China: Qualitative and quantitative growth

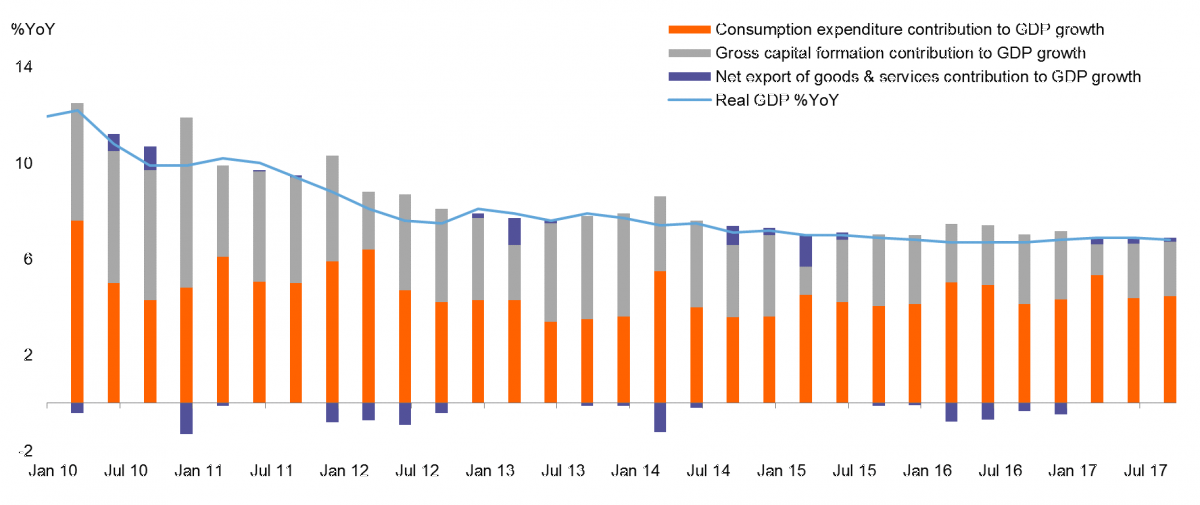

Our forecast for GDP growth is the same as consensus at 6.8% for 2017 and 6.7% YoY for 4Q17, but this could surprise on the upside as hinted by Premier Li. In 2018, the government will strive for qualitative and quantitative growth amidst financial deleveraging reforms and fighting pollution.

2017 GDP could surprise on the upside

Our forecast for GDP growth is the same as consensus at 6.8% for 2017, and 6.7% YoY for 4Q17. As Premier Li hinted at 6.9% growth for 2017, the GDP data is likely to surprise on the upside. The key is which part of the GDP will surprise? This could come from trade as imports in December were exceptionally low, partly due to restrictions on solid waste imports.

Retail sales could take the lead

Within the three main components of economic activity, we expect retail sales to stand out - growing at 10.4% YoY in December compared to the prior month's 10.2%. Spending growth should benefit from the western holiday atmosphere.

Fixed asset investment should hold up at 7.2% YoY as infrastructure investment (arouond 20%YoY) continues to keep overall investment growth stable. Investment in real estate should continue to grow, albeit at a slower rate (around 4% YoY).

Industrial production should be slower in December to 6.0% YoY, from 6.1% YoY in November, as some coal and copper factories stopped production in the month for the sake of better air. We expect that production of technology-related parts and products will continue to be strong. This includes industrial robots and integrated circuits.

2018 is a year for qualitative growth

We expect the Chinese government to put more emphasis on striving for quanlitative growth and at the same time keeping quantitative growth stable at 6.7%.

This in fact would be a continuation of the 2017 growth pattern but through different channels. In 2017 qualitative improvement came from overcapacity cuts that have forced corporates to deleverage and also help in the fight against pollution.

In 2018, we see at least two source of qualitative improvement:

The first comes from financial deleveraging reforms already in progress. This progress could be more gradual than corporate deleveraging via overcapcaity cuts. The risks could be systemic if reform is too aggressive - shadow banking and the banking sector are interlinked. Depressed growth in the shadow banking sector would have a direct feedback effect on banks and other non-bank financial institutions. Therefore we see that quite a few regulations and guidelines have been issued and the speed of implementation varies. We do not expect strict implementation of all the restrictive measures at once but instead a gradual approach.

Another qualitative improvement channel would come from the desire to have a better and more sustainable environment. This includes generation of more power from clean energy instead of polluting sources such as coal. The impact is two-fold. Building more infrastructure on clean energy production would offset the loss of production from polluting energy sources. But the change process will be painful for these polluting sectors.

| 6.7% |

China GDP growth in 2018versus 6.8% forecast in 2017 |

As well as quantitative growth

To keep economic growth stable at 6.7% in 2017, consumption from the rising middle income class would be key. There should not be any difficulties in growing consumption. However, there is a small hidden risk of decreasing wealth effect for wealth management product investors. Financial deleveraging reform could reduce the return of wealth mangement products because fewer producers would invest in high-risk investment tools.

Fixed asset investments would continue to be the secondary driver of the economy, mostly coming from infrastructure investments, including water management and clean energy investments.

Industrial production would continue to be derailed by slower growth in energy production but on the other hand supported by products for the high-tech and services sectors.

Again, we are not particularly worried that export growth will slow because of yuan appreciation, with imports of parts that are part of value add production for exports.

Our expectation of 3% yuan appreciation against the dollar in 2018 is mild enough to avoid a fall in export growth, given global demand is rising.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 January 2018

Good MornING Asia - 17 January 2018 This bundle contains 3 Articles