CEE: One last inflation push for rates

Excluding one-off effects, inflation in Central and Eastern Europe should continue to surprise on the upside. Inflation in December and especially January re-pricing may provide a final opportunity to reassess the market's extremely dovish expectations for this year

Without one-off factors inflation in the region should continue to surprise

Following a downward inflation surprise in Poland, December figures for the rest of the CEE region will be published this week. Inflation in the Czech Republic will be published on Wednesday with data due from Hungary and Romania on Friday. In all three cases, our economists expect inflation to be slightly above market expectations.

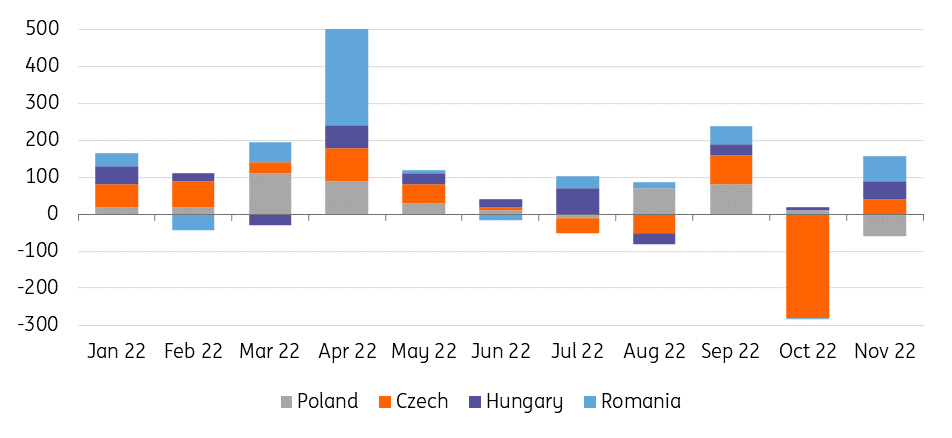

Last week, Polish inflation delivered a significant downside surprise (0.8pp), one of the largest in the region over the past year, triggering a massive rally across the board in rates and bonds. We saw a similar situation in the October data with a huge downside surprise in Czech inflation (2.8pp). However, in both cases, specific reasons can be found to explain the result. In the case of Poland, the surprise was mainly attributable to energy prices, including government-subsidised imported coal. In the Czech Republic, it was due to the approach of the statistical office, which entirely included the government's measure to reduce energy prices in the CPI. Without this effect, inflation in the Czech Republic would have been 3.5pp higher, implying an upside surprise of 0.7pp from the consensus.

Moreover, across the region, core inflation remains high and shows little inclination to slow. If we remove these one-off effects, inflation in the CEE region is still surprising to the upside and we are still not past the peak. Although we are probably out of the worst of it and massive upside surprises will hopefully no longer take place, we should still keep in mind that the inflation problem in the region is not over, and inflation will be more persistent than in developed markets due to specific regional factors.

Furthermore, the main test is yet to come. January is likely to be the last chance for retailers to increase their margins in response to increased costs. Last January, we saw a more significant re-pricing only in the case of the Czech Republic (4.4% month-on-month), while the rest of the region averaged only 1.5% MoM, just slightly above the previous year.

Inflation surprises in the CEE region versus market consensus (pp)

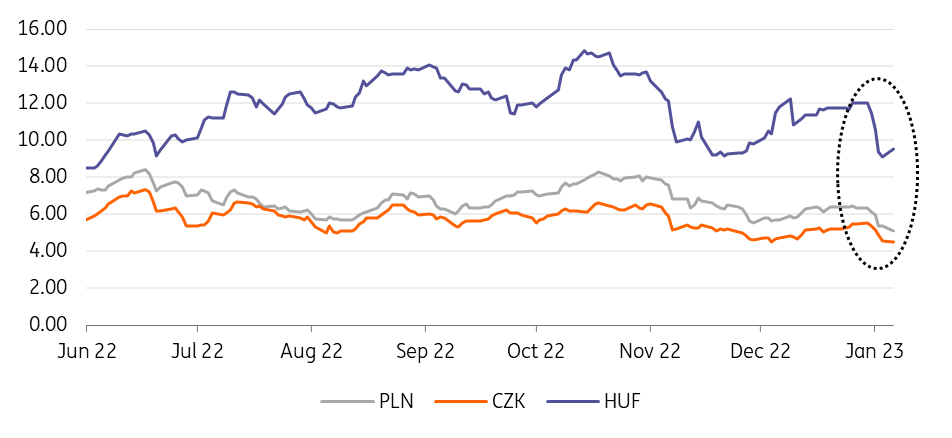

Inflation prints an opportunity to reassess the dovish expectations

A sense that inflation in the region is slowing, coupled with the global story, has forced markets to price in massive monetary easing in the short term. In the Czech Republic, the market is targeting a roughly 185bp cut over the one-year horizon and within two years, the key rate should return to 3%, a level currently considered by the central bank to be an equilibrium level. Although we forecast a rate cut this year, such expectations are in direct conflict with the current rhetoric of the Bank board of "higher rates for longer" and a record strong koruna.

In Poland, the market is currently the furthest away from our forecast. Here, we expect inflation, and core inflation in particular, to be the most persistent, so it’s hard to imagine a 150bp rate cut this year, which is currently priced in. Our economists expect rates to remain unchanged for at least the whole of this year, plus inflation should pick up again in January and February.

Overall, we believe that the current situation offers limited scope for further declines in rates and yields in the region. We believe that the current situation is not the end of the payers in the market and we should see at least one more upward push in rates and yields in the coming weeks, supported by the global story as well. This week's inflation numbers could be the first trigger, and January inflation numbers should remind us that inflation is still a hot topic in the region.

Market expectations - 1y1y IRS forward (%)

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more