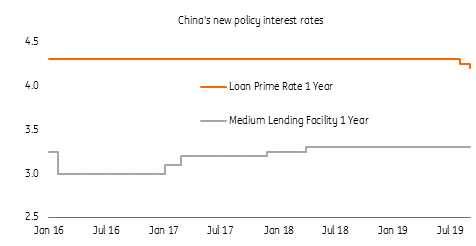

China cuts rates via a new tool

China has cut the one-year loan prime rate, which we think was a result of the very weak August activity data, especially fixed asset investments and industrial production. Another cut is expected in October unless we see a very encouraging outcome from the trade talks, which is unlikely. We don't expect this cut to move the yuan

China cuts loan prime rate

The People's Bank of China cut the one-year loan prime rate (LPR) by five basis points to 4.2% while keeping the five-year LPR rate unchanged at 4.85%. The LPR is the new reference rate for banks and other financial assets, which can quote an interest rate linked to the LPR.

The last time the PBoC cut the one-year LPR was on 20 August, from 4.31% to 4.25%.

Here's how the interest rate works:

- the change in the LPR is an average of quotations from some banks;

- each rate change is a multiple of 5 bps;

- the LPR is linked to the medium lending facility (MLF) interest rate, i.e., LPR is +/- MLF;

- the MLF has not changed since 16 March 2018, when it rose 5 bps from 3.25% to 3.3%.

Why now?

We believe that the decision to cut the rate came from very weak August data released a few days ago. Industrial production grew just 4.4% year-on-year, the lowest level since February 2002, while fixed asset investments grew 5.5%, down from 5.7% previously, even with support from infrastructure stimulus.

A 5 bps cut in the one-year LPR will guide interest rates lower in bank loans and other financial assets, including local government special bonds which are used to fund infrastructure projects. This means that production costs and investment costs will be lowered slightly.

As the trade war is expected to continue for some time, this rate cut is clearly necessary.

Impact on the economy

A 5 bps cut in the LPR alone won't be enough to soothe the market or counter weak growth right now. This cut, together with last month's move, will be too small (in total 10 bps) to have an obvious impact on economic growth. But we shouldn't forget that the PBoC also cut reserve requirement ratios on 16 September, and there will be more targeted RRR cuts on 15 October and 15 November. Together, these should be able to suppress overall interest costs in the economy.

We want to emphasise the benefits of fiscal stimulus and monetary easing working together. This PBoC rate cut, along with RRR cuts and the issuance of local government special bonds to finance infrastructure projects, should create synergies, which may be magnified in the fourth quarter.

We expect another cut in October unless September data is very encouraging, which we think is unlikely. With more rate cuts, the Chinese economy should grow at 6% in 2019.

Rate cut doesn't necessarily mean a weaker yuan

Impact on the yuan

A rate cut doesn't necessarily mean a weaker yuan. There is very little arbitrage opportunity given that China's capital account is not fully open. Put simply, the theory that lower interest rates weaken the currency doesn't apply in China.

USD/CNY peaked at 7.1054 on Thursday then closed at 7.0965. After the rate cut today, the USD/CNY moved to 7.0903. That is, the yuan actually strengthened rather than weakened.

We expect a weaker yuan if the trade talks go poorly. Our USD/CNY forecast is 7.20 by the end of 2019.

MLF and LPR

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

20 September 2019

Good MornING Asia - 23 September 2019 This bundle contains 3 Articles