Canada: What wage growth concerns?

When it comes to the story of sluggish wage growth, the Groundhog Day we've been seeing since June last year has finally changed its tune. January saw wage growth finally pick-up for full-time workers, and we don't expect this to just be a temporary relief

After the hiring blitz in November (+94,000), there was a much slower pace of job gains in December (+9,300), but Canada is back on track in January creating 67,000 jobs. The unemployment rate ticked back up to 5.8% after sitting at a four-decade low of 5.6% for two months as more people entered the labour market. That said this is still a relatively low unemployment rate and jobs are still being created, so on face value, the picture is pretty positive and won’t be too much of a concern for the Bank of Canada (BoC).

Light at the end of the tunnel

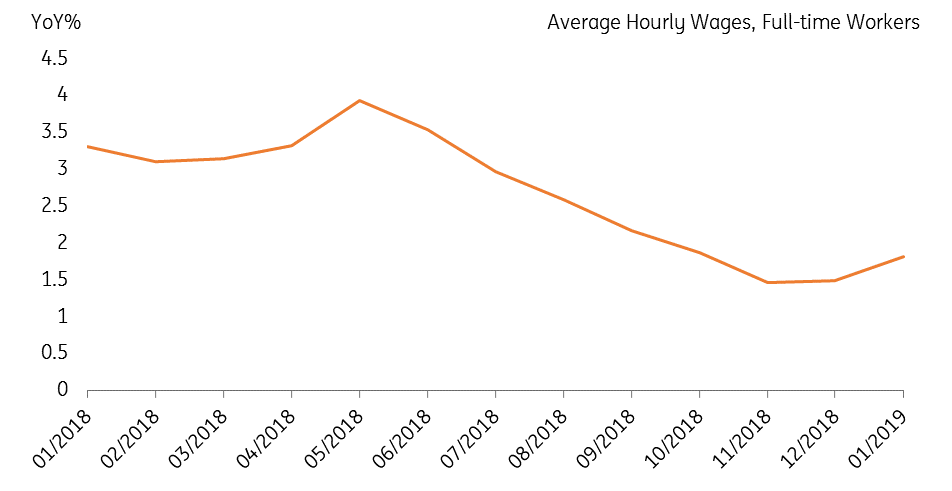

The long-awaited pick-up in wage growth is tentatively beginning to show. For full-time workers, average hourly wages ticked up to 1.8% year on year from its 2018 low of 1.5% YoY. 2019 should see some further upside for wages, given the economy is operating close to full capacity and unemployment is so low. Today’s number backs up the view, which was hinted at the central bank's most recent business outlook survey.

Wage growth heads back in an upward direction

The full-time hiring reinforces our view the economy is in decent shape

This employment report was reassuring despite the fact the unemployment rate ticked up. Both full-time and part-time positions drove January job gains, reinforcing our view the economy is still in good health given firms now require to hire permanent positions – likely because of the high level of demand (particularly from the US) that is expected to persist in the near-term.

This employment report was reassuring despite the fact the unemployment rate ticked up

However, it is worth noting strengths will probably come outside of the energy sector given its deteriorating outlook. The mandatory oil production cuts in Alberta - enforced by the local government have started to hurt employment figures; we’ve seen declines for two months in a row now – driven by losses in full-time positions, and this could overall start to weigh on employment.

Reducing output has helped to lift oil prices in Western Canada, but it isn’t all good news. The reduction in output puts the energy sector’s performance below par (and will be for some time), and this was a significant contributor to our downward 2019 growth revisions from 2.1% to 1.8% given Canada is large net-exporter of oil.

Escalation of the risk environment could quickly change things

Nevertheless, if we continue to see wages heading in an upward direction and the job creation momentum carries on, we anticipate household activity should still contribute a decent amount to growth this year. This is despite headwinds such as a housing market correction and higher rates feeding through into the economy. This would support our view that the central bank could hike rates twice this year – likely in the third and fourth quarter – although the risks are skewed to the downside on this.

The central bank governor Stephen Poloz recently said in Davos that oil prices and global trade tensions would play a large part in determining the timing of the next rate hike. Any escalation of these risks would likely push us into revising down our anticipated number of rate hikes to one or possibly even none.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CanadaDownload

Download article

8 February 2019

In case you missed it: Trade truce withering away This bundle contains 8 Articles