Canada: August GDP to reassure economy still close to potential

On face value, a flat monthly figure isn’t always good news, but Canada's August GDP numbers released tomorrow are expected to show the economy is still close to its potential. Our growth outlook remains upbeat, with 2.6% and 2.1% average growth predicted for 2018 and 2019 while the door for more hikes remains very much open for the Bank of Canada

July’s GDP print (0.2% MoM) was slightly better than we expected, but we're not expecting any surprises to the upside for August - in fact, we see a flat monthly figure. This shouldn’t take the shine off things as the growth story in Canada has shown underlying momentum throughout summer, and we don’t see this changing anytime soon – we are forecasting a healthy 2.4% YoY print.

Trading surplus won’t be enough to see gains from July

Despite August posting the first trading surplus (0.526 CAD billion) since December 2016, negative data for both retail sales and wholesale trade are likely to weigh on GDP - and ironically so will manufacturing.

For August, we're forecasting a healthy 2.4% YoY print

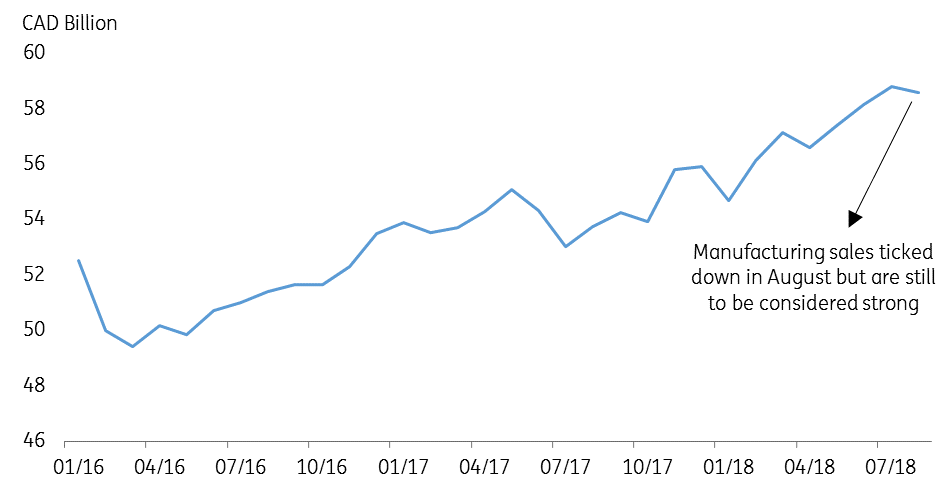

July saw the largest monthly manufacturing gains since November 2017 (1.2% MoM), so even though the ‘Canada’s strong manufacturing sector’ sentiment is likely to be reiterated in August – when tied to solid domestic and foreign demand, it will be a dampener on August growth as it struggled to top July’s bumper figure.

Manufacturing sales down from July

Hawkish hike signals to come

The Bank of Canada hiked interest rates a further 25bp last week, and their hawkish tone suggested more is to come. Consistently good growth numbers support the notion that Canada’s economy is tracking close to potential. This is putting upward pressure on prices – with a particular focus on the (less-volatile) core measures which currently average the banks 2% inflation target. The central bank remains upbeat that their tightening path will continue and we forecast two more hikes in 2019 and we aren’t ruling out a third just yet.

Canada’s hottest housing markets haven’t yet seen a moderation in house prices like other regions, leaving the risk of a sharp price decline plausible

Wage growth has been woeful (yet it’s worth noting that we expect the labour market to tighten, which should aid a pick-up). Canada’s hottest housing markets haven’t yet seen a moderation in house prices like other regions, leaving the risk of a sharp price decline plausible (a sizeable burden on growth). And of course, the US-China trade spat still persists, which probably would also see a negative net effect on growth – albeit only slightly, if the situation worsens. Coupling these risks together leaves a wobbly growth outlook.

The risks will be watched closely, but the chance of all of them escalating at once is very small – jeopardising growth expectations.

For now, our growth outlook remains upbeat, with 2.6% and 2.1% average growth predicted for 2018 and 2019 respectively.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more