Biden’s billions – a sustainable shift?

The $1.2tn infrastructure bill is a first step toward putting ambitious climate goals into policy and will accelerate the US’s clean energy transition, but alone it won’t be enough to achieve net-zero emissions by 2050. The $1.75bn Build Back Better bill would have a huge additional effect via generous tax credits on clean power, carbon capture and EVs

US President Joe Biden signed the $1.2tn bipartisan infrastructure bill into law this Monday after a difficult congressional process that lasted for months. The bill has $550bn in new spending to improve the country’s infrastructure – from public transport to the power system and from climate resiliency to emerging technologies that can accelerate the country’s energy transition.

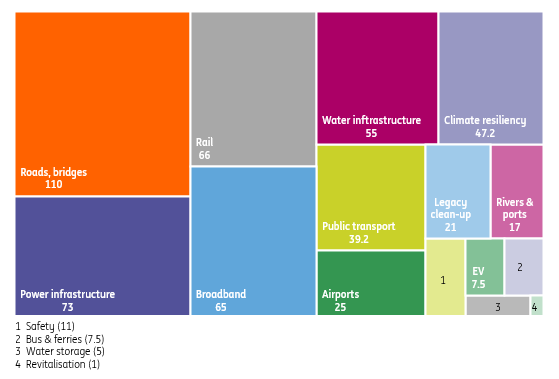

Components of the new spending of the infrastructure bill

EV infrastructure will be expanded to facilitate transport electrification

A major objective of the infrastructure bill – with around half of the $550bn new spending allocated – is to improve the transport system across the country. Under that, roughly $110bn will be used to repair and build new roads and bridges. While that $110bn is well short of the $786 billion backlog of investment needs, as estimated by the American Society of Civil Engineers, it is still a substantial amount of money.

Electrifying the transport sector is also a focus of the bill. It includes $7.5bn to expand the US’ electric vehicle (EV) network of charging stations, with another $7.5bn aimed at developing zero and low-emission buses and ferries. Currently, the US has one of the lowest charging densities of the world’s major economies, and this has become a bottleneck to further EV development in the country. Although this level of investment still looks low, especially compared to the amounts allocated to renewable power infrastructure, expanding the EV charging network would prove to be effective in driving a more rapid uptake of the US EV market.

EV chargers per EV by country, 2020

Power sector set to experience infrastructure upgrade

The infrastructure bill also emphasises the importance of cleaning up the power sector, which currently accounts for 26% of US emissions. The bill will allocate $73bn to build and upgrade transmission lines; it is also investing in research and development (R&D) to advance smart grid technologies.

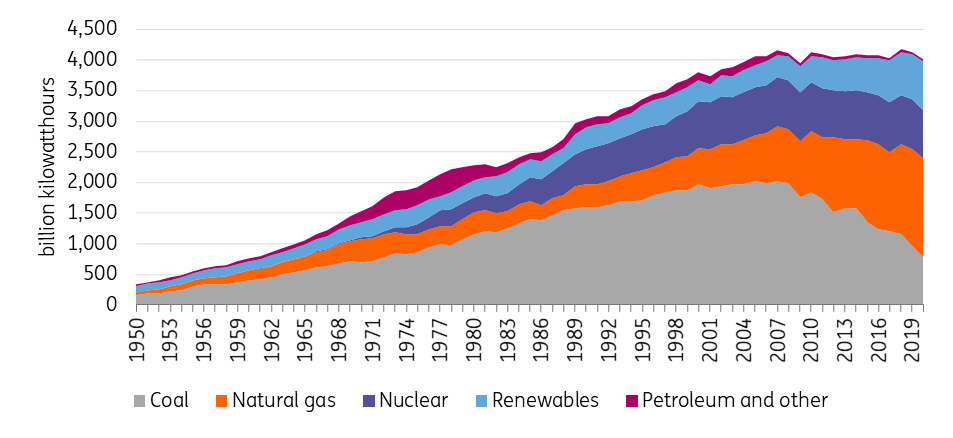

Today, only 40% of the electricity generated in the US is from clean energy, half of which is from nuclear and the other half from renewables. The Biden administration has set an ambitious goal to change that and achieve 100% clean electricity generation by 2035.

US electricity generation by major energy source

Realising this environmental target will mean the power system needs to address the “intermittent” nature of renewables, as well as overload pressures during peak demand. The chances of meeting these challenges can be improved by enhancing the capacity, stability, and flexibility of the grid. Developing transmission lines and smart technologies, issues that are addressed in the infrastructure bill, could contribute to tackling these issues.

However, the level of investment planned in the infrastructure bill is far from enough. According to a Princeton University study, achieving net-zero by the middle of the century would require the US to expand its high-voltage transmission network by 60% by 2030, a target which would require $360bn in investment in transmission infrastructure. There is therefore a gap between the infrastructure bill’s offering and what is needed to achieve 100% clean power generation on time. Moreover, incentives should also be coupled with more stringent regulations, such as a mandate to phase out coal-fired power generation. At the recently concluded COP26, it was considered underwhelming that the US did not go further than the joint declaration to phase down coal use, to a more ambitious commitment of eliminating its use completely. Although the US and China issued a joint pledge to slow climate change, it did not set firm deadlines on coal.

The bill bets on carbon capture and hydrogen

The infrastructure bill will also support two key emerging technologies that are crucial to achieving net-zero emissions: carbon capture and storage (CCS) and hydrogen. The bill is investing $11bn in CCS demonstration and networks. The US is already a leader in the field: during the first nine months of 2021, 36 of the 71 newly added CCS projects worldwide were in the US. Combined with geological advantages in storing CO2, the federal 45Q tax credits and California’s low-carbon fuel credits, as well as the separately passed Energy Act to devote $6bn to advance R&D, CCS is poised to see huge growth over the next decade.

CCS is poised to see huge growth in the US over the next decade

As for hydrogen, the administration plans to dedicate $9.5bn to developing hydrogen hubs and demonstration. Such an investment could substantially enlarge the US’ hydrogen economy. The bill also directs the Department of Energy to establish a national clean hydrogen strategy, which could lead to a more orderly advancement of technologies, industrial hubs, and transport networks.

Climate resiliency also gets the attention

Additionally, $47.2bn of investment is planned to enhance climate resiliency through addressing extreme weather events such as wildfires, droughts, hurricanes, among other challenges. An additional $80bn will be devoted to improving the water infrastructure, water storage, and environmental remediation, which would indirectly help enhance climate resiliency. Maintaining that resiliency will become increasingly important to preserving people’s quality of life. In 2020, extreme weather events cost US taxpayers $99bn, and about 25% of all US infrastructure is reportedly at risk of severe flooding.

What it might mean for the broader economy

The infrastructure bill’s $550bn in new spending is worth around 2.5% of GDP, but assuming it is spread out evenly over five years, it is equivalent to around 0.5ppt of GDP per year. So the actual economic impact of this spending should be far more significant.

Infrastructure investment typically has a large multiplier effect in that it can lead to higher GDP growth than the spending alone implies. In the near term, it will create jobs and boost incomes, which in turn can facilitate more spending in the economy – President Biden has emphasised the importance of the plan in “creating the good-paying, union jobs of the future”. In the longer term, it should boost the productive potential for the economy while complementing ongoing private sector capital expenditure and stimulating new business and job creation.

In the near term, it will create jobs and boost incomes, which can facilitate more spending in the economy

Examples include the rollout of EV charging points, which will help incentivise additional EV design and production in the United States, or the emphasis on broadband connectivity that can improve business capabilities. Meanwhile, investment in housing, water and transportation can boost educational outcomes and improve health and well-being, which in turn can lead to better job opportunities for millions of Americans. All of this should, in theory, raise the productive potential of the economy.

However, there is concern that extra spending in an economy that is already booming, could have some detrimental impact in the near term. Inflation is running above 6%YoY – three times its target – and additional infrastructure spending runs the risk of intensifying supply chain strains and labour market shortages. Consequently, projects could end up taking far longer to be delivered than planned and inflation pressures could become more intense. Some fear that the Federal Reserve may be forced into implementing more aggressive monetary policy tightening that will act as a brake on the economy.

However, this extra $550bn of spending over five years has to be put in the context of the $5tn of government support for the economy implemented since the start of the pandemic and the additional $4tn+ of asset purchases made by the Federal Reserve as part of its quantitative easing program. Looking at it this way the infrastructure spending seems much less worrisome. In any case, we already expect the Federal Reserve to implement a swifter normalisation of its monetary policy stance, with QE ending in the first quarter of 2022 and with at least two expected interest rate increases in the second half of next year. All of which reflects the current strength of the US economy.

Build Back Better has a large add-on impact to help realize climate goals

While the infrastructure bill will be effective in strengthening the network needed to support decarbonisation, the level of investment is low, and the infrastructure-focused approach alone will be limited to reach net-zero emissions.

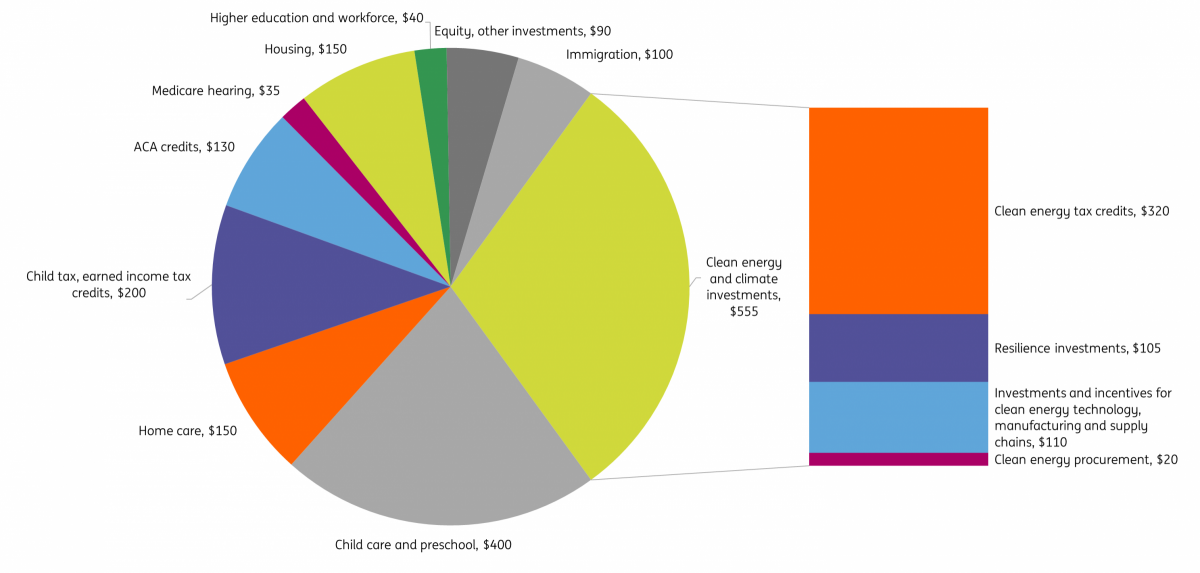

Another larger, social and climate spending bill, known as the Build Back Better framework, has been proposed in parallel, to lay a more solid groundwork for the energy transition. Albeit slashed from $3.5tn to $1.75tn, Build Back Better would devote $555bn of its spending to climate and the energy transition.

Breakdown of the $1.75tn Build Back Better spending framework (in $bn)

The most influential feature of Build Back Better is larger tax credits for renewables, nuclear, grids, CCS, clean hydrogen, and EVs. Renewable projects would be able to enjoy more generous schedules of Production Tax Credits and Investment Tax Credits; CCS projects would be eligible for an $85 credit per tonne of CO2 captured and stored, up from the current $50/tonne. Importantly, certain projects would qualify for direct pay, which is attractive as project developers would be able to fully capitalise on existing credits. Similarly, the tax credit rules for EVs would become more generous. The current $7,500 credit for EV purchasing would become refundable, meaning that these credits can be used when customers buy their EVs.

The most influential feature of Build Back Better is larger tax credits for renewables, nuclear, grids, CCS, clean hydrogen, and EVs

These tax credits strongly favour domestic production, aiming to create more American jobs in clean energy. The $7,500 EV credit could be increased by $4,500 if an EV is produced by union labour and by another $500 if the battery is manufactured in the US. Renewable projects with components produced in the US would also receive higher tax credits. While some labour unions applauded the strategy, foreign manufacturers worry that the plan would hurt their competitiveness in the US market. Nevertheless, these expanded credits would significantly accelerate decarbonisation in the power and transport sectors.

The combination of the infrastructure and Build Back Better bills are a booster to the programme of reaching the country's climate targets. What is worth noting though is that the two bills are just part of a wider holistic approach of transitioning the US to net-zero emissions. A system of clean energy incentives, environmental regulations, R&D spending, education and re-training, as well as corporate sustainability and sustainable investment guidelines, should all be kept in the policy picture.

Additional federal policies that can take the US to reach net zero—and why they wouldn’t pass

- Carbon pricing: In form of cap-and-trade or a carbon tax, a carbon pricing mechanism would discourage emissions and spur developments in low-carbon alternatives. Yet the lack of political will from federal lawmakers to support carbon pricing means it is a long way from being included in the national agenda. It is also hard to implement across the US, given the vast differences in opinions between states. Cap-and-trade, for instance, can lead to inter-state carbon leakage even before international carbon leakage is concerned.

- Vehicle taxes: There are no economy-wide taxes on vehicle emissions (a targeted carbon tax), but such taxes have been widely established in Europe. Biden’s infrastructure bill proposes to study a vehicle mileage tax, but that tax is based on miles travelled and could harm vehicles with higher energy efficiency. An emissions-based vehicle tax will be hard to pass because of the opposition from vested interest groups, as well as voter skepcitism towards its benefits.

- Air passenger taxes: Aviation is increasingly under decarbonisation pressures but has largely escaped tougher regulations. Air passenger taxes could direct consumers toward taking fewer or lower emission flights and have already been imposed in European countries such as the UK. Yet the tax is not attracting attention in the US—instead Biden’s efforts have been focussed on investing in sustainable aviation fuels (SAFs). While the latter is crucial in the medium term, to scale up SAF technology and usage, air passenger tax would become much a more potent policy tool as we get closer to 2050.

Whether Build Back Better will pass Congress is unclear. House Democrats have pushed their voting timeline to later in November; the bill also faces challenges in the Senate due to objections from moderate Democratic Senators Joe Machin and Kyrsten Sinema. Manchin has expressed that he would not support the bill until there is more detailed analysis of its impact on debt, inflation, and the economy. If the impact analysis is not in line with the proposed framework, the bill could go through another round of trimming.

Let us be clear. While a clear step in the right direction, these plans will not be enough to deliver on Biden’s aspirational targets for net-zero carbon emissions. Should Build Back Better not pass or be diluted further there will be next to zero prospect of success. Moreover, there is less than a year until the 2022 mid-term elections and the clock is ticking for Biden. Losing control over at least one branch of Congress, which current polling suggests is likely, would make it nigh impossible for Biden to pass sweeping clean energy legislation. In that case, the administration could also expect proposals to roll back some of the more progressive climate policies, setting the US on a course to massively miss its climate targets.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article