Carbon prices in the EU crash despite rising fossil fuel prices

Since Russia launched its invasion of Ukraine, the price of carbon allowances in the EU has fallen drastically, lowering the cost to emit carbon despite record high fossil fuel prices. Negotiations to strengthen the EU's Emissions Trading System could be delayed but the proposal is unlikely to be cancelled

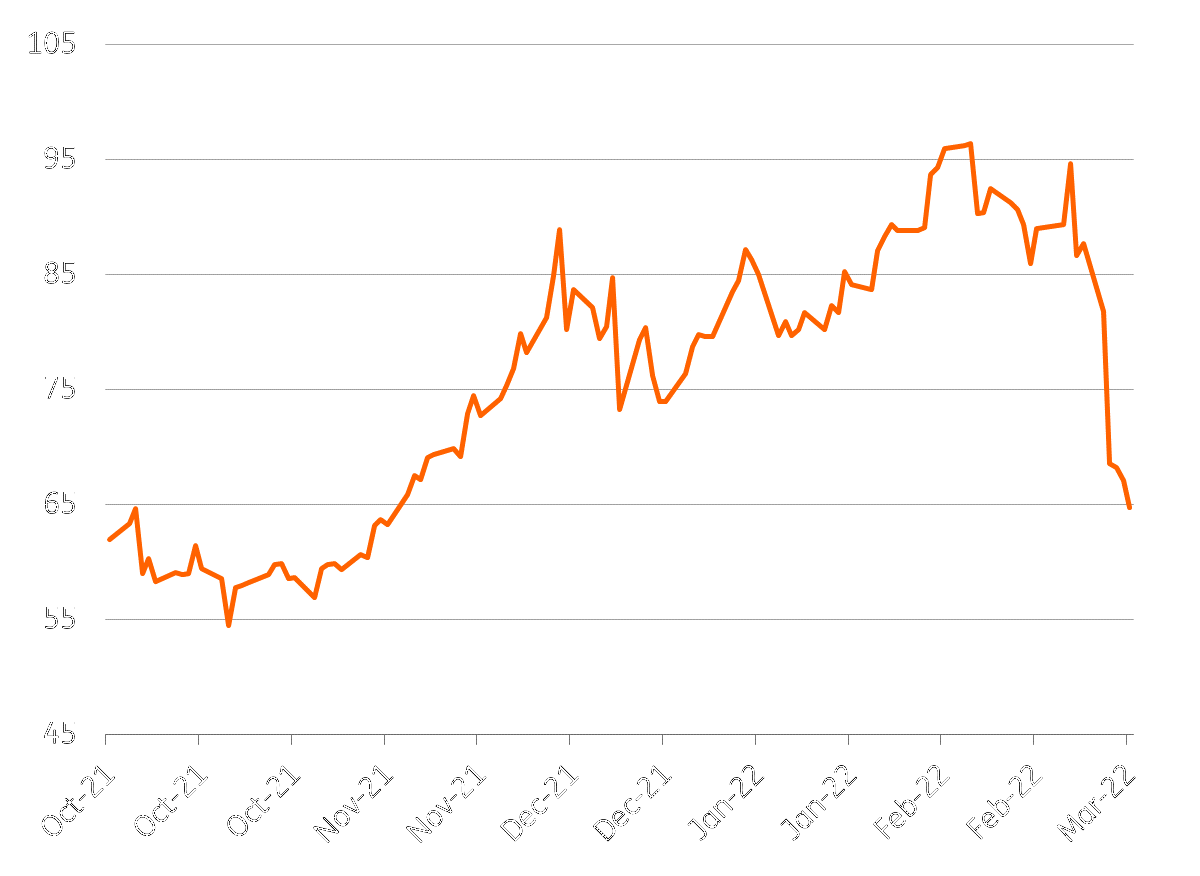

Carbon permits have lost 35% of their value since the beginning of the war

Just a few weeks ago, we described the trend of rising prices in the European carbon market as promising for the transition to low-carbon technologies. The EU's ambition to further strengthen the carbon market as a cornerstone of its Fit-for-55 package was fuelling bullish sentiment among market participants. A ton of carbon was flirting with €100.

Carbon pricing is the cornerstone of the EU's climate policy aimed at curbing emissions across energy-intensive sectors like power generation and heavy industry. In theory, the more companies need to pay for their emissions as the price of CO2 rises, the more effort they will put into cutting emissions.

But all of that has changed with Russia's invasion of Ukraine. The price of carbon allowances, which some energy-intensive industries must buy in order to emit CO2, has lost around 35% of its value since the beginning of the war. The fall observed over the last few days thus brings the market back to the price levels observed in November, below the €70/tCO2 mark.

The price of carbon is falling on the EU ETS

Euros per ton of CO2

Energy prices are surging, but carbon is decoupling for three reasons

At first sight, this fall is quite surprising given that carbon is theoretically correlated to the energy complex. The decline is in complete contrast to the move seen in gas prices. The European gas market benchmark, the Dutch TTF, doubled last week, surpassing the 200€/MWh. Given Europe’s dependency on Russian gas, the market is very nervous about Russia/Ukraine developments and what that could potentially mean for gas flows into Europe.

Three reasons behind the fall

- Liquidity needs. Investors are trimming their EUA positions to cover losses in other asset classes and/or access liquidity for more expensive gas and electricity. This confirms that carbon rights can be used as liquid assets in case of cash needs, somewhat like some currency or interest rate hedges.

- Anticipation of lower demand. Concern that higher energy prices and war will lead some industrials to reduce operating rates and thus CO2 emissions is fuelling anticipation of lower demand for carbon allowances.

- Technical trading. There is a snowball effect with stop-losses being triggered and more automatic selling of positions as the market has dipped.

Long-term outlook unchanged

But conflicting forces could push the market back up. The prospect of more coal-burning this year to substitute for a squeezed gas market will increase power sector CO2 emissions and thus demand for allowances. Coal emits more than twice as much CO2 per unit of power production.

In the longer term, the picture remains bullish for the market: the proposal to further strengthen the carbon market as the cornerstone of the EU's new climate strategy, Fit for 55, is still being discussed in the European Parliament. More industrials are calling for the EU to postpone the talks and review the extension of the EU ETS as excessive market speculation pushes up CO2 emission prices to the detriment of producers, but we still expect the proposal to tighten the market and to support a steady increase in carbon prices. The European Securities and Markets Authority (ESMA) recently concluded in a report that speculative activity makes up only 4% of the EU ETS market.

With energy security now at the heart of the EU's political agenda, negotiations on the carbon proposal may be slightly delayed but certainly not cancelled. Strengthening the carbon market should remain the cornerstone of the European Commission's package to achieve its climate target. Arguments for the introduction of a carbon price floor in the proposal are likely to gain momentum given the volatility observed.

The forthcoming EU strategy to reduce reliance on imported gas from Russia and increase countries' energy system resiliency will provide some important clarification.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article