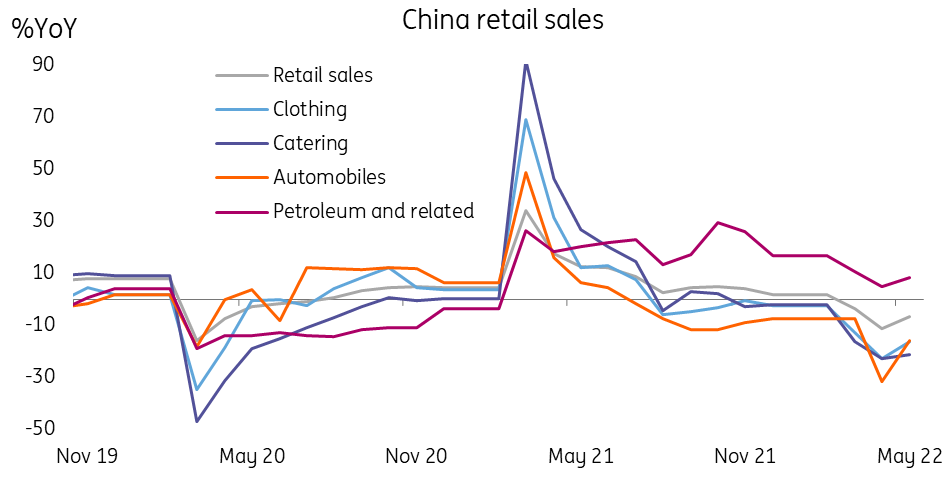

During the worst period of lockdowns, the (negative) contribution of the consumer market to the economy was obvious. Structurally, it means the Chinese economy has transformed into a more diversified economy, with a big consumer market and more capital-intensive manufacturing activities. Consumer demand should return as Covid rules are relaxed. It is expected that retail sales will turn from negative year-on-year growth in 2Q22 to positive year-on-year growth in 2H22. Foreign exporters can also benefit from the recovery of the Chinese consumer market.

Infrastructure investment: a form of fiscal stimulus

With the consumer market undergoing a recovery, infrastructure investments are a key support for the economy after the contraction of most economic activities in 2Q22. We expect an infrastructure investment equivalent to around 5% of GDP for 2022. These investments are mostly funded by local government special bonds, local government financial vehicles, central government funds, and loans from policy banks in China.

China retail sales slumped during lockdowns

Home sales' slow recovery can't stop bond defaults

Homes sales have gone up slightly. Home purchase vouchers for shanty town residents are a short-term policy to boost home sales. Although this is a positive move for home sales, it is not positive for property developers that have defaulted on their bonds, whether onshore or offshore, as potential home buyers will stay away from homes sold by those developers to avoid non-completion risk and after-sales property management risk.

As such, we do not expect defaulted real estate developers to get cash from home sales quickly, which will continue to put pressure on their liquidity. We will discuss this later in this article.

China's residential property market missed sales target in May before a slow recovery in June

Robust external demand, but the technology war continues

External demand has been robust and Chinese port congestion has eased, which implies a better international trade environment.

The US is considering removing some of the tariffs on goods imported from China that were imposed by the Trump government. But there will likely be no removal of tariffs on technology-related products produced by China, which will remain a drag on Chinese technology companies.

The technology war will be a long-term issue for economic growth. China does not have the technology to manufacture semiconductor equipment for the most advanced semiconductors. The obstacle comes from the US and its allies that are preventing China from gaining access to this technology. China is trying to get talent from the rest of the world, hoping to create its own advanced technologies, which is a challenging mission.

High-tech product imports and exports suffer from the technology war

Chinese yuan and monetary policy

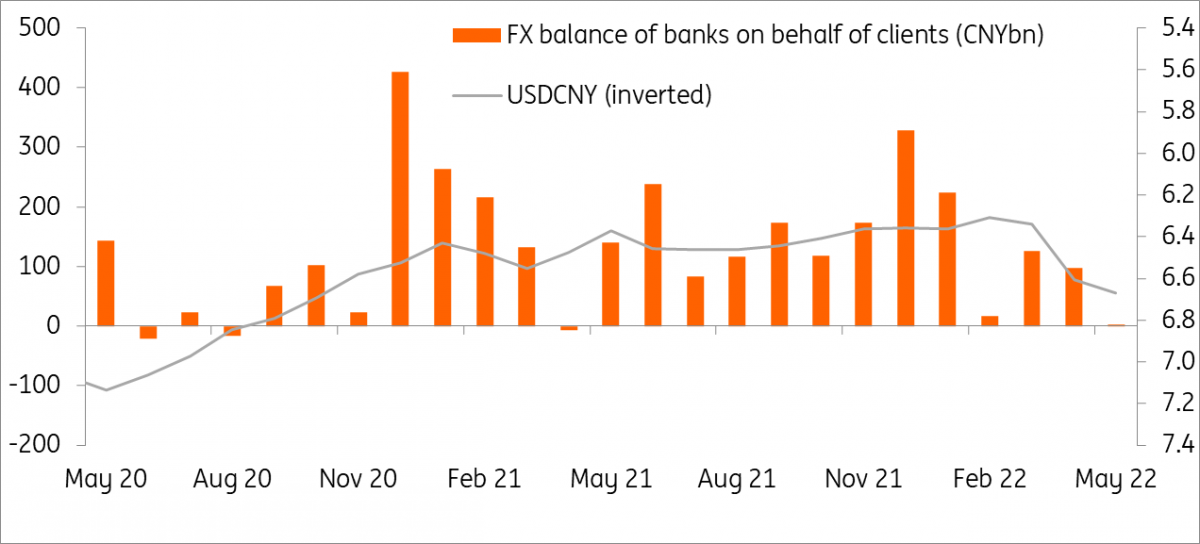

The Chinese yuan (CNY) is suffering depreciation pressure from the widening interest rate differential with the US. The Fed is expected to continue interest rate hikes this year. At the same time, the People's Bank of China is reluctant to lower rates further as, according to governor Yi Gang, China’s real interest rate is “pretty low”. This should provide a steady interest margin for banks in China. But the risk of portfolio outflows could increase from the China sovereign bond market as US interest rates should rise relative to China’s interest rates.

However, China is considered a growth market for equity investors, and Chinese equities are included in some global stock market indices. The deregulation of the e-commerce industry has attracted equity portfolio inflows into China.

The two opposing forces should balance the yuan exchange rate for now. With the easing of Covid measures, net portfolio inflows can be expected to support the yuan in terms of a mild appreciation in 2H22.

USD/CNY

Loan growth to rise

Deposits in terms of M2 grew faster to 11.1%YoY. Deposits increased because companies maintained a wait-and-see approach to business investment due to the uncertainty about the length of lockdowns. Banks were also reluctant to lend as credit risks increased during lockdowns.

But less restrictive Covid measures announced on 28 June should bring back some confidence in business investments and loan growth.

Yuan liberalisation to continue

During the tough economic period caused by the March to May lockdowns, China did not stop opening up the capital account. Not only has China widened inflow channels for foreign bond investors to trade bonds in the onshore market, but it has also built a yuan reserve pool with the help of the Bank of International Settlements (BIS), which is the central bank of central banks. This should increase the importance of the yuan for the next crisis.

China is also lengthening yuan trading hours to 3am. But volumes are likely to be thin. The idea is part of a plan to move yuan reforms forward. This step is not as important as opening more channels for portfolio flows but could be necessary during bad times when the yuan reserve pool is being tapped.

Bond market risks

China’s fiscal position is still strong. The IMF’s forecast on China’s general government gross debt as a proportion of GDP is less than 100. If there is any risk, it is mostly on subnational sovereign (i.e. local governments as issuers), not the sovereign risk.

Some property developers are expected to default on their bonds in 2H22 and 2023. Furthermore, some conglomerates have begun to be affected by their property development arms and have been tight on cash. The liquidity and credit risks of these conglomerates are rising.

Forecasts

Our GDP forecast for China is 3.6% for 2022. An upward revision of this GDP forecast is likely if retail sales rebound strongly after the relaxation of the Covid quarantine duration.

On USD/CNY, our current forecast is 6.7, but a revision to a stronger yuan is also possible for the aforementioned reason.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article