Changes in the automobile sector in China – an effect of the trade war?

China has hiked tariffs on US imported vehicles but simultaneously lowered tariffs on automobiles from other countries alongside promoting foreign ownership in the industry. We think this is a response to the intensifying trade dispute and will change both the production and consumption of China’s automobile industry

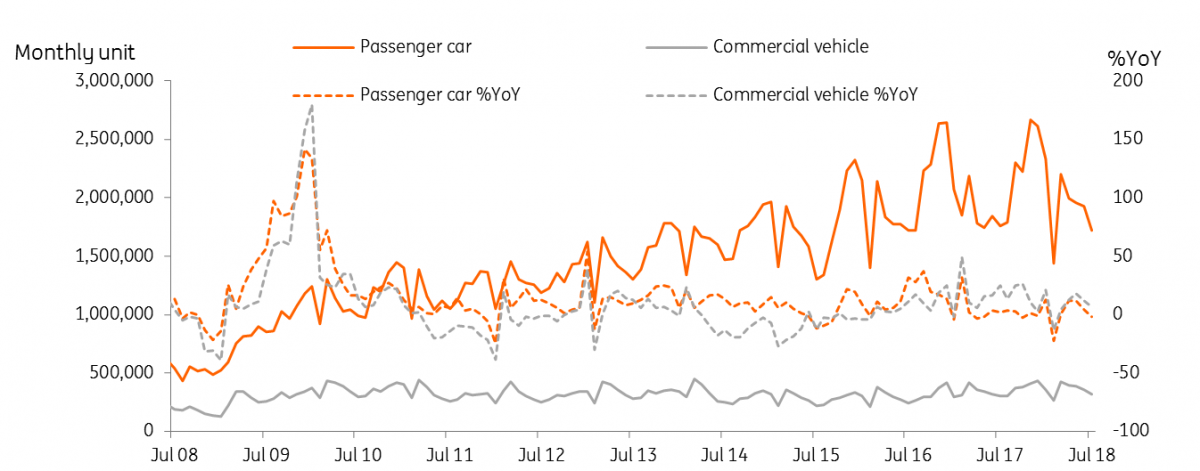

Most of China’s automobile production are passenger cars. Commercial vehicles make up less than 20% of the auto production market, though, in terms of growth rates, commercial vehicle production has grown more quickly than passenger cars since early 2017. But we don’t think China is about to make significant changes to the market share of this industry.

China automobile production

As passenger cars constitute the bulk of automobile production in China, we will focus on their production and sales and how tariffs and changes in foreign ownership could affect this market.

Chinese car market is mostly a joint venture market

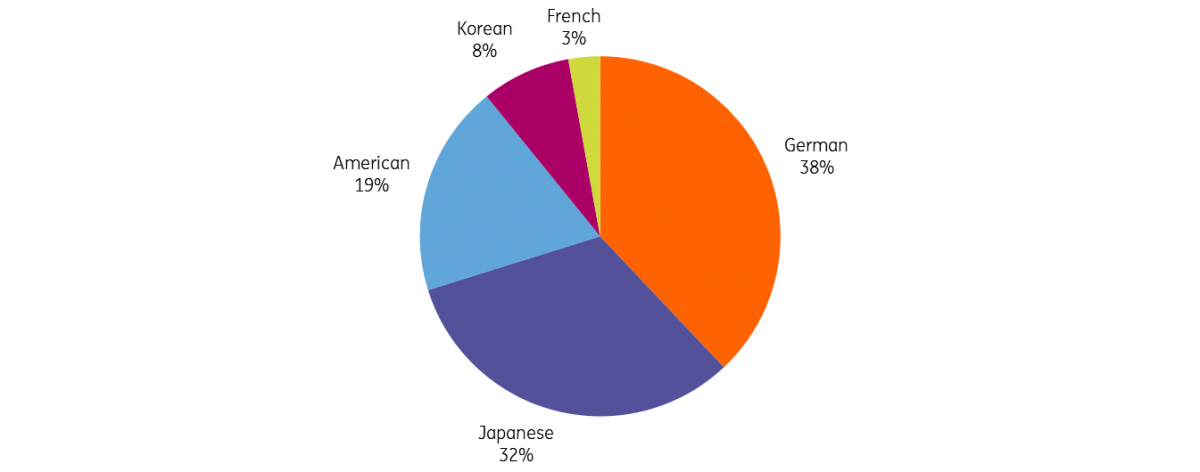

The Chinese automobile market is mainly a joint venture market with both domestic and foreign auto producers producing joint venture brands. This is a legacy of the first auto manufacturing in China, which started with joint ventures. Local brands did not have a chance to develop. There might also be a “consumption bias” on JV brands, since early on, there may have been little trust in local brands, even if the foreign joint venture brands were manufactured in China. Most automobile companies in China have joint ventures with European and Japanese manufacturers. There are only a few Korean and American joint ventures.

According to media reports, foreign players have around 60% of sales in the Chinese automobile market which includes joint ventures. The chart below shows the Chinese passenger market, and then how this translates into better known JV brands.

However, one caveat to this are the new “energy cars” that are being built from scratch recently. One consequence of this is that some local brands are becoming more popular in the electric car arena than established JVs of traditional combustion cars, e.g. BYD.

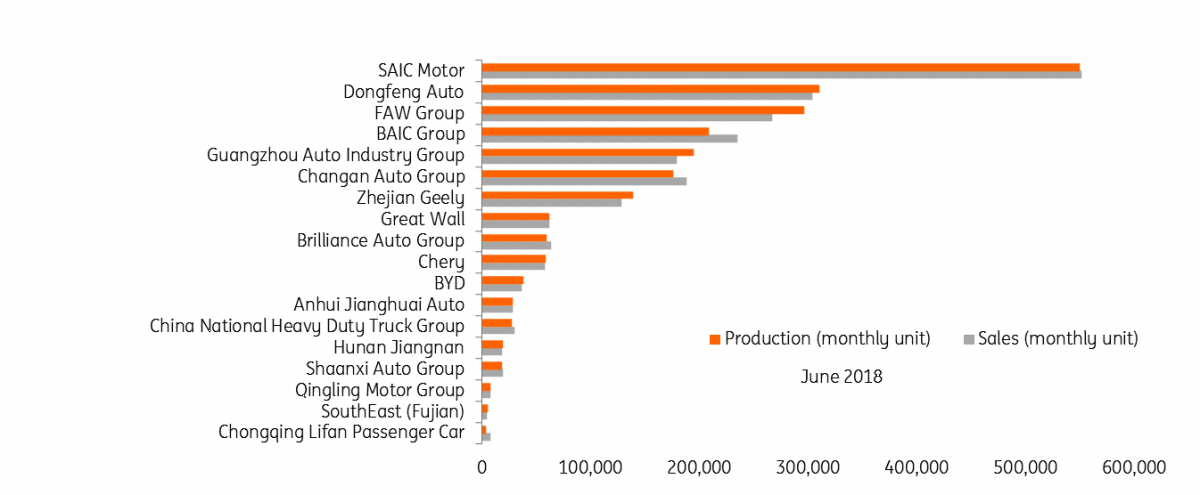

Production and sales of passenger cars by brand in China

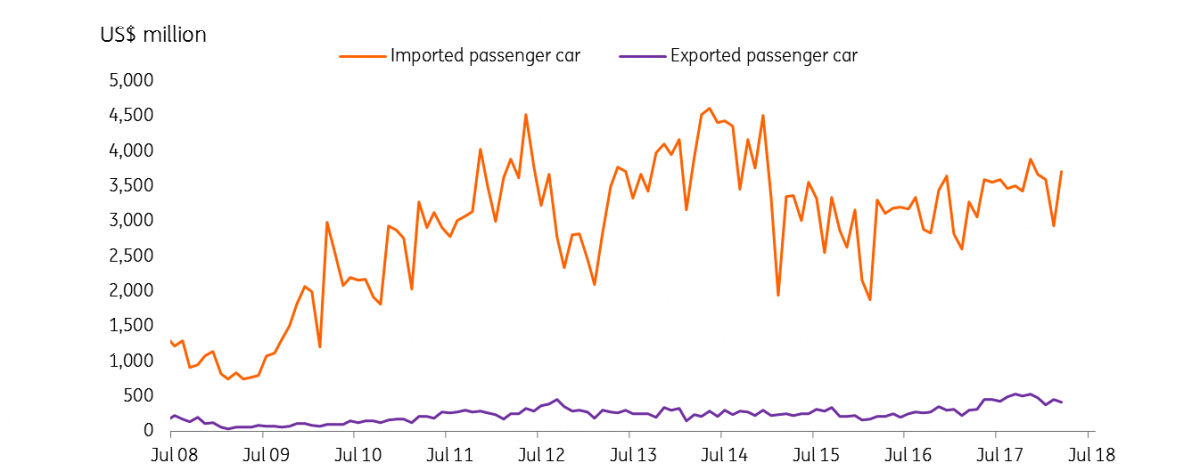

Imports are growing, but still account for a very small share

In the 12 months to June 2018, domestic passenger car production, including joint ventures, didn't match the volume of domestic car sales even with production volume running at more than a million units per month, which is why imports filled the difference.

Currently, auto-import volumes are still only about 5% of domestic production, but the import trend has picked up from around 43,000 in early 2015 to about 76,000 units now.

Imports have been much larger than exports in terms of passenger cars (around 30,000 units per month) and also in terms of the dollar value (see chart). The rise in imports from 2016 indicates there is room for more imports in the Chinese passenger car market.

We believe the market is changing as consumers will prefer foreign brands after tariffs have been cut for most imported cars. We expect local production to fall as imports increase after the tariff changes.

The fall in imports of passenger cars in 2015, which didn't pick up until 2017 could be a phenomenon related to the loss of wealth during the 2015-2016 crisis driven by the sudden depreciation of the yuan against the dollar, which triggered fall in prices of the A-share stock market and the Chinese housing market.

The trade war impact

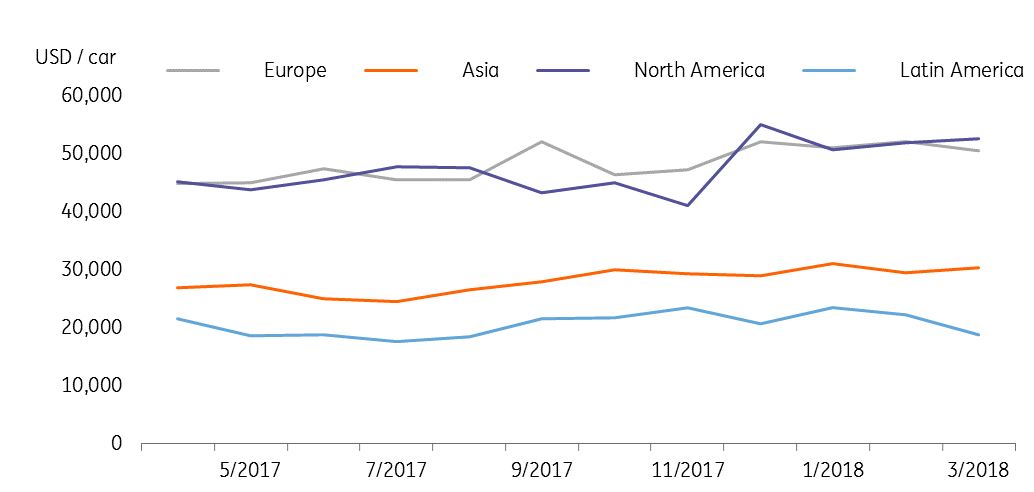

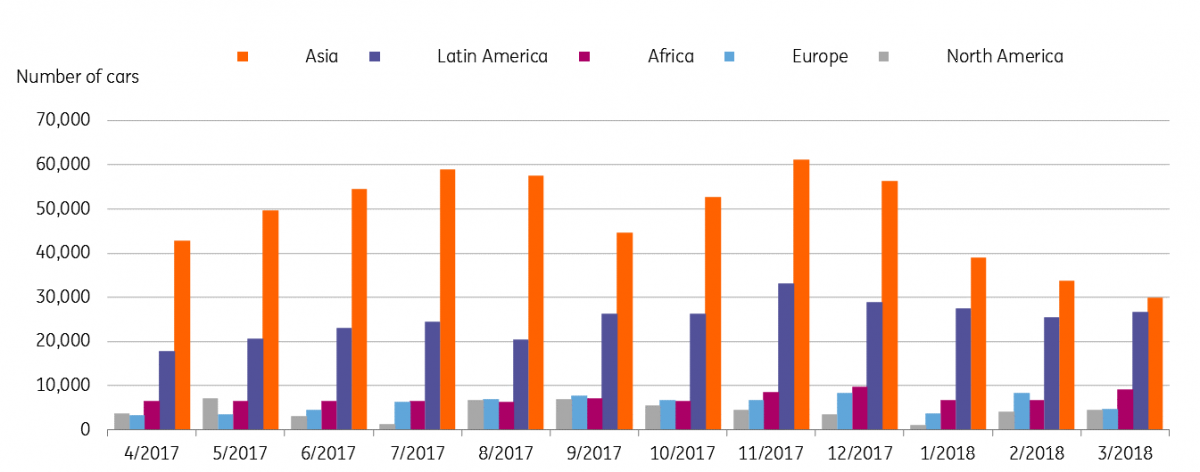

Most of China’s passenger car imports come from Europe (48%) and Asia (33%). Imports from North America make up only 18% of China’s car imports.

Number of China's imported passenger cars

One possible reason is that there are not as many US brands as European brands in the global automobile market. Another reason could be prices. American cars are not cheap with higher transportation costs. They have either been as expensive as European made cars or even more expensive in the last nine months.

Or it simply could be a matter of consumer preference or perception, with European cars having a greater cache than their US counterparts.

Unit price of China's imported passenger cars

Policy change on tariffs of imported automobiles

Tariffs make US car exports to China even more difficult

Looking ahead, prices of automobiles imported into China from the US will become even higher compared to other import origins. US car imports will attract an additional 25% of tariffs under the $16 billion goods tariff list effective on 23rd August, which delivers a total tariffs rate on imported American cars to 40%.What's worse for US imports, is that China has lowered tariffs for automobiles which aren't American to 15% from 25%,

The net effect will be a price cut for cars imported to China except, for the cars imported from the US. Unsurprisingly, we expect Chinese consumers to favour purchases of European cars.

Though the changes in tariffs will benefit European imports and hurt US ones, they could also have some substitution effects on European joint venture brands produced in China, which may grow more slowly as a result.

The US export market for China’s passenger cars is very small. China’s main export market is Asia and Latin America, so tariffs imposed by the US shouldn't affect China’s passenger car exports in general.

Number of China's exported passenger cars

Impact of changes in foreign ownership

Opening up the market for more foreign ownership will affect new energy cars immediately. More global brands producing new energy vehicles will start production in China, as they can now have full ownership of the brand in China. This is a break from the long-lasting tradition of joint ventures in the sector.

Policy change on foreign ownership

It is well known that the automobile manufacturing industry in China has a lot of joint ventures between domestic and foreign brands. The practice is that foreign manufacturers could only set up a joint venture up to a 50% stake. The National Development and Reform Commission (NDRC) announced opening up the industry to foreigners on 17th April 2018.

Relaxing foreign ownership in China's automobile industry

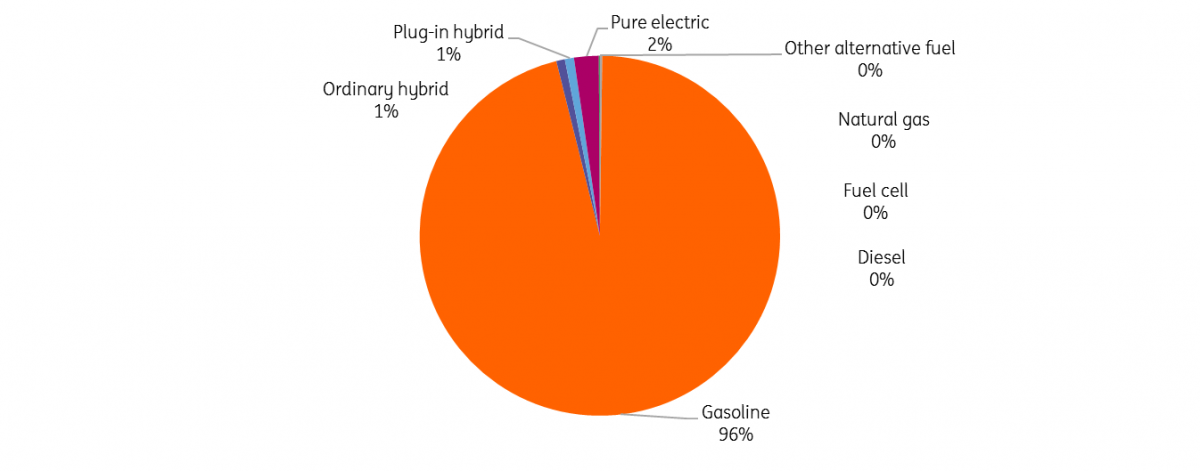

96% of Chinese auto production is of conventional gasoline engine vehicles. Only around 3% are either hybrid or pure electric cars.

By relaxing the rules around foreign ownership, we expect more foreign brand new energy vehicles to be produced in China. Tesla has already set up a production factory in China. In the future, foreign wholly-owned automobile production in China may not only serve the domestic market but also help increase exports.

This could bring competition to local brands that focus on new energy car production. But as we expect the pie of new energy vehicles to expand, the competition that local new energy vehicle brands may face may not be as fierce as competition in the traditional car market.

Production of passenger car by energy type June 2018 YTD

The change in foreign ownership policy will not benefit all global passenger car producers equally. If they do not manufacture new energy cars, i.e., traditional combustion cars, then they need to wait until 2022 to have the joint venture restrictions removed.

Nowadays, American brands make up 11% of total production in China. If tariffs on US imported automobiles continue to be in place into 2022 then US brands may choose to increase production lines in China to circumvent the tariffs.

Foreign brands market share in China

In short, changes in policies in the automobile sector, namely on tariffs and foreign ownership, will induce Chinese consumers to buy more imported cars from the rest of the world (except the US) and to buy fewer imported cars from the US. US automobile producers, which are also new energy car producers, can build a production line in China now without ownership restrictions.

Other US car manufacturers might also move their production lines to China if tariffs continue into 2022. We do not expect tariffs to affect China automobile and parts producers as fall in exports to the US could be sold to the domestic market, which is growing.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

ChinaDownload

Download article

11 September 2018

In case you missed it: The surprising and predictable This bundle contains 9 Articles