CAD: Hard to buck the bullish trend

With the Bank of Canada now a hawkish standout in the G10 space, CAD's rate attractiveness is set to stay relatively high and provide extended support to the currency. Canada’s accelerating vaccinations and flattening contagion curve, along with supported oil prices, have convinced us to upgrade our USD/CAD profile: we now expect 1.16 at the end of 2021

The Canadian dollar has risen 3.2% against the US dollar over the past month, as monetary policy and external factors offered support while domestic recovery-related concerns have started to ease of late.

We were already confident in a move to 1.19 by the end of the year in USD/CAD, but the earlier than expected hawkish shift by the Bank of Canada forces us to upgrade our profile for the pair, and we now expect a move below 1.20 in the third quarter, with downside room – aided by a weak USD – extending to 1.16 by year-end.

Hawkish hopes to keep supporting CAD rate profile

The Bank of Canada has been a hawkish voice in the G10 space recently, especially after it surprised the market by bringing forward its expected first rate hike to the second half of 2022 from 2023, along with delivering a much anticipated CA$ 1bn-a-week tapering of asset purchases.

We reviewed April’s rate decision in “Canada: Hawkish BoC to lead the tightening charge?”, and we expect more tapering announcements to follow, thanks to the well-paced domestic and international recovery. While the Bank of Canada will not make any further, casual changes to its forward guidance from now on, additional tapering should at least put a floor under current rate expectations.

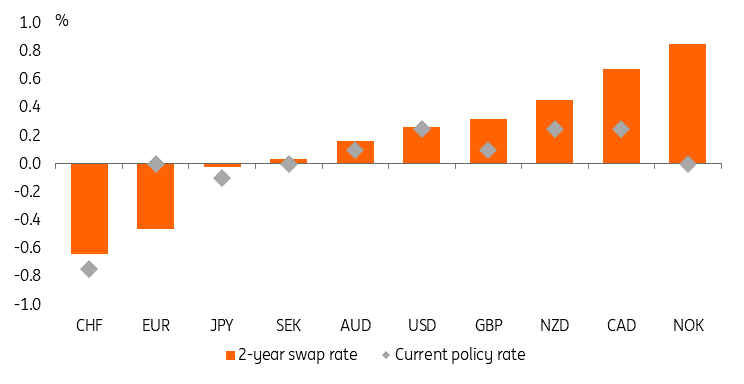

At the moment, the swap market is already pricing in some monetary tightening. The 2-year swap rate, which is a measure of market expectations on the average outstanding rate in the next few years, is currently the second highest in the G10 space, after Norway's krone (as shown in the chart below).

2-year swap rates in G10

The OIS market is currently pricing in three 25 basis point rate hikes by the BoC in the next two years. By comparison, only one rate hike is priced in for the Fed. This would suggest that the benefit to the Canadian dollar from the re-pricing of rate expectations has largely been absorbed already. At the same time, the higher-yielding status of the currency should mean that it is still a more attractive option from a carry perspective than most of its G10 peers, until other central banks match the BoC’s dovishness.

Virus situation in Canada: the worst may be behind us

The fate of the economic recovery in Canada is strictly connected to external dynamics, with any potential slowdown in global trade set to badly affect the export-oriented domestic activity. On the domestic front, the combination of monetary and fiscal stimulus has been significant and decisive in assisting the recovery, but a severe third Covid-19 wave has forced new restrictions and prompted a re-rating of the Canadian economic outlook.

However, there have been multiple indications that the restrictions have had the desired effect of flattening the contagion curve, with daily cases and hospitalisations starting to edge lower in the past few weeks.

Covid-19 in Canada May 2021

As shown in the chart above, a reduction in cases has been accompanied by a sharp increase on the vaccination side. At the moment, Canada is administering more daily vaccine doses per 100 people than the US, the UK and the EU.

Canada is administering more daily vaccine doses per 100 people than the US, the UK and the EU

Markets are seeing the effect of a large vaccination rollout in countries like the UK, the US and Israel, where lifting of some containment measures has not led to a new wave of Covid-19 cases – ultimately this is fuelling hopes that restrictions will be eased sooner than previously expected in Canada.

With this in mind, investors may partly overlook a forthcoming set of bad Canadian data (the drop in employment in April was likely just the start) caused by new restrictions, as those may be seen as a temporary blip while the recovery outlook remains rather bright thanks to faster vaccinations. All this suggests that the short-term downside risks for CAD stemming from the third virus wave (both directly and through worsening data-flow) may actually be quite moderate.

Oil should also remain supported

A third important factor for CAD, oil, is also not looking likely to turn into a headwind. A recent analysis of the global crude market by OPEC shrugged off fears related to the slowdown in Indian demand due to the health emergency, highlighting how rising demand in countries such as China and the US should offset this.

Despite rising OPEC+ output, and accounting for larger Iranian supply, the market is still set to draw down inventories throughout the year, according to our commodities team, which is expecting Brent to be supported around the 70$/bbl in the second half of 2021.

This should continue to provide room for recovery to the battered Canadian energy sector, which in normal times accounts for more than 10% of the country’s GDP.

We expect USD/CAD to touch.1.16 at the end of the year

As discussed in the May edition of FX Talking: Feeling the heat, we expect the market to keep rewarding currencies (like CAD) with less dovish central banks to the detriment of currencies (like USD) which have been left unprotected by their central banks and are now at the mercy of rising inflation.

A strong economic rebound in the US and dormant Federal Reserve, despite spikes in inflation, are an ideal combination for CAD

A strong economic rebound in the US and dormant Federal Reserve, despite spikes in inflation, are an ideal combination for CAD, allowing the currency to benefit from improving demand from the US (20% of Canadian GDP comes from exports to the US) while still enjoying the monetary policy divergence with the BoC.

In line with our bearish view on the USD, and considering all the factors highlighted above, we expect USD/CAD to start trading sustainably below 1.20 by the third quarter and we target 1.16 in the fourth quarter.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article