Car Market Outlook: Recovery Postponed Again

We are revising our global car sales forecasts for 2022 into negative territory. While we had hoped that a recovery in car sales would gather momentum this year, new factors, most notably further lockdowns in China and Russia's invasion of Ukraine, have intervened and compounded the continued car chip shortages, undermining our earlier growth scenario

Downgrading our forecasts mid-way through the year

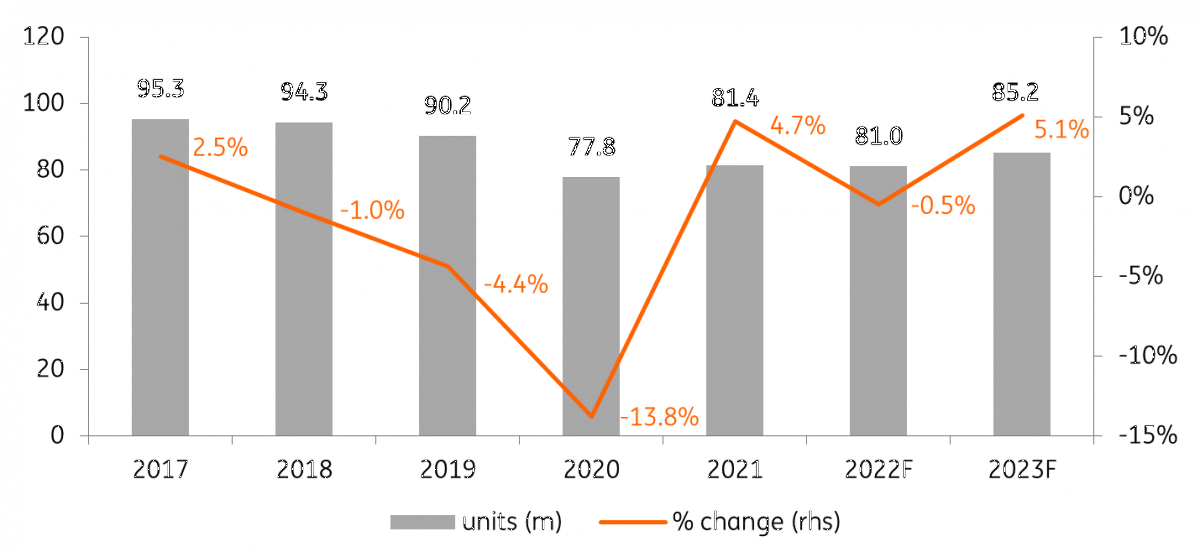

With the first half of 2022 behind us, we are revising our forecasts for the full year and also trying to provide some insight into the next one. After two Covid-19-impacted years, which were further affected by the auto chip shortages, we had hoped that the current year would deliver a continued recovery in global car sales, beginning to bridge the gap with the pre-pandemic sales levels. Our constructive view, articulated at the start of this year, was based on the demonstrable robust consumer demand that allowed automakers to maintain or improve their profits, in spite of the weak volumes during the second half of last year. However, new adverse factors have intervened since the start of 2022, including Russia’s invasion of Ukraine and continued strict lockdowns in China. This has led to new disruption at various production sites in Europe and Asia, while chip shortages have remained. As a result, we are downgrading our growth forecast for global light vehicle sales to -0.5% in FY 2022 from +4-6% previously. To put our revision in perspective, our preceding expectations date back to early January as we traditionally update our forecasts on a semi-annual, rather than ad hoc or more frequent basis. In our view, this gives us some perspective but also may necessitate more meaningful one-time adjustments.

From growth to modest negative territory

While we would be happy for our expectations to be exceeded by the end of this year, with so many moving parts at play, we remain cautious and wary of further shortfalls vis-a-vis our current base-case scenario. We note that the second half of 2021 experienced the most acute impact of auto chip shortages, so the comparative base will become more accommodating for the second half of this year. And we expect chip shortages to subside further as also supported by comments made recently by Volkswagen. Yet, after a disappointing first half of the year, there is a lot of catching up to do to even meet, not to mention exceed, our full-year forecasts.

Global light vehicle unit sales (m)

Difficult first half across three major geographies

We note that light vehicle sales experienced a drop across three major car markets, including China, the United States and the European Union, in the first half of 2022. In the EU, new car registrations dropped by 14.0% year-on-year in 1H 2022 (totalling approximately 4.6mn units), with the four top markets registering sharp declines over the period, including Italy (-22.7%), France (-16.3%), Germany (-11.0%) and Spain (-10.7%).

In Western Europe, comprising EU14+EFTA+UK, new passenger car registrations – following sales with a delay due to longer delivery times – were down 14.3% year-on-year during the first half of this year, including an 11.9% drop in the UK. In China, according to the China Association of Automobile Manufacturers, auto sales were down 6.6% year-on-year during the first half of 2022 (but with a jump of +23.8% in the month of June). We believe that the Chinese market has a greater propensity to recover during the second half of this year, due to the government’s reduction in the vehicle purchase tax, which should last until the end of the year, and some potentially lower impact from the Covid-19 restrictions. Based on our forecasts, China is the only one of the three major regions that we assume will experience growth in 2022. In the US, auto sales declined by double digits during 1H 2022 and while we anticipate a recovery in the second half of this year, we still expect the year to end in negative territory. As we have indicated, we believe we are cutting our forecasts notably to bring them in line with our current expectations. However, we have become somewhat more cautious in the face of many headwinds and risks, including potential adverse changes in consumer sentiment.

Auto part manufacturers have less propensity to sustain profitability in the face of lower growth expectations

In our previous sector outlook, we indicated that we expected production to exceed auto sales growth rate by some two to three percentage points. We continue to expect this relationship to hold, implying rather modest production growth of sub-3% year-on-year for FY 2022. Production numbers and dynamics are particularly important drivers for auto parts manufacturers, which are more volume-dependent than car manufacturers and do not have the same flexibility to vary their sales mix in order to maintain their margins and profitability. Conversely, major OEM’s have managed to sustain a reasonable level of earnings during the past 12 months in the face of sales and production volume headwinds. This was achieved by the car manufacturers through rebalancing their production and sales mixes towards the higher-priced, higher-margin model ranges.

Will next year finally deliver a healthy rate of growth?

We currently expect auto sales growth to rebound in 2023, with a potential rate of expansion of 5% year-on-year, or higher. However, we caution that such a growth scenario also assumes that while some headwinds, such as car chip shortages, will finally fade in the rear-view mirror, the demand side will remain solid. This cannot be taken for granted entirely given deteriorating purchasing power and consumer confidence in the major car buying geographies. Therefore, we believe there is a risk that some of the pent-up international demand for light vehicles will fall during the upcoming year. Another relevant factor is the high price of petrol which is pushing up costs for drivers. But on the other hand, the labour market still supports demand from the corporate side and cars have gained greater popularity over the pandemic, so it is not all negative.

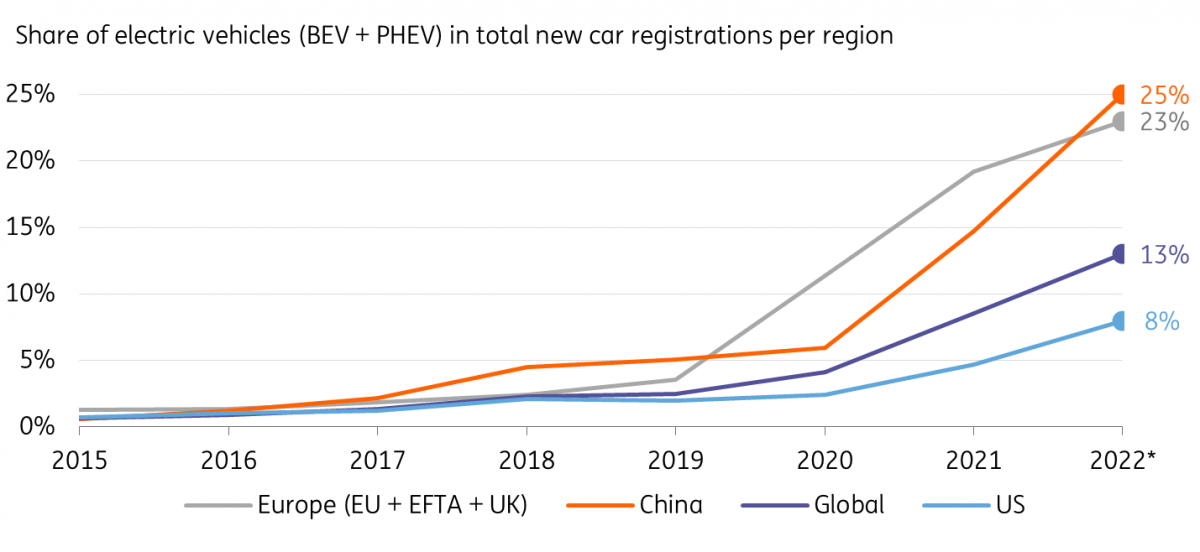

China to take the lead in global electrification, heading for a quarter of total sales in 2022

While the global car market was facing the impact of the pandemic, the process of electrification continued to progress. Electric cars (EVs) are of course not immune from production struggles, as they consume even more chips than conventional cars. But at the same time, EVs have also been prioritised by car makers for strategic and regulatory reasons. Almost all car manufacturers have now revealed their transition strategies, in addition to further developments on the regulatory front, and new entrants like Xpeng, Nio and Rivian are trying to use this disruptive momentum to penetrate the market and make their way through the production upscaling challenge. And on the demand side, the appetite for EVs is soaring, according to global surveys. The Chinese EV market is growing particularly rapidly. With 3.3mn EVs sold (including plug-in hybrid: PHEV + battery electric: BEV) in 2021, the Chinese market has continued to maintain growth momentum. The world’s most populous country already is the biggest EV market in the world, but in 2022 we expected it to overtake Europe in terms of the share of the overall car sales. This is also reflected in production figures of regional market leader BYD exceeding Tesla’s in the first half of 2022 (654,000 vs. 564,000, respectively).

China is expected to hit a key milestone in 2022 with one in four new cars being electric, whereas Europe is expected to remain slightly below that figure. In the US, the process of electrification has lagged somewhat, but times are changing and EVs are also gaining traction across America, as reflected by the popularity and large orderbook of the all-electric Ford F-150 Lightning. On a global scale, this results in an expected electric share (PHEV + BEV) of 13% in total new car registrations in FY 2022.

Although electrification is progressing, the road ahead is not free from road bumps. Charging infrastructure is lagging but has become increasingly important as EVs spread among the urban population with few home charging facilities. Another critical point is the elevated price of raw materials, particularly for an essential battery metal like lithium, which delays the lower cost path for new EVs.

China to take over Europe in the shift toward electric vehicles

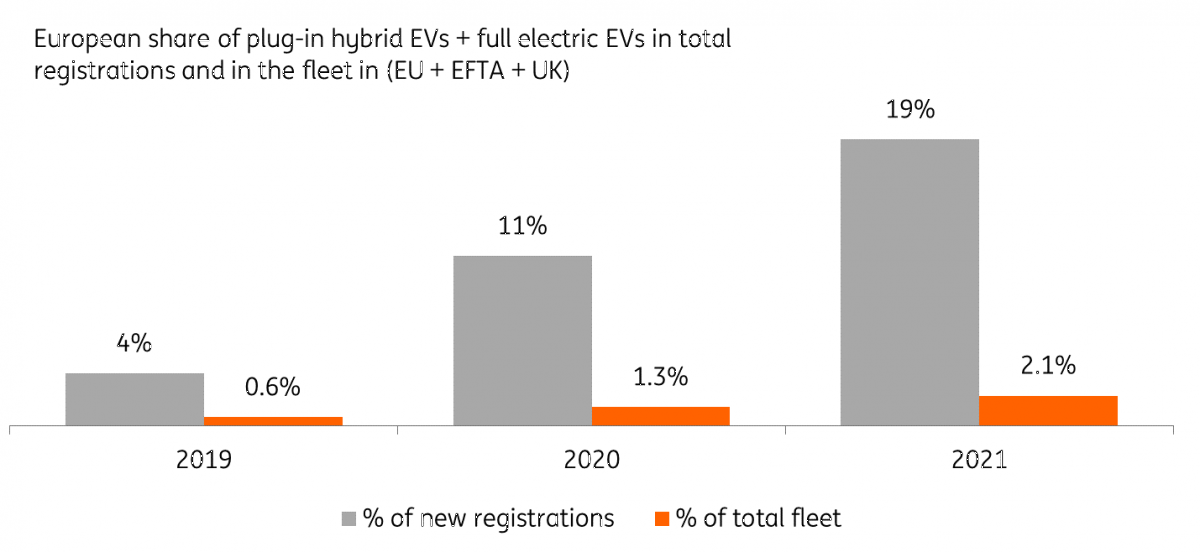

While EV share accelerates, low production volumes slow fleet replacement

While the electrification of new sales is going faster than expected, the total number of cars delivered is under pressure for the third consecutive year because of production struggles. Just 4% of the fleet was renewed in Europe in 2021 while the average age of rolling stock reached 12 years. Due to low replacement levels, electrification of the fleet is also slow. The fact that cars have a longer lifecycle and many consumers opt for used cars weighs on this as well. While the European share of EVs in new sales reached 19% in 2021 and will go beyond that this year, just over 2% of the total fleet has been electrified.

EV share in new sales in Europe exceeds expectations, but replacement of the fleet is slow

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

European car marketDownload

Download article