BIS FX Survey: No sign of de-dollarization just yet

The BIS has just released its triennial survey of FX turnover. The stand-outs include: a) The dollar has consolidated its position as the world’s most liquid currency, b) the march of the renminbi has slowed c) emerging market FX pairs have seen some of the biggest increases in volumes, while GBP turnover has held up despite Brexit

No signs of de-dollarization at a global level

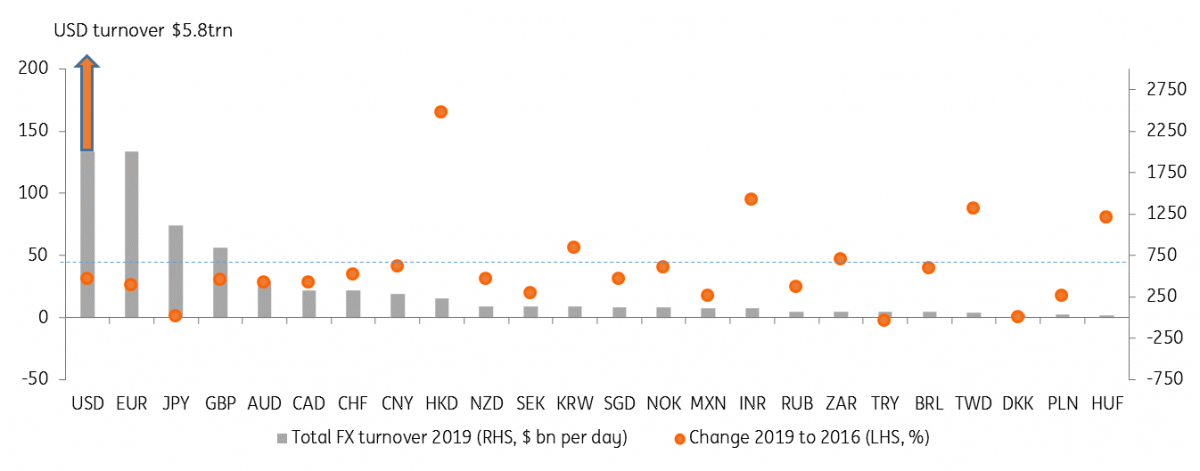

The latest triennial BIS FX turnover survey was released last night and covers FX trading activity from April this year. There are no signs as yet that de-dollarization is taking hold on a global level. In other words, the dollar remains central to the world’s exchange of trade and portfolio flows. The dollar retains its clear leadership status, still one side of 88% of all FX trades. Its nearest challenger remains the euro at 32%.

Despite fears that some of Washington’s foreign policy could force trading partners away from using the dollar – especially the long reach of the US Treasury when it comes to sanctions – there are no signs that the dollar is losing its pre-eminent status on a global level. This bestows some benefits of seigniorage – or potentially lower borrowing costs as investors pay up for the privilege of investing in an asset backed by a liquid currency. Though former Federal Reserve Chairman Ben Bernanke does a good job in a blog post of dismissing what seigniorage is really worth.

Dollar retains stand-out role as most liquid currency

The march of the renminbi slows

Having joined the IMF’s Special Drawing Right (SDR) in 2016, Chinese authorities might have hoped the renminbi would continue to climb up the rankings of the world’s most traded currencies. CNY trading volumes have increased 40% since 2016, but the growth has not outstripped the aggregate trading volume increase sufficiently and the renminbi remains the eighth most liquid currency.

The difficulty in managing changes to the People's Bank of China fixing adjustment in summer 2016 and the authorities’ reluctance to completely open the valves on the capital account (largely to prevent a disorderly renminbi decline) will no doubt have played a role here. Yet the PBOC's use of CNY swap lines to encourage trade in renminbi (over 30 countries now have CNY swap agreements with the PBOC) and China’s increasing inclusion into benchmark equity and bond indices suggest that the renminbi will play an ever-large role in global FX markets.

That said, it is notable that the single biggest increase in trading volumes over the last three years has been the Hong Kong dollar (volumes up 165%) suggesting that renminbi volumes will increase when capital account restrictions are loosened further.

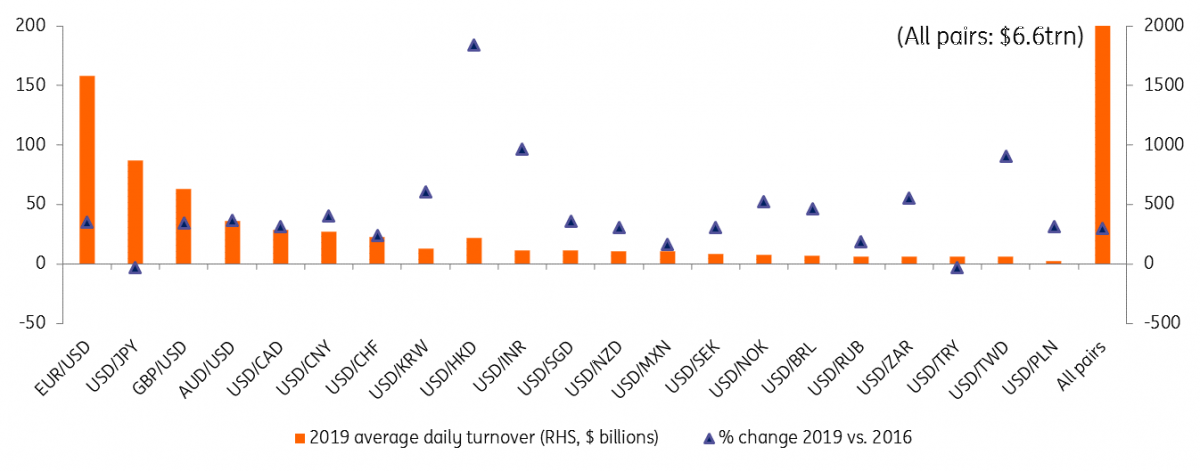

Big pick-up in USD/Asia FX pairs

Key changes in trading volumes

The other key story is the relative change in trading volumes. Only two dollar/FX pairs have seen a decline in FX turnover since 2016 – these were USD/JPY and USD/TRY. The lack of volatility probably explains the former and domestic challenges through 2018/19 the latter. Despite the overall decline in the Japanese yen, the survey did pick out the big increase in JPY/TRY, JPY/BRL and JPY/ZAR cross trading – suggesting that Japanese retail margin trading of high yield FX is alive and well and partly explaining some of the big moves in the Turkish lira and South African rand seen in early Asian trading hours.

Currencies enjoying an above average (30%+) increase in turnover were the Indian rupee (INR), Taiwan dollar (TWD), Hungarian forint (HUF), Korean won (KRW), and South African rand (ZAR). Turnover in EUR/HUF doubled between 2016 and 2019 while EUR/PLN turnover was flat. We also note that GBP trading volumes increased largely in line with peers – suggesting no damage to liquidity from Brexit, whilst EUR/CHF turnover bounced back from the Swiss National Bank's floor exit debacle in 2015.

One final point, in terms of FX product lines, outright forwards (+43%) saw the biggest increase led by strong activity in KRW, INR and BRL non-deliverable forwards.

There are no signs of de-dollarization just yet, but the growth in HKD trading volumes suggests the renminbi’s march to reserve status has just slowed rather than stalled.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 September 2019

In case you missed it: A big week for oil This bundle contains 10 Articles