Brazil: Frontloading the easing cycle

Decisive progress on the passage of the pension reform should pave the way for central bankers to launch an easing cycle at this week’s policy meeting. We expect three consecutive 50 basis point cuts to bring the SELIC rate to 5% by October

A new record-low for the SELIC rate

The social security reform was approved in a first-round vote by the Lower House early in July. The second-round vote is expected next week and Senate approval is widely expected to take place by October but, with the first Lower House vote, the reform has already moved beyond its most critical stage.

As a result, political uncertainties related to the sustainability of fiscal accounts have eased materially. And this should be enough to pave the way for monetary authorities to launch the easing cycle in their upcoming policy meeting, on Wednesday.

The prospect of a relatively smooth process for the reform’s final approval in the coming months also suggests that political uncertainties should not be an impediment for the central bank (BACEN) to extend the easing cycle beyond this week’s meeting.

We expect the SELIC rate to drop from 6.5% now to 5.0% by the end of October

In fact, we expect the SELIC rate to drop from 6.5% now to 5.0% by the end of October, as a result of a 50bp cut at this week’s meeting, followed by two additional 50bp cuts at the next two meetings. Even though there’s a widespread consensus that BACEN will launch an easing cycle at this week’s meeting, analysts are split about the pace authorities will set, 25bp or 50bp.

A frontloaded and enduring easing cycle

Our call is similar to current market pricing in terms of the total size of the cycle (150bp) but it differs from market prices in two aspects. The first is that we expect the cycle to be more frontloaded. And the second is that we expect the cycle to be longer-lasting, with no rate hikes at least until the end of 2020. This compares with the local curve incorporating nearly 75bp of hikes during 2020.

A faster policy adjustment would be justifiable as a catch-up measure to help address below-target inflation trends and the paralysis in economic activity seen in recent quarters. Brazil’s GDP remains 5.5 percentage points below the peak seen in 2013, while expectations for inflation and economic activity have fallen sharply (see chart below), with the yearly inflation rate expected to trend considerably below-target, at around 3-3.5%, throughout 2H19.

CB surveys reinforce prospects for low inflation and a delayed recovery

The dovish shift seen in monetary policy across the world is another element that should also favour a more frontloaded cycle and suggests that BACEN should have no difficulties in arguing for the need to implement a decisive adjustment in its policy stance.

Reassessing the “neutral” policy rate

Apart from inflation/growth considerations and the passage of the social security reform, the outlook for monetary policy must also incorporate the prospect of considerable fiscal tightening in the foreseeable future.

The public sector fiscal balance needs to tighten by at least 4-5ppt of GDP to return to a sustainable trajectory, and this substantial fiscal tightening will add an important hawkish bias to the policy mix in the coming years.

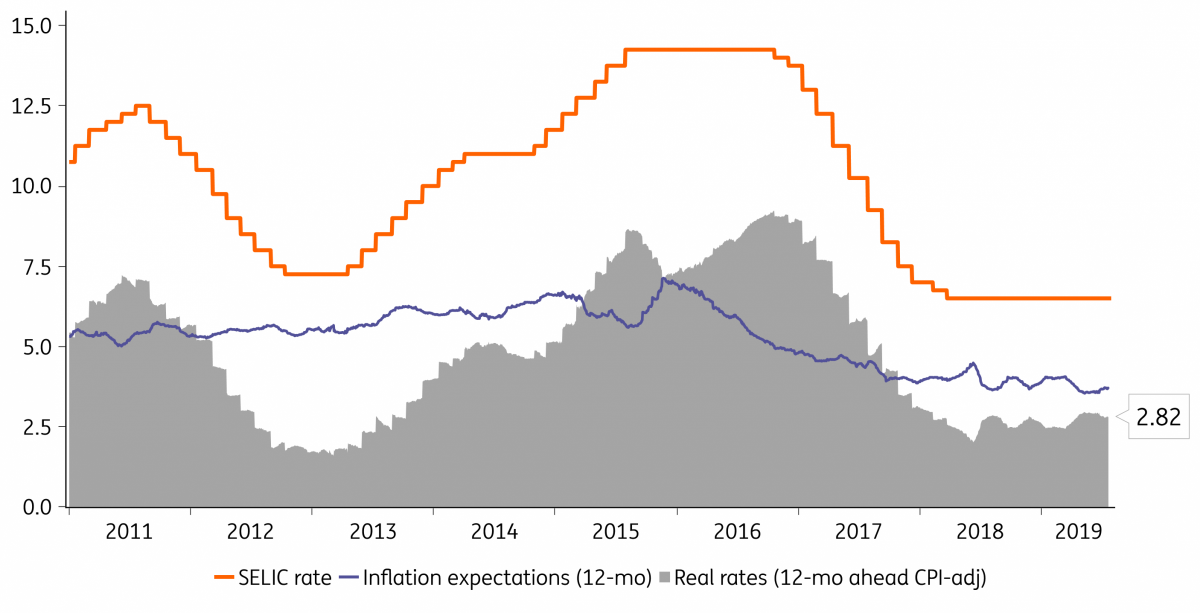

As the chart below illustrates, with real rates near 3%, the current monetary policy stance is just slightly expansionary, when considering historical estimates for the “neutral” policy rate in the 4-5% range, in real terms.

Monetary policy is just mildly expansionary

This suggests that even though the SELIC rate is at the lowest nominal level it has ever been, the policy mix, i.e. when taking both fiscal and monetary policy into consideration, may be less expansionary than generally thought. As a result, the SELIC rate may be cut further without the risk of the policy mix becoming excessively loose.

The fiscal contraction is also evident in the structural changes being implemented by state-controlled banks, including the marked reduction in their loan portfolios, which have been contracting for almost three years now. Current policy guidance for state-controlled banks contrasts sharply with the policy prevailing in the 2009-15 period, when state banks were used as para-fiscal instruments in the government’s policy toolkit to stimulate economic activity.

As the chart below illustrates, during 2009-15, public banks increased their loan portfolios much faster than private sector banks. A reversal is now taking place amid fast deleveraging by public sector institutions.

After years of expansion, state-controlled banks reduce their loan portfolios

Overall, this new fiscal policy framework, chiefly defined by a ceiling on fiscal spending and the structural changes taking place in Brazil’s large public sector banks (including the end of the implied subsidies by BNDES), should provide a good opportunity for the reassessment of the neutral level for the policy rate.

In particular, the case for a smaller “neutral” policy rate, i.e. smaller than 4-5%, should strengthen, and provide support for a more dovish monetary stance in the coming quarters.

All of these factors should, in the context of stronger market credibility in the inflation-targeting regime, add to BACEN’s impetus to cut the SELIC rate and suggest that the SELIC rate should remain expansionary for a prolonged period of time.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).