Canada builds the case for higher rates

The Bank of Canada left policy unchanged, but offered hints that we should expect further QE tapering soon with a rate hike firmly on the agenda for the second half of next year. In FX, this should translate into USD/CAD trading consistently below 1.20 in 2H21

| 0.25% |

Canada's key policy rate |

A steady ship... for now...

The Bank of Canada haven’t provided any surprises, leaving the policy rate at 0.25% and keeping weekly QE asset purchases at C$3bn. They have also maintained their forward guidance that they will keep interest rates unchanged until excess capacity in the economy has been absorbed and inflation consistently hits 2%. They continue to think this will be “sometime in the second half of 2022”.

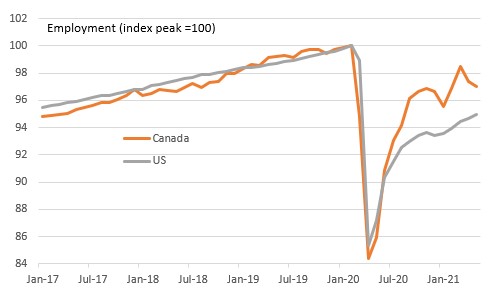

The BoC acknowledge that 1Q GDP was a touch softer than expected and April and May activity data will be hampered by the constraints from Covid containment. Employment has also stalled recently for the same reasons, but things are set to change rapidly.

Canada employment versus US Feb 2020 = 100

Strong vaccine programme points to vigorous 3Q growth

Canada’s Covid vaccination programme has been remarkably successful over the past two months. The proportion of people having received at least one dose of the Covid vaccine has surged from below 15% at the beginning of April to overtaking that of the US at 60% today. This has been aided by the government’s strategy of delaying second doses for two-shot vaccines, hoping that the degree of protection provided by first dose will contain hospitalisations.

The number of Covid cases is indeed dropping fast in response (from above 9,000 new daily cases in mid-April to below 1,300 yesterday) and we expect the bulk of the recently imposed restrictions to be eased just ahead of the summer vacation season. This should allow a broad re-opening of the service sector, which should rebound sharply and complement the vigorous growth experienced in the manufacturing, construction and commodity sectors.

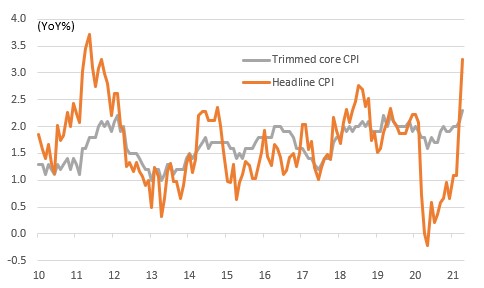

Inflation could linger for longer

We suspect the strong growth outlook means that both all of the lost GDP output and jobs could be fully recovered in the third quarter. This vigorous growth story, supported by additional fiscal support, together with supply constraints implies the potential for more inflation pressures. Already the headline rate is at 3.4% and rising while core rates are at or around 2%. The BoC think this will soon mark the peak, but as with the US, we think it could remain elevated for a while longer.

Canada: annual inflation rates

BoC at the front of the grid

With the economic outlook for the second half of the year undoubtedly brightening, the Bank of Canada remains on track to taper its asset purchases to C$2bn per week from July and conclude the QE programme around year-end.

The Bank of Canada forward guidance continues to indicate that they will be at the forefront of the global rate tightening cycle. We anticipate that the BoC will indeed start lifting interest rates in 4Q22 with the policy rate expected to end next year at 0.5% and 1.25% for end-2023.

CAD: The BoC tightening path is set to provide more of a tailwind

The notion that the Bank of Canada reamins a hawkish stand-out in G10 is set to continue providing support to the Canadian dollar, in our view. In particular, the diverging patterns in monetary policy in Canada and in the US should applying pressure on USD/CAD.

Recently, a break below 1.2000 has been averted by the USD regaining some momentum and the loonie likely suffering from its overstretched net-long positioning. But, in line with our view that the BoC will continue to taper asset purchases in 2021 while not denting market confidence about a rate hike in 2022, we think the fundamentals for a break below 1.2000 are there, and we continue to expect USD/CAD to stay on a depreciating trend in 2H21 and touch 1.16 in 4Q21.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article