Central Banks: Our latest calls

What our economists expect from central banks over coming months

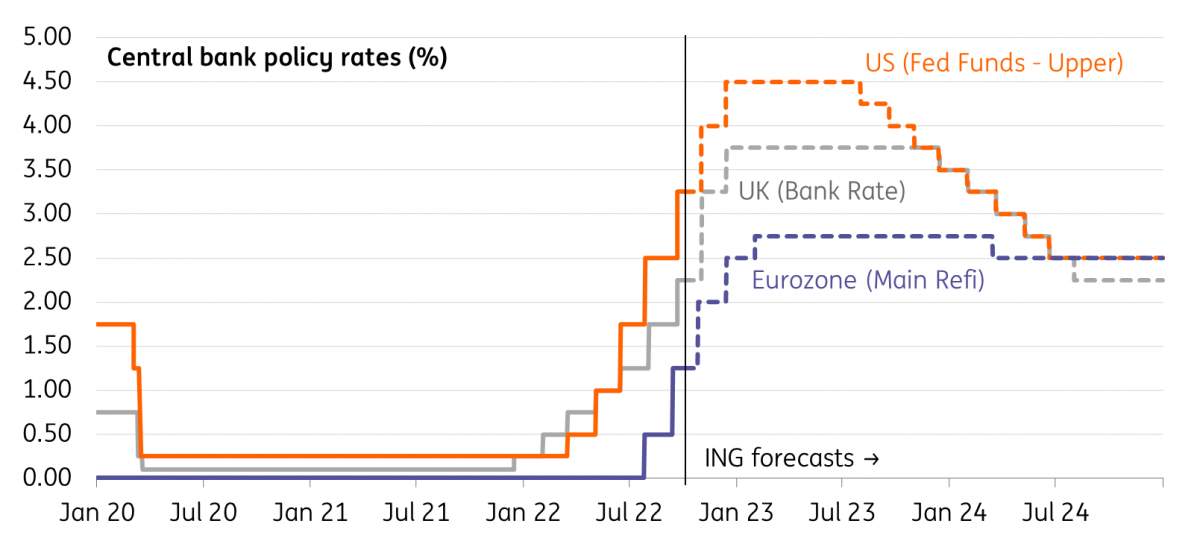

Major central banks: Our calls at a glance

Federal Reserve

Our call: A fourth consecutive 75bp hike in November with a final 50bp hike in December. Rate cuts in 2H23. Quantitative tightening (QT) to continue until rate cuts begin.

Rationale: Borrowing costs are rising rapidly throughout the economy with the housing market already showing clear signs of weakening and consumer spending plateauing more broadly. However, the jobs market remains tight and core inflation continues to surprise on the upside. We expect a further 75bp hike in November, but the economy’s loss of momentum suggests a more modest 50bp hike in December. We think this will mark the peak. Intensifying recessionary forces and falling inflation to prompt rate cuts in 2H 2023.

Risk to our call: Two-way. On the one hand, the tight labour market and sticky inflation could force the Fed to keep hiking. Conversely, recession and a steep housing market correction may lead to steeper falls in inflation and earlier, more aggressive rate cuts in 2023.

James Knightley

European Central Bank

Our call: 75bp hike in October, 50bp in December, 25bp in February.

Rationale: What started off as a gradual normalisation process has become a hardcore fight against actual inflation. With eurozone inflation at 10%, it is hard to see how the ECB cannot move again by 75bp at the October meeting. Even an unfolding recession does not seem to be enough to slow down the central bank. This is clearly an experiment with a risk of turning into a policy mistake, particularly if the economy falters much more than the ECB currently expects. But for the time being, the central bank looks fully determined to continue on the path of aggressive rate hikes. That said, a new round of staff projections is likely to show further downward revisions to growth and could show 2025 inflation at 2%, tempting some of the newly self-declared tough inflation fighters to blink.

Risk to our call: Gas rationing and higher energy costs trigger a deep recession. ECB hikes by 75bp in October but cuts rates by 25bp in February. A new euro crisis forces the ECB to intervene to contain spreads.

Carsten Brzeski

Bank of England

Our call: 100bp hike in November and 50bp in December.

Rationale: With markets pricing in another 300bp+ of tightening, the BoE has no good options. If it follows through on that, there’s a strong likelihood of housing market stress. Some price correction already looks inevitable with mortgage rates quickly climbing irrespective of BoE action. Under-delivery on rate hikes risks triggering further pound weakness at a time when the committee is already worried about inflation staying above target in the medium term. But that seems like the lesser of two evils. It’s a close call between 75bp and 100bp for November, but thereafter we expect the Bank to disappoint market expectations.

Risk to our call: BoE hikes rates to 5% to force inflation lower.

James Smith

Bank of Japan

Our call: No policy action is expected for a while.

Rationale: Unlike other major economies, Japan’s CPI inflation is expected to peak at 3% this year and fall back to below 2% next year.

Risk to our call: Recent data releases have been positive and the economy continues to recover. If this leads to wage growth, the Bank of Japan could reconsider its policy stance, though not in the foreseeable future.

Min Joo Kang

The rest of G10: Our calls at a glance

Bank of Canada

Our call: A 50bp hike in October and a final 25bp hike in December with rate cuts starting in 2H 2023.

Rationale: The Canadian economy has performed well, but there is increasing evidence that a slowdown is underway with the frothy housing market under pressure and the economy having lost jobs in each of the past three months. The central bank has already moderated the pace of hikes having raised rates by 75bp in September after July’s 100bp move, and we expect the Bank to shift to a 50bp move in October and 25bp in December. Inflation surprised to the downside last month and a recessionary environment could allow modest rate cuts from 3Q 2023 onwards.

Risks to our call: Shifting more to the downside given the deteriorating jobs market and slightly softer inflation. A December hike may not happen and rate cuts could come sooner – the Bank of Canada has a history of changing its stance quickly.

James Knightley

Reserve Bank of Australia

Our call: We anticipate the Reserve Bank of Australia (RBA) hiking 25bp at each of its monthly meetings until the year-end and continuing to tighten into the early part of 2023 at the same pace. That will take the cash rate target to 3.10% by the end of the year, and a peak of 3.35% by 1Q23.

Rationale: The RBA confounded markets recently by hiking at a 25bp pace, down from its previous run of 50bp hikes. The RBA had been hinting for some time that it wanted to scale back the pace of tightening, though a “final” 50bp hike had been expected following strong labour market and retail sales data which showed little sign that the domestic economy was slowing.

RIsk to our call: The accompanying statement made clear that the RBA views seriously the risk of overdoing the tightening on the way up, and contrary to other central banks like the US Fed, seems relatively relaxed about the inflation fight. The main risk to its view and our forecast will be that the economy takes longer to slow, and inflation longer to come back down towards its target, resulting in a higher-for-longer rate profile than our base case.

Rob Carnell

Riksbank

Our call: 75bp hike in November and 50bp in February (3% peak).

Rationale: The Riksbank’s massive 100bp September rate hike was coupled with a message that the committee won’t need to hike that much further. The committee is split between those concerned about further krona weakness, and those more concerned about damaging an already-fragile housing market. For now, we expect the hawks to win the battle, and Governor Stefan Ingves said in the latest minutes that the Riksbank needed to stay a “comfortable distance” in front of the ECB. With the ECB set for another 75bp hike in a few weeks, we would expect the same from the Riksbank – and given the latter only has one meeting left this year compared to the ECB’s two, we wouldn’t rule out an even larger move.

Risk to our call: Desperate to support the krona, Riksbank hikes much more aggressively despite concerns about the housing market.

James Smith

Norges Bank

Our call: 50bp hike in November and 25bp in December.

Rationale: Norway’s central bank has been hiking consistently in 50bp increments throughout the summer, and we expect one more such move in November. But the message from the most recent interest rate projection is that the central bank is less than 100bp from the expected peak. With a preference for front-loading, we’d expect the anticipated 3% level to be hit by year-end.

Risk to our call: More aggressive hikes from other central banks, perhaps coupled with higher oil prices, sees Norges Bank hike rates closer to 4%.

James Smith

Swiss National Bank

Our forecast: 75bp hike in December and 25bp in March 2023, thereafter the rate will remain unchanged.

Rationale: Swiss inflation fell in September to 3.2% from 3.5% in August and appears to have passed its peak. However, inflation remains above the SNB's target, which will prompt the Bank to raise rates again at its next quarterly meeting, following the 50bp hike in June and the 75bp hike in September. A 75bp increase seems likely for the December meeting. After that, the SNB could raise rates by another 25bp at its March 2023 meeting to 1.5%, but we believe that it will not go further and will then keep rates unchanged for a long period. This is because, by that time, inflation should have slowed significantly due to the global economic slowdown.

Risk to our call: If the economic slowdown were to be more severe than expected or if the Swiss franc were to appreciate more significantly, inflation could slow more quickly than expected. This could lead the SNB to stop raising rates after December and leave rates unchanged in March 2023.

Charlotte de Montpellier

CEE: Our calls at a glance

National Bank of Hungary

Our call: Effective tightening continues with liquidity measures.

Rationale: The National Bank of Hungary surprised markets at its September meeting, hiking the base rate by 125bp to 13% and announcing the end of the hiking cycle. With this move, it ended a long and extensive tightening cycle (16 months and 1,240bp). The goal now is to maintain strict monetary conditions, and the focus shifts to tightening liquidity and improving the monetary transmission. The new tools (1-week central bank bill, longer-dated deposit with floating rate and stricter reserve requirement regulation) need some time to take full effect, pushing the effective rates above the base rate in various submarkets. We see the central bank keeping the 13% base rate unchanged at least until mid-2023 when a window of opportunity might emerge to start easing.

Risk to our call: The vulnerability of the forint from the energy crisis, the Rule-of-Law debate and the country's external financing needs might force decision-makers to re-think the policy of a permanent hold in rates. We also see upside risks to inflation which could also signal the need for higher interest rates in the short run.

Peter Virovacz

Czech National Bank

Our call: Stable rates until the end of this year and the first rate cut in 1H23.

Rationale: The CNB was the first in the CEE region to start hiking rates and the first to end the hiking cycle. After changes in the board in July, the CNB has turned more dovish and we do not expect further rate hikes. The central bank has started FX intervention to defend the koruna and we expect it to continue doing so at least until the end of the year.

Risk to our call: Although we see the probability of an additional rate hike after the September meeting higher than in August, this is still far from our baseline scenario of stable rates. The CNB is focusing on wage growth, which is surprising to the upside, and the board has repeatedly signalled that it is prepared to hike rates if wages rise too fast, and create a wage-price spiral. However, the pain threshold has not been set and the next release of 3Q wage statistics is not until December when we believe inflation, and the economy will have already slowed and the window for rate hikes will close. The second risk is the increasing pressure on the koruna, which could increase so much in the coming months that the CNB may have to change its strategy.

Frantisek Taborsky

National Bank of Poland

Our call: We believe the MPC will hike by 25bp in November (to 7%) and should end the tightening cycle without an official announcement. During 2023, we see cosmetic cuts to 6.5%, while in 2024 we will see a renewed fight against persistently high inflation and another tightening of the policy mix, either through rate hikes or a large tightening of fiscal policy.

Rationale: The MPC reaction function has changed in the last few months. The de facto target is now to lower CPI with a soft landing in GDP. The actual target of 2.5% is less important now.

Risk to our call: We see upside risks to our rates call. The economy is now experiencing a new wave of price rises due to the recent energy shock. CEE FX will be fragile given the strong dollar and that central banks in the region are trying to end their tightening cycles. In 2023, inflation should fall significantly from around 20% to below 10% by the end of the year), before spiking again in 2024. Our models indicate persistently high core inflation, and the removal of extraordinary fiscal measures will unleash 'deferred inflation', adding 4ppt to CPI in 2024.

Rafal Benecki

Central Bank of Turkey

Our call: Interest rates remain on hold for the rest of the year.

Rationale: Inflation has continued on a strong upward path but there have been some signs of a slowdown in core inflation lately. Increased pressure on the current account and subdued capital flows suggest a further drawdown in reserves is possible in the near term. In this environment, policymakers will be wary of another FX shock given the current global risk-off sentiment which could further weigh on key macro indicators. Thus, the central bank may be careful about any policy easing. We think any central bank action ahead will likely be determined by the path of the exchange rate and FX reserves.

Risk to our call: There is a significant risk skewed towards more easing given i) President Erdogan’s call for further rate cuts to single digits by the end of the year ii) the CBT’s focus on supportive financial conditions so as to preserve the growth momentum in industrial production, and the positive trend in employment given recent signals of decelerating economic activity.

Muhammet Mercan

National Bank of Romania

Our call: Terminal key rate at 6.75% in November 2022.

Rationale: With the CEE3 central banks apparently done with rate hikes, inflation visibly decelerating into year-end and GDP growth plunging, the NBR will likely use its last policy meeting in 2022 for one more hike. Nevertheless, we don’t think that the Bank will announce an end to the hiking cycle, as the NBR has never pre-committed to a policy course.

Risk to our call: The tail risks are significant both ways. A final 25bp hike in November (leaving the terminal rate at 6.50%) cannot be excluded given the weak macro environment. At the same time, a more sequential approach of a 50bp hike in November and 25bp in January (taking the key rate to 7.00%) would be much more consistent with the NBR’s usual approach and rhetoric.

Valentin Tataru

Asia (ex Japan): Our calls at a glance

People's Bank of China

Our call: Policy rate cuts put on hold.

Rationale: The PBoC has stated a few times that the current interest rate level is the neutral level. This suggests that the central bank is not going to cut interest rates any further. The main issues for the Chinese economy are ongoing Covid containment measures and a property crisis characterised by falling sales, developer defaults and mortgage boycotts as new homes are left unfinished. None of these issues can be resolved by simply cutting interest rates. The central bank could expand re-lending programmes to smaller firms and the agricultural sector. This would be useful to support the job market indirectly, with cheap loans for smaller firms particularly helpful. We don't think the central bank will easily decide on cutting the required reserve ratio (RRR), which would inject a lot of cash into the banking system. Frankly, there is not much demand for loans as economic activity has picked up only gradually.

Risks to our call: If the economy turns down more than expected, mainly due to the real estate sector, then the central bank would act fast and may cut the RRR to ease the rise in interest rates from higher credit costs.

Iris Pang

Reserve Bank of India

Our call: The last rate move by the Reserve Bank of India (RBI) was a 50bp hike taking the repo rate to 5.9%. We believe that the Bank will hike again in December, but by a smaller 25bp increment, and that that will mark the peak for rates, which will begin to slowly ease lower again in 2023 from the May meeting.

Rationale: The main driver for rates currently is the inflation rate, which at 7%, and moving higher rather than lower, means the RBI needs to keep raising rates to close the gap between the policy rate and inflation (the negative real policy rate). Until it does this, the rupee will likely remain under weakening pressure. But inflation should begin to peak during 2023, helping to close that gap anyway – the economy is already showing some signs of a slowdown and we have recently revised down our GDP forecast below 7% for 2022.

Risk to our call: Sticky high commodity prices is likely to be the main source of error to these assumptions – which could reflect either a Chinese recovery, escalation of geopolitical tensions, or adverse weather shocks.

Rob Carnell

Bank of Korea

Our call: A further 50bp hike in October, a 25 hike in November, then a cut in 4Q23.

Rationale: We expect CPI inflation to stay above 5% in 4Q22, while GDP growth is likely to contract by year-end due to weak external and internal demand. We expect the BoK to end its hiking cycle this year at 3.25% but markets expect it to be 3.50%, reaching that point by 1Q23.

Risk to our call: If inflation does not come down to below 5% by early next year, the Bank of Korea may hike by another 25bp in February.

Min Joo Kang

Bank Indonesia

Our call: Bank Indonesia (BI) to deliver 75bp worth of rate hikes for the balance of the year.

Rationale: BI has been able to hold off from raising rates for most of 2022. But accelerating inflation finally prompted action from BI Governor, Perry Warjiyo, and his first hike surprised market participants. Headline inflation recently hit 6% after subsidised fuel prices were hiked and we can expect inflation to accelerate further in the coming months. Price pressures and a weaker currency will keep BI on a tightening path going into 2023.

Risk to our call: A much more pronounced pickup in price pressures could prompt a more forceful response from BI. On top of supply-side pressures, domestic economic activity has been robust which could lead to additional price pressures coming from the demand side. BI could also double down on rate hikes should the Indonesian rupiah come under intense pressure in the coming months.

Nicholas Mapa

Bangko Sentral ng Pilipinas

Our call: Bangko Sentral ng Pilipinas (BSP) to hike a cumulative 100bp at its last two policy meetings in 2022.

Rationale: Inflation continues to heat up with price increases driven by a mix of demand and supply factors. Recent wage and transport fare adjustments were implemented, and domestic economic activity returned to pre-Covid levels. Meanwhile, food inflation remains elevated due to supply disruptions linked to storm damage. BSP is likely to retain its hawkish tone as the peso faces intense depreciation pressure, fanning imported inflation. BSP Governor, Felipe Medalla, vowed to retain his hawkish stance until he achieves his price stability objective so we expect further tightening in 2023.

Risk to our call: The BSP governor has acknowledged that recent PHP weakness threatens the inflation outlook. Intensified pressure on the PHP could force BSP to hike more aggressively to close out 2022.

Nicholas Mapa

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article