Canadian inflation preview: Will the core cause concern?

Headline inflation is likely to be depressed by the slump in energy prices, but this is unlikely to overly concern the Bank of Canada unless we also see a drag on core figures – a real risk given persistently weak wage growth

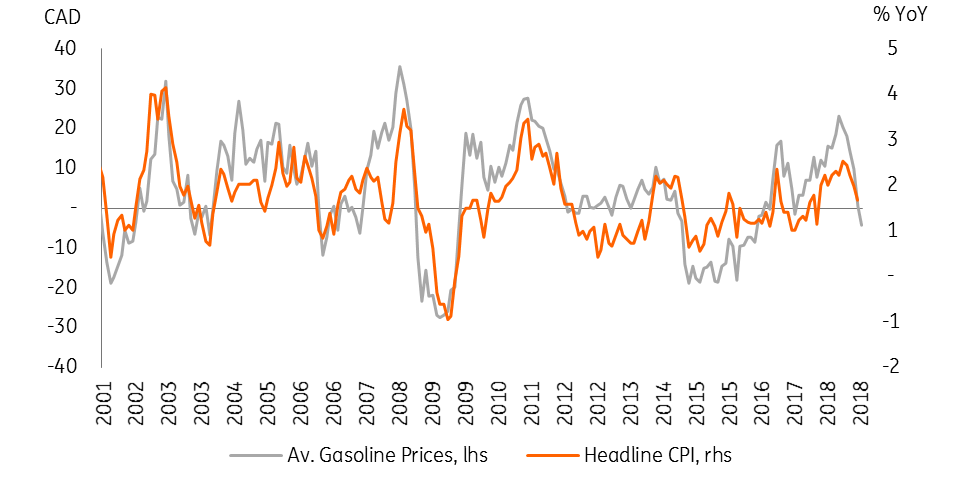

December’s headline inflation will be depressed by the slump in energy prices. We should see the annual figure pulled down to 1.6% from 1.7% in November.

Average prices for both Brent and Western Texas Intermediate both contracted by around USD8/bbl in December, a softer decline relative to the USD15/bbl contraction in November. That said, oil prices tend to feed through into gasoline prices with around a one month lag, so December will take the brunt of the plunge.

Gasoline prices will drag down headline inflation

A slight revision to our inflation forecast for this year, and oil is largely to blame

We’ve revised down our annual inflation forecast for 2019 from 2.1% to 1.9% on the basis that Canada’s energy sector will be considerably weaker this year than previously expected. This is predominantly due to issues with pipeline capacity, as well as the recent materialisation of lower-than-anticipated inflation figures.

| 1.9% |

Headline inflation, % YoYrevised down from 2.1% |

Weak wage growth is still a concern, but we see a pick-up on the horizon

Average hourly wage growth for full-time workers disappointed again in December and remained at 1.5%. The long-awaited wage growth pick-up hasn’t yet arrived and we worry that this could suppress household activity as disposable incomes stagnate, although we’ve seen no adverse effects on core inflation so far. It would be a cause of concern for policymakers if core inflation starts being dragged down.

That said, in the Bank of Canada’s (BoC’s) most recent Business Outlook Survey firms again reported that labour-related production constraints are a key problem. We continue to expect this will lead to upward pressure on wages as firms seek to attract workers.

The Bank of Canada also revised down its inflation forecasts for 2019

Following a more dovish tone in December and slowing economic momentum, both in Canada and across the globe, the central bank held the policy rate at 1.75% in its January meeting. From the bank's outlook in the October monetary policy, there was also a downward revision of 0.3% to this year’s headline inflation forecast, though this shouldn’t imply a slower tightening of policy given core inflation tends to be the bank's main hiking rational.

See here for more details on why the Bank of Canada held in January

The central bank will likely resume its tightening cycle, but the question is when

The next rate hike opportunity would be April when a new monetary policy report will be published, but we think a hike is more likely to come in July. This will allow the BoC to wait for confirmation that the Fed is still in hiking mode (if, as we expect, the Fed resumes hiking in June).

The next rate hike opportunity would be April, but we think a hike is more likely to come in July

We also see a second rate hike coming in the fourth quarter, but believe more than that is unlikely in light of the current risk environment and our view that the Fed is likely to moderate the pace of policy tightening in the US.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article