Canada: July GDP to clear way for rate hike

A slight improvement in Canadian growth during July should be enough to see the Bank of Canada hike rates in October. But with Nafta talks still failing to yield any breakthrough, the outlook for growth remains uncertain

Strong sales and shrinking trade deficit key contributors to small gain

After a flat month for growth in June, we expect a slightly more positive story from July’s GDP print on Friday.

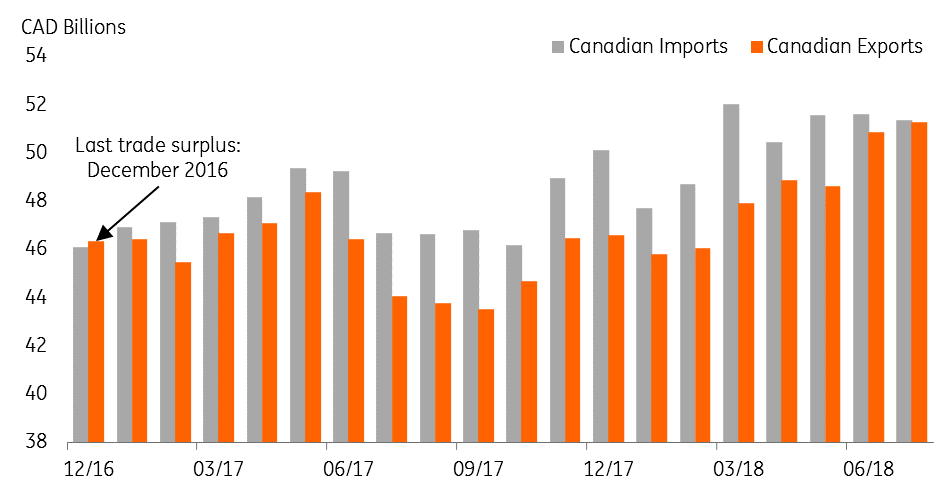

Following decent sets of retail and wholesale trade data, as well as a further narrowing in the trade deficit during July (which incidentally is now the smallest since December 2016), we expect July’s growth to come in at 0.1% month-on-month. That said, this could be held back again somewhat by reduced oil and gas output. June’s production was lower following a power outage at a facility operated by Syncrude – one of the world’s largest single source producers – and this reportedly persisted throughout July.

Narrowing Canadian trade deficit

Negotiations miss yet another deadline

Where does Canadian growth go from here? Well, although recent GDP figures have shown no sign of impact from trade tensions, the heightened uncertainty surrounding the Nafta agreement is continuing to cloud the outlook. The negotiations last week failed to yield any big steps forward, despite the ‘tentative deadline’ set for last Thursday/Friday, which was designed to allow time for a deal to be signed before Mexican President Enrique Pena Nieto leaves office in December. But given how Nafta deadlines have come and gone in the past, this wasn’t too surprising.

Base case: fudge, but no deal possibility isn’t off the cards

In our Nafta outlook last week, we saw three possible outcomes from the negotiations. Out of these, we still stick with our base case that a fudge is possible. For the Canadian economy, this means that growth should remain relatively healthy, albeit gradually easing off into 2019. This tallies with our forecast for a modest US slowdown next year, as higher borrowing costs and persistent uncertainty surrounding the overall world trade outlook start to weigh on activity.

However, we can’t exclude the possibility that there is a ‘no deal Nafta’, where Canadian growth slows much more rapidly – particularly if President Trump decides to impose tariffs on Canada’s auto industry, which he has threatened if a deal isn’t quickly reached.

Concrete answers are needed to de-neutralise the CAD

With uncertainty surrounding trade already high, our FX team doesn't expect any huge impact on the Canadian dollar should the talks fail to yield any breakthrough over coming days, as market expectations for an immediate resolution are fairly low. Meanwhile, barring any wildly negative headlines, we think the current run of healthy Canadian data and the recent pick-up in inflation should see the Bank of Canada hike rates in October.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

NAFTADownload

Download article