Sharp drop in Canadian inflation suggests rates have peaked

Canadian inflation slowed more rapidly than expected in February. With global banking woes adding to downside growth risks and the upcoming budget expected to exercise fiscal restraint, the next move in rates should be downward, with a rate cut possible before the end of the year

Slower inflation boosts the case for a 4.5% peak in rates

Headline inflation in Canada rose 0.4%MoM, below the 0.5% expected, resulting in the annual rate of consumer price inflation falling sharply to 5.2% from 5.9%. The core measures of inflation broadly performed as expected but are now below 5%YoY. Gasoline prices were the main downward influence, falling 1 %MoM, meaning that the YoY rate for this component is now -4.7%. The main upward influences were clothing prices, which jumped 1.9%MoM after three consecutive monthly declines, while “household operations” saw prices rise 1.1%MoM, but again this follows three months of relatively soft or negative price changes.

At the 8 March Bank of Canada policy meeting, officials outlined their view that “weak economic growth for the next couple of quarters” and increasing “competitive pressures” will bear down on inflation and allow it to “come down to around 3% in the middle of this year”. Today’s data should give them more confidence in this happening and reinforce the market view that 4.5%, reached in January, will be the peak for the policy rate.

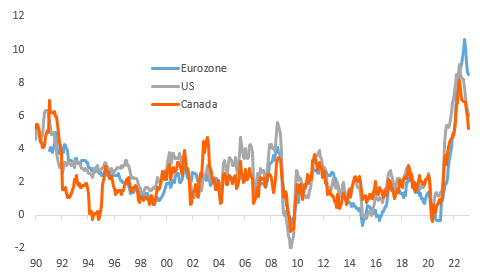

Headline annual inflation rates (YoY%)

Rates to move lower before year-end

Back in January, the BoC indicated that “it expected to hold the policy interest rate at its current level, conditional on economic developments evolving broadly in line with the MPR outlook”. This guidance is likely to remain in place at the next BoC meeting on April 12, with the BoC likely to sound even more cautious in the wake of US and European banking woes. Canadian banks are looking relatively resilient right now, but they too are likely to become increasingly wary given the fallout from what has happened. We should expect to see some modest tightening of lending standards which means access to credit will become more restricted throughout the economy.

We still think the next move in the BoC policy rate will be downwards and that the first cut is likely to come before the end of the year. Canada’s greater exposure to interest rates rate hikes via a high prevalence of variable rate borrowing means consumer activity should slow through 2023. High household debt levels in Canada - equivalent to more than 180% of disposable income versus 103% in the US – mean that Canada is especially exposed to the risk of a housing market correction in a rising interest rate environment. Falling inflation rates will give the BoC the room to respond with looser monetary policy, especially with the Finance Minister Chrystia Freeland suggesting her upcoming budget will “exercise fiscal restraint” to help in the battle against inflation.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article