Brazil: Fiscal policy in the driver’s seat

Election results triggered an improvement in the fiscal outlook that should help extend the rally in local assets. The stronger currency helps the inflation outlook and reduces the central bank’s incentive to end, prematurely, the monetary stimulus. We expect the SELIC rate to remain unchanged until the end of 1Q19, at least

Monetary policy to react to fiscal policy in the foreseeable future

The most immediate implication of Jair Bolsonaro’s election over the weekend has been the improvement in the outlook for fiscal consolidation in the coming years, validating and reinforcing, in our view, the rally in local assets seen over the past month.

The rally in the Brazilian real (BRL), meanwhile, instantly improved the inflation outlook and reduced the central bank’s incentive to end, prematurely, the ongoing monetary stimulus. In its latest policy meeting, central bank authorities kept the policy rate on hold at 6.5% but altered the guidance from neutral to hawkish. They indicated that they would be open to considering a “gradual” policy tightening programme, but only if the inflation outlook deteriorated further. That would have been the case, for instance, if the BRL had weakened further due to the political/fiscal uncertainties.

This was not the case. As a result, we expect the central bank (BACEN) to keep the SELIC rate unchanged tonight and acknowledge the somewhat improved inflation outlook. In fact, we now have higher conviction that inflation will stay close to the target and that the SELIC policy rate should remain unchanged, at 6.5%, until the end of 1Q19, at least.

| 6.5% |

SELIC ratemonetary policy on hold for now |

After that, should the approval of the fiscal austerity agenda fail to gain traction in Congress, local assets should suffer, hurting the outlook for inflation and ultimately forcing the central bank to react accordingly, raising rates.

In other words, without concrete confidence-boosting progress in the social security reform by early 2Q19, the BRL should weaken, worsening the inflation outlook and likely triggering the start of a monetary tightening process.

Alternatively, credible progress in the fiscal consolidation front would support local assets and allow the central bank to keep the monetary stimulus in place for an extended period of time

Fiscal tightening has already started

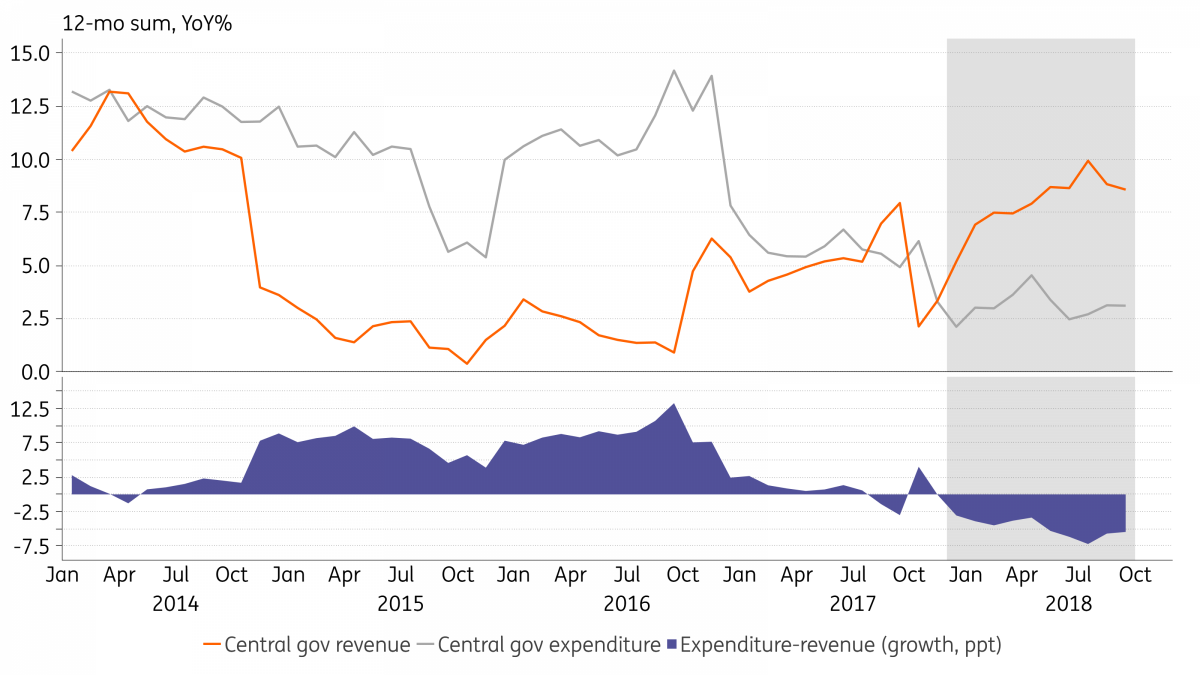

Fiscal policy has already turned markedly tighter over the past year, with fiscal expenditure rising at a much slower pace than fiscal revenue. As the chart below shows, after two years of massive fiscal expansion (2015-16), fiscal policy turned more neutral last year and only now has turned decidedly contractionary.

And should fiscal tightening continue, or even deepen, under Bolsonaro, it could pave the way for monetary policy to stay expansionary for at least a couple more years, without the risk of turning the policy mix excessively expansionary.

Apart from the “help” from fiscal policy, our dovish monetary policy outlook reflects the fact that, given Brazil’s stage in the business cycle, imbalances such as high inflation and/or excessive current account deficits, are unlikely to resurface any time soon.

Brazil’s output gap is unlikely to close for quite some time, while the outsized spare capacity, in terms of labour and capital utilisation, suggests that demand-side price pressures should remain soft for an extended period of time.

As for the external accounts, with the current account deficit trending at less than 1% of GDP, there’s much room for the deficit to rise, especially in the context of a favourable outlook for financial FX inflows, which would be the case if Bolsonaro succeeds in re-anchoring fiscal accounts, reigniting investor optimism that Brazil is finally on track to recover its lost investment grade.

Rally in local rates could endure

Local rates have rallied substantially over the past month, in line with the rally in the Brazilian real and the reduction in sovereign’s risk premium. But, if the pro-reform scenario is realised, there’s considerable room for the rally to extend much further, given that the local curve is still pricing a 3.5 percentage point increase in the SELIC rate, from 6.5%, until the end 2020.

The near-term inflation outlook has improved, with the recent announcement of a cut in electricity prices in November (due to improved hydrology) and the stronger currency, while longer-term inflation expectations remain fully anchored. But, ultimately, the outlook for local rates depends chiefly on the success, or failure, of Bolsonaro to deliver the fiscal adjustment he and his economic advisor have advocated.

As we’ve said before, it’s still too soon to say whether Bolsonaro will be able to re-anchor Brazil’s fiscal accounts, but the signs have been encouraging. Bolsonaro’s ability to negotiate with Congress is untested, so we would be especially reassured if the new administration is able to garner enough support to approve an important piece of legislation already this year, during the transition period.

The social security reform proposed by President Temer and the central bank's independence appear to be under consideration for an immediate Lower House vote, while a pending auction of oil exploration rights (“cessão onerosa”) could be approved by the Senate.

Informal polls with newly-elected congressmen also suggest that resistance to social security reform has fallen sharply, while the opposition is not large enough to block its approval.

More importantly, the new administration appears to understand the urgency and the stakes involved in the approval of this reform, which is a pre-condition for fiscal sustainability and the economic recovery. Failure to approve it would inevitably create enough uncertainty and financial market instability to threaten governability and the administration's own survival. It may not be a smooth process, but Bolsonaro should eventually be able to persuade hesitant but, in principle, swayable Congressmen to support his legislative agenda.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 October 2018

In case you missed it: Change of guard This bundle contains 9 Articles