Canada: Rate hike next week all but confirmed

Everything is going swimmingly for the Bank of Canada. This week should see headline CPI begin a gradual slide towards the 2% target, and with core measures also around this mark, we see the central bank hiking rates three more times before the end of 2019

September’s headline inflation should come in at 2.6% year-on-year, unchanged (in monthly terms) from August. And given the newly minted United-States-Mexico-Canada-Agreement (USMCA), prior trade insecurities - which could have seen the Bank of Canada rethink its tightening plans - have ended, clearing the path for three more rate hikes before the end of 2019.

| 1.75% |

BoC Policy Rate25bp hike |

Late September oil rally should prop up headline CPI

Household activity may be subdued due to slowing wage growth, which may have dampening effects on inflation in the near-term.

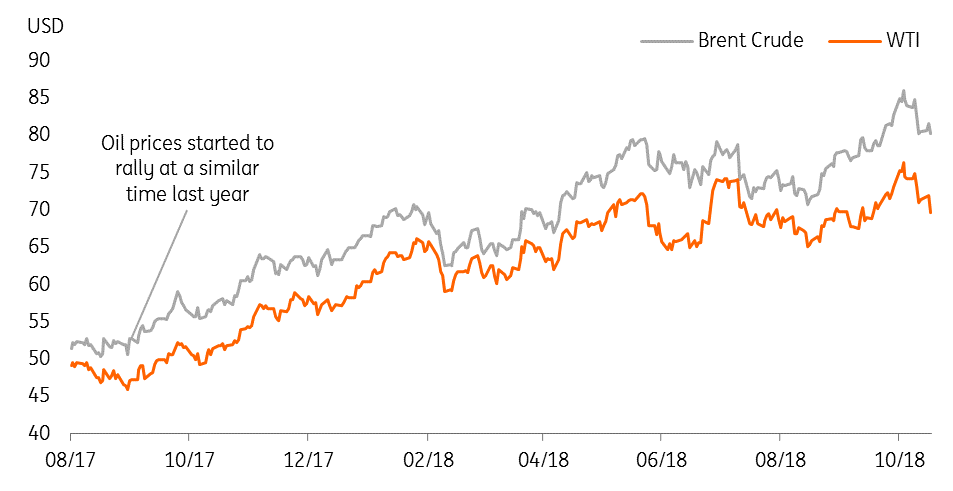

However, rising oil prices should help to keep September’s figure aloft. An oil price rally occurred at a similar time last year, creating a high base effect for inflation in September. Without the recent rally in oil prices, the year-on-year CPI figure would have been subject to downward pressure.

Global oil prices rallied at a similar time in 2017

Consumer prices aren’t at risk from tariffs

Although USMCA hasn’t led to the removal of the US’s existing steel and aluminium tariffs, this shouldn’t prove too much of a threat to consumer prices. In the BoC’s recent Autumn Business Outlook Survey firms reported that they are absorbing a large chunk of the extra cost from tariffs, rather than lifting output prices, amid competitive pressure.

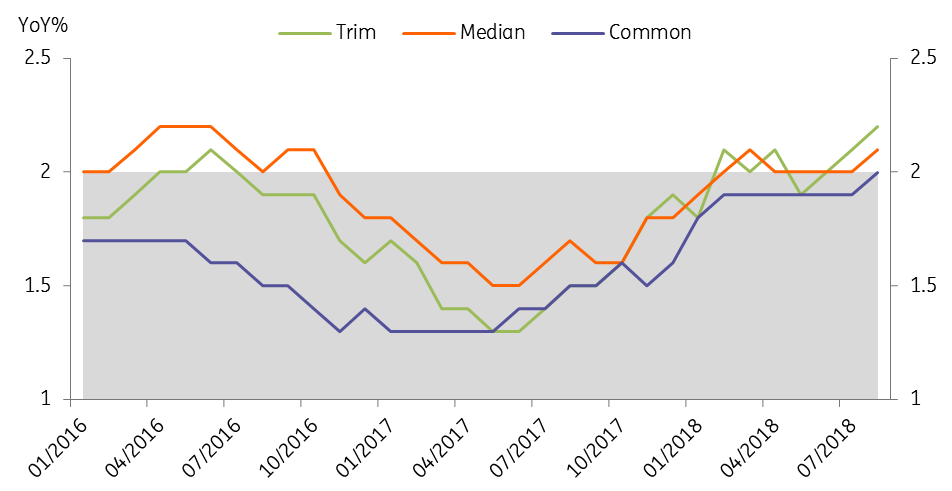

Core inflation is the key element influencing BoC policy decisions

More importantly for the BoC, all three of its main measures of core inflation ticked up in August and sit at, or slightly ahead of, the 2% target. Even further upward pressure on core numbers could come from positive news on wage growth; the BoC’s Autumn Business Outlook Survey indicated labour shortages are intensifying, so firms may move to push up wages in order to attract the desired skills.

Core measures are are all at least on the 2% target

Hike should come next week, regardless of CPI

The BoC will make its policy decision on the 24 October. And given this is the last chance (in 2018) for it to make a rate decision in tandem with the release of its quarterly monetary policy report, markets have priced in a 90% chance of a hike.

Core inflation is the key variable for the BoC’s policy decisions and the news here is good. This, coupled with the removal of the tariff threat on the back of USMCA, puts the BoC on track for two more rate hikes in 1Q19 and 3Q19.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

BoCDownload

Download article