China: Downgrading GDP growth rate

China is once again using infrastructure investment to avoid an economic slowdown. Sound familiar? It doesn't matter. We're still downgrading our GDP growth rate for this year and next

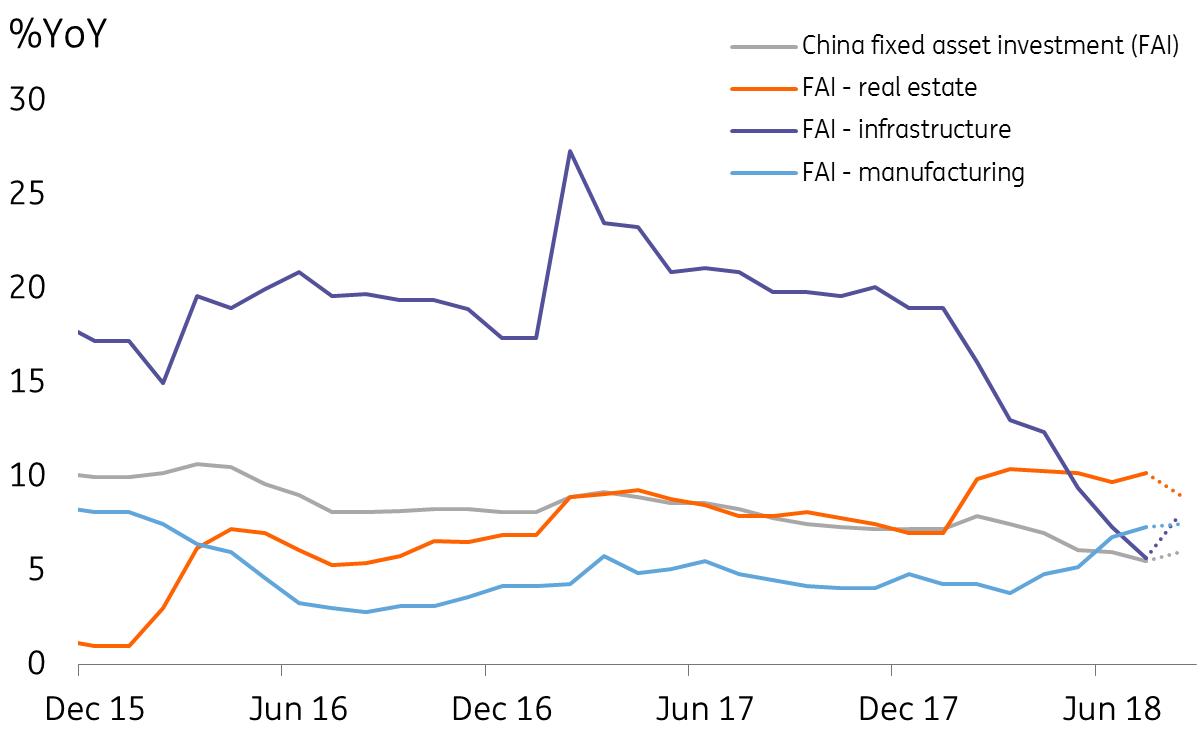

Fixed asset investment comes to the rescue

The term "trade war" appears almost everyday in economists' analyses, blogs, tweets and on social media in China. It is something we are squarely focused on as well. But we would like to be a little bit more forward-looking.

We know that a trade war is upon us and is going to escalate. The uncertainty is timing, with one wave of tariffs after another.

The Chinese government is trying to offset the damage, relying once again on infrastructure investment.

We expect fixed asset investment will rise to 6.0% year-on-year in August from 5.5% YoY in July. Infrastructure investment could rise from 5.7% YoY to 8.0% YoY, while real estate investment could decelerate from 10.2% YoY to 9.0% YoY.

Infrastructure investment could accelerate

Industrial production to rise along with infrastructure

With more infrastructure projects, industrial production in general should improve. We expect industrial production to rise 6.2% YoY in August from 6.0% YoY in July.

The manufacturing story is slightly more complicated than the investment story. There are two opposing factors: One is negative as the trade war dampens export-related manufacturing activities while the other is positive as infrastructure projects boost manufacturing activity. We expect the overall growth trend to be stable. There is no need to over-borrow to boost manufacturing to a growth rate that is much higher than a no-trade-war scenario.

Retail sales should hold up well but the future is worrying

We expect retail sales growth to rise to 8.9% YoY in August from 8.8% YoY in the previous month. The rise reflects stable growth in the spending power of the rising middle-income class, especially in the summer holidays.

However, if a trade war escalates, we expect that some Small and Medium-sized Enterprise exporters could be forced to close down. Some workers would be made redundant, and while some of those could be absorbed by State-Owned Enterprises, not everyone would. The rest would likely try to find a low-skilled job in the service sector. The redundant labour force would drive low-skilled wages lower, which could, in turn, lower basic consumption. This could create a negative feedback loop to other industries in China, affecting spending power there, too.

However, these would come at a later stage, as we expect a lagged effect on unemployment.

Infrastructure investment could provide additional job vacancies for redundant workers but we are not completely optimistic on the outlook.

GDP growth downgrade in 2018 and 2019

Even with fiscal stimulus supporting infrastructure investment and monetary easing at the same time, we worry about the outlook for the Chinese economy in light of the trade war.

We are lowering our GDP growth rate in 2018 from 6.7% to 6.6% and from 6.5% to 6.3% in 2019.

More stimulus would support the 2019 growth rate, but there is still a limit to what the government can do.

Fiscal stimulus likely to create overcapacity and over-borrowing

Once again, infrastructure projects will be at the heart of fiscal stimulus. This will come from credit expansion because some of the fiscal stimulus comes from SOEs or local government financial vehicles. This also means that we will see overcapacity both this year and next.

The side-effect of over-leveraged corporates or local government would probably be seen only after a couple of years when interest costs rise after the effects of the trade war fade. By that time, we may need to analyse overcapacity and financial deleveraging for a second time.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

12 September 2018

In case you missed it: The surprising and predictable This bundle contains 9 Articles