China’s digital economy: Divided but growing

Increased regulation of China's consumer tech industry has seriously dented company revenues, with widespread implications. But the digitisation of industry - supported by government policies - provides an opportunity for growth, which could help the overall digital economy grow by an average of 16% per year over the next decade

Introduction

In this note, we aim to provide a top-down view of the economic impact of internet policies in China. In our view, the Chinese government has begun to soften its stance on heavy regulation in the digital consumer market in the past few years. At the same time, there is policy support for digitising industry.

We will try to quantify the loss of revenue from regulation in the digital consumer market as well as the potential gains from policy support within the digital industrial market. This should give us some idea about the outlook for the overall digital economy.

Data and methodology

The digital economy, also known as the new economy or cyber economy, is intended to make traditional economic activity more efficient through the use of information and communication technology (ICT). It also creates new activity.

We differentiate between the consumer and business side of the digital economy and the industrial side. This is because China has imposed more regulations on consumer-related internet activities. In contrast, the digital industrial economy benefits from 20th Party Congress' plans to advance technologies.

The size of the industry in China

China’s digital economy grew rapidly before 2020 when intensive regulations started to be imposed. The digital economy first developed in social media and search engines before expanding to online shopping, payment and fintech. It then expanded further to maps, ride-hailing apps and delivery services, and then into online games and streaming. This industry is a source of significant data, and Artificial Intelligence has been developed to collect, analyse and apply that data. For now, the mainstream focus is largely on digital activity at the consumer and business level. Digitising the industrial economy is still at an early stage.

According to a white paper issued by the China Academy of Information and Communications Technology (CAICT), the overall digital economy was valued at CNY45.5 trillion in China, ranking second after the US, in 2021. The industry’s value to GDP has doubled in 10 years to nearly 40%.

Timeline of internet policies in China

From few to many regulations

Big companies in China’s digital economy have developed their own market with few overlaps. For example, Baidu focuses on search engines, maps and cloud storage, Alibaba on shopping, payment and fintech, and Tencent on social media, payments within its app and online games, and public services.

After Alibaba’s Jack Ma commented that regulation was essentially absent in China’s financial system in October 2020, his Ant IPO was deferred, and there have been 12 new cyberspace regulations as of June 2022.

Intense regulation started with anti-monopoly

Regulations began with the implementation of anti-monopoly laws. The government stated that tech companies had abused monopolistic power, massively collecting personal data and abusing its access, and recklessly developing fintech. Against such a background, the government rolled out a bundle of new laws and regulations targeting various aspects of the consumer-based digital economy. Investigations into Alibaba by the State Administration for Market Regulation (SAMR) resulted in fines on the company in 2022.

Fines and penalties on the industry

In this section, we look at penalties and fines to evaluate the monetary impact of intensive regulation on the industry. Fines and penalties amounted to CNY303.5 billion between November 2020 and July 2022 from 143 cases. This includes the IPO deferral of Ant Group, which had an estimated value of $34 billion. This looks like a small amount as it was less than 1% of the size of the industry in 2021. But it has serious consequences that we will discuss in the latter part of the note.

Among those cases, 140 of them were related to anti-monopoly regulations, two were related to data security and one was related to consumer lending.

Companies charged with violating anti-monopoly regulations were fined just CNY500,00 in each incident. These fines are relatively small for the companies involved. The regulator fined Alibaba CNY18.2 billion for breaching competition law in April 2022 but the size of the penalty was an outlier. It was based on 4% of Alibaba’s 2019 domestic revenue though the upper bound is 10% of revenue.

Quantifying long term consequences

Still, the economic loss is not just confined to fines and penalties. We will focus on two sub-sectors of the digital consumer economy that have incurred the most serious consequences from regulation. One is mobile apps, the other is real-time webcasting online sales.

A. Estimated reduction in app revenue into 2030

There have been two regulatory incidents that have affected app revenue.

- The first is that China banned some apps from being freshly downloaded due to data privacy and security violations. Since November 2021, regulators have started to monitor apps and have ordered app stores to ban downloads of 106 mobile applications due to data privacy violations. This included Didi, the ride-hailing app, although users who have downloaded the app are not affected and can continue to use it; the ban only applies to new downloads. The cost to app developers will come from aligning apps with tighter regulations, which directly reduce data collection, and analysis that could enhance and create new functions to attract more businesses. This could also affect advertising revenue. We think the cost of app bans is more about future business development than existing business.

-

The second regulatory incident is that regulators have imposed a limitation on the time children can spend playing games online, including mobile gaming apps.

China made up 40% of the CNY1190 billion ($170 billion) global app spending in 2021, which was up 19% from 2020. Of this CNY1190 billion, 68% came from mobile games. Growth in mobile gaming revenue grew 15% from 2020, slower than the overall app spending growth of 19%, due to the restrictions on the time children can spend playing games online in China.

When estimating the cost to the industry, we add a “slow growth” parameter in our calculation. The ban on new apps and regulations on online games have reduced revenue growth from 2022 to 2024. Growth should pick up after companies adjust to the regulations but the rate of growth will be fairly slow compared to the pre-regulation period.

We estimate that app spending in China under the current regulatory environment should grow 23% between 2021-2030. Under a hypothetical assumption, if there were no such restrictive environment, the growth rate would be 64%. That is equivalent to a reduction of CNY1544 billion in revenue between 2021-2030.

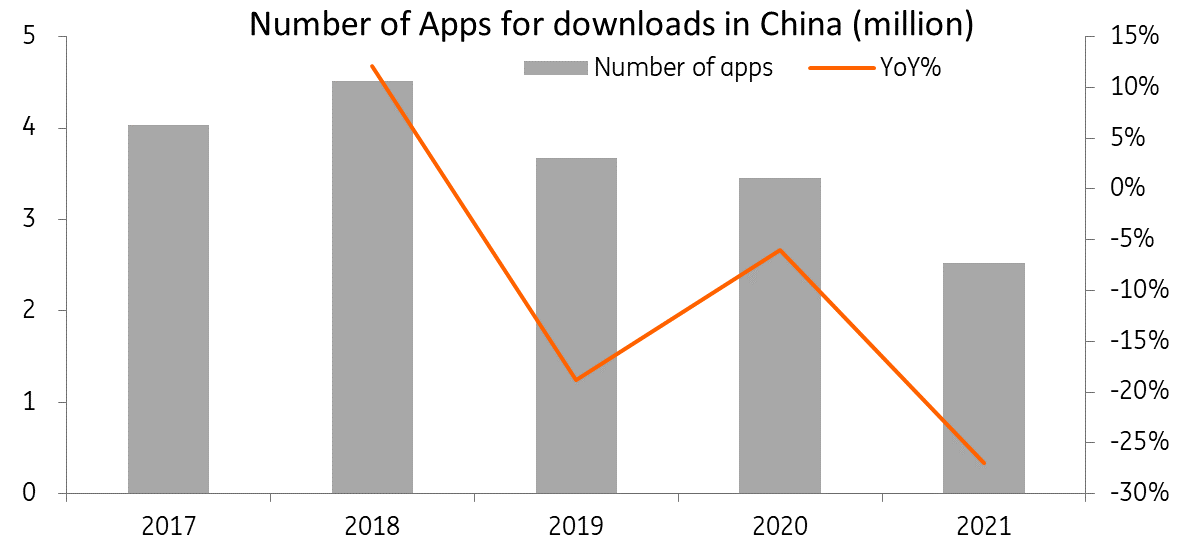

App downloads in China

B. Estimated reduction in e-commerce sales affected by tax evasion cases

Realtime webcast marketing, a facilitator of sales in e-commerce platforms, has also been on the regulatory radar. Realtime webcast sales were CNY2.27 trillion in 2021, contributing 21% of online sales. Online sales contributed 24.5% of retail sales in China, with the share doubling from 2014. Retail sales in China hit CNY44 trillion in 2021.

Since early 2022, regulators have started to audit this subsector, finding that sales were over-reported during webcasts with the aim of luring in more customers. They also found that webcast anchors might not have correctly reported their income. Some webcast anchors were prevented from appearing in real-time sales activities. This led to a substantial fall in sales on e-commerce platforms in China.

We estimate that sales from real-time webcasting fell around 75% in 2022 but should recover in 2023 as some real-time sales anchors have resumed work after paying taxes. This segment should recover partially after complying with regulatory requirements. From our calculations, the loss of revenue from real-time webcast sales could be CNY19.0 trillion between 2022-2030 if there are no tax evasion cases.

There are other subsectors within China’s internet industry that have been transformed due to intensive regulation in the past three years. We have only uncovered part of it due to limits on data availability.

The impact from the penalties and fines alone was less than 1% of the size of the industry in China. But the consequences are substantial as shown in the potential reduction in revenue from regulations. Ultimately, the industry needs to change the way it operates and its business model to fulfil regulatory requirements. This implies that business growth could be challenging in the coming years, before we even consider the economic slowdown from Covid and other challenges.

Estimated revenue loss in the digital consumer economy

New areas for growth

One area for growth lies in the digitisation of manufacturing and industry. The consumer-based cyberspace has been developed to a more advanced level compared to that seen in industry. The 14th Five-Year Plan highlights the need for automation, the application of robots, algorithms and blockchain applications for industrial use. And the more recent 20th Party Congress highlighted advanced technology as one of the pillars for future growth. These policies should steer the future of cyberspace in a new direction, giving existing internet companies an opportunity to create growth.

The main benefits will come from an increase in the efficiency of production. Big data will play an important role just as it does in consumer cyberspace. Deficiencies in production and streamlining production operations are the two areas where big data could shorten production time and improve quality.

In 2019, the digital industrial economy was CNY7.1 trillion, having grown 11.1% year-on-year. That was slower than the 14.8% growth of the tertiary industry (mainly consumer-based). We estimate that the value of the digital industrial economy was CNY11 trillion in 2021. Even with strong growth in the past few years, this value is still small relative to China's digital economy of CNY45.5 trillion in that year.

But the trend is going to change. China has begun to specialise more in higher value-add production, big data and AI. This implies the internet of things could be widely applied. This trend is also partly forced by the ageing workforce. More importantly, the 20th Party Congress highlights the need to advance technology for the economy’s future development, which should result in a boom in R&D for industrial technology, mainly in 2024-2027. We assume no big breakthroughs in industrial technology from the R&D spending, e.g. breakthroughs in advanced semiconductor chips. But some R&D results could benefit industrial activity, e.g. further robotisation and a more comprehensive internet of things.

We estimate that the value of industrial cyberspace could reach CNY80 trillion in 2030 in real terms, and would contribute 40% to the overall digital economy in China by 2030.

This estimate means the digital industrial economy could grow ninefold over the coming decade. Fast growth in this area could mean that the overall digital economy would be more balanced, with contributions of 60% from the consumer segment and 40% from the industrial segment by 2030, compared to the ratio of 81% to 19% in 2020.

Potential value of the digital economy in China by 2030

Combining the consumer and industrial aspects, the overall digital economy could be valued at CNY99 trillion by 2030 with an average annual growth rate of 16%, driven mainly by the digital industrial economy.

Estimated value of China's digital economy by 2030

Summary

This note has found that intensive regulation of the internet sector in China has more serious consequences than just the fines and penalties imposed so far. Most of the regulations affect sub-sectors of the digital consumer economy. The potential loss in value could be close to CNY21 trillion between 2021-2030, which is a lot bigger than the fines and penalties of CNY303.5 billion in 2020-2022. This loss of revenue could be reflected in less innovation and creative business ideas.

At the same time, the digital industrial economy could grow very fast, mainly from policy support. The 20th Party Congress highlighted an objective to build advanced technology by Chinese companies. This self-sustained intention could push the value of the digital industrial economy to CNY80 trillion by 2030 from CNY7.1 trillion in 2019.

For the digital economy, the main challenge remains the uncertainty of new and tighter regulations from the Chinese government on both sub-sectors of the consumer and industrial digital economy. There could also be challenges from global regulations on the sector.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).