Brazil: Low inflation and a longer easing cycle

Recent data shows economic growth remains solid, but inflation has surprised considerably. We expect falling inflation expectations to prompt the central bank to extend the rate cutting cycle this week

Inflation surprises are the highlight of the economic calendar

As a result of the low inflation seen in recent weeks, contrary to expectations, the yearly CPI trend changed directions and fell in the first quarter. After bottoming out at 2.5% year-on-year in August, inflation rose steadily until December, ending 2017 at 3.0%. That rise was interrupted, and now inflation is on track to end the first quarter close to 2.8% YoY, significantly lower than the central bank's forecast of 3.2%, included in the fourth quarter Inflation Report.

Low wage pressures, notably the low 1.8% annual adjustment in the minimum wage, the favourable inertia, and the continued deflation in food prices, among other factors, help explain the lower-than-expected CPI trajectory.

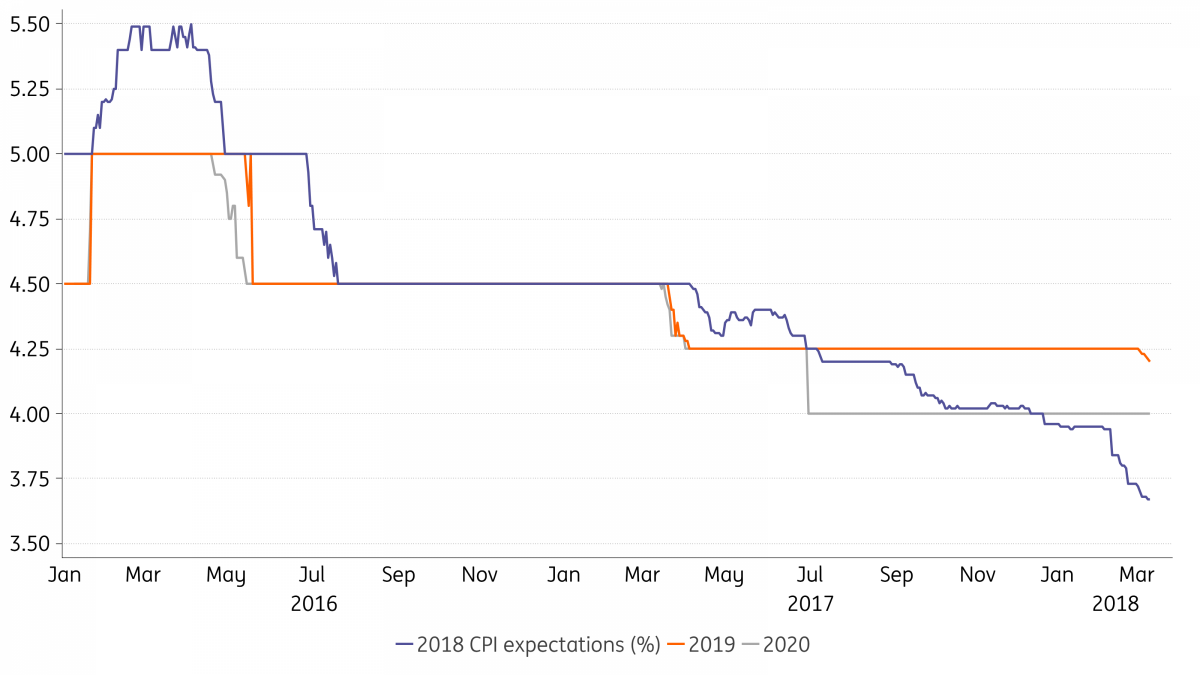

This surprising second wave of disinflation has triggered a significant drop in inflation expectations, with the Bank's surveys expecting a drop from 4.0% to 3.7% throughout the first quarter, i.e., once again considerably lower than the 4.5% target for 2018. Consensus estimates for 2019 have also started to drop, for the first time in almost a year, from 4.25% (i.e. the target for 2019) to 4.20%.

We now expect inflation to end the year at 3.5% and remain materially below target throughout 2019. In principle, this benign inflation trajectory suggests that inflation is unlikely to add upside pressure to the policy rate trajectory in the foreseeable future.

Drop in inflation expectations has intensified in recent weeks

In recent statements, the central bank governor Ilan Goldfajn highlighted his surprise with the inflation trajectory, which helped consolidate market expectations that the Bank should indeed extend the rate cutting cycle with one more cut on 21 March, bringing the SELIC to 6.5%.

| 6.5% |

After a total of 775bp in cutsAnother record-low for the SELIC rate |

What to focus on?

Much of the market focus will be on the post-meeting statement, specifically on whether the central bank will keep the door open to further cuts, or close it more firmly this time. Given the potential for continued downside surprises on the inflation front, it's possible the Bank maintains the current guidance, which states that the base-case scenario would be consistent with no additional rate cuts. But cuts will be considered if the inflation outlook (once again) surprises to the downside.

The choice of forward guidance remains a close call but, in any case, we don't expect further cuts, with the SELIC rate staying stable at 6.5% in the foreseeable future. Even though additional cuts in the second quarter could be justifiable, given the benign inflation outlook, Bank authorities should opt for caution in light of the expected uptick in FX market volatility later this year.

Our rate call contrasts with the local yield curve that now incorporates close to 40bp in rate hikes during 2H18 and 225bp in additional hikes throughout 2019. This is considerably less than the levels prevailing before last month’s monetary policy meeting (i.e., 100bp for 2H18 and 240bp for 2019), and still suggests large levels of risk premium in the local yield curve, consistent with a scenario of heightened political uncertainties, FX volatility and persistent fiscal challenges.

Political uncertainties cloud 2019 assessment

The interest rate trajectory in 2019 should depend largely on the fiscal policy adopted by the next administration. A market-friendly and fiscally-responsible administration could pave the way for a moderately strong trajectory for the Brazilian Real (BRL), which is seen as the primary source of upside inflation risk by the central bank, and, therefore, could contribute to a considerable delay in eventual policy rate normalisation.

But the election of a market-friendly and fiscally-responsible administration remains highly uncertain. A positive assessment of electoral/fiscal risks depends on several key assumptions, including:

- Former President Lula will not be eligible to run for president and may get arrested after the final ruling by the regional court (TRF-4) in the next few weeks.

- The left will remain fragmented, with its electoral base split across potentially four presidential candidates,

- To boost their chances of moving to the second round, centre-leaning candidates (currently trailing in the polls) will eventually consolidate around a single hegemonic candidacy, supported by a broad-based party alliance containing roughly the same parties that composed of President Temer’s congressional base in the past year, and

- Candidates that are currently popular in the polls but lack in party structure will eventually lose ground because they will lack public campaign funding and access to free state-sponsored advertising, as both of these are now primarily determined by the candidate’s party size.

This last assumption is crucial and is perhaps the one that most divides local pundits. The differing views reflect, to a large extent, analysts’ views on issues such as 1) the importance of traditional media (radio and TV) vs. social media, 2) the electoral weight of the appeal of “non-establishment” vs. “establishment” candidates, and 3) the importance of the government “machinery”, especially at the local level, to boost the candidacy of establishment candidates.

The conclusion is that roughly two camps appear to be forming. The first is the more “traditionalist” camp, which expects the establishment candidate to win, i.e., São Paulo Governor Geraldo Alckmin, backed by the PSDB-DEM-MDB after the Lower House Speaker Rodrigo Maia, Finance Minister Meirelles and President Temer drop out from the race.

The second camp tends to weigh more heavily the impact of social media and anti-establishment sentiment, asserting that “this time is different”. For them, the current leader in the polls (ex-Lula), Jair Bolsonaro, a long-time Lower House representative known for his socially conservative and militaristic agenda, is most likely to get elected. This camp also typically considered Luciano Huck or João Doria, early favourites that decided to drop out of the race, to be the most electable candidates running with a centrist market-friendly platform.

There are legitimate reasons to question Bolsonaro’s ability to run a successful campaign and maintain his lead. These include his minimal party support base, his Trumpian penchant for controversies, which assures the greatest visibility in social media among all candidates but also tends to increase his rejection rate (notably among women and the socially liberal electorate). However, in principle, the importance of the rejection rate depends on the level of fragmentation of the electoral process. As it stands now, polls suggest that Bolsonaro is very likely to make to the second round. The latest poll gave Bolsonaro 20% support, followed by Marina Silva with 14%, Geraldo Alckmin with 9% and Ciro Gomes with 8% while close to 40% of the electorate chose the undecided/blank option.

Bolsonaro’s lead should diminish when the campaign gains steam, and the benefits of belonging to a resource-rich party alliance kick-in, boosting the visibility of the establishment candidates. But the lack of an establishment candidate with enough popular appeal to be a competitive candidate severely complicates our ability to make any high-conviction calls about the elections.

So long as the rationale for the eventual victory of a market-friendly establishment candidate remains relatively sound, a certain degree of investor complacency should prevail. More serious doubts about that scenario should creep in only gradually if, for instance, the race remains polarized between Bolsonaro and a candidate from the left (either Ciro Gomes or Marina Silva, who also appeals to segments on the left, for instance) through June/July, with the centrist candidate still trailing in third place. The official start of the campaign is on 31 August.

Questions over the ability of the next administration to re-anchor fiscal accounts would intensify if any of these three candidates win the election. The reasons for concern would include, in varying degrees, inconsistent or little known economic policy views, and expected difficulties to negotiate a working majority in Congress. Given the heavy legislative agenda, a weak Congressional base would exacerbate governability risks and pave the way for renewed financial market instability in 2019, when the biting budget constraints will force the new administration to deliver on the fiscal austerity front.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).