Beverages: The grass is greener beyond beer

The largest beer brewer in the world is looking to expand beyond beer. What does this tell us?

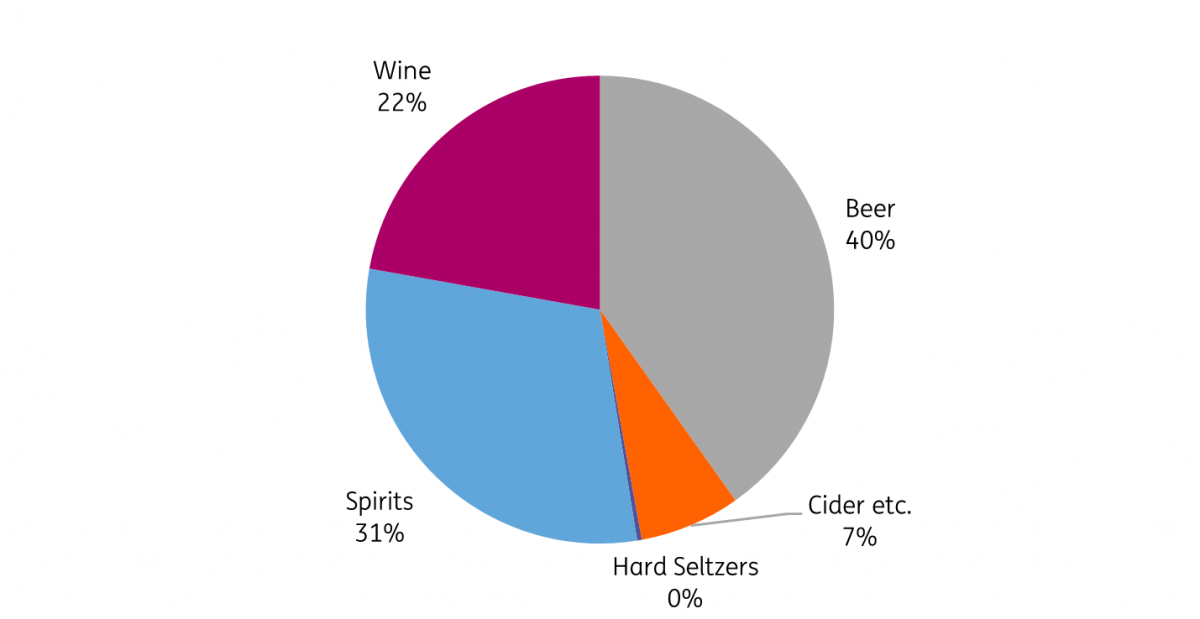

Although nothing is set in stone, AB InBev is supposedly looking to shed some of its beer assets in order to focus on growth in other areas. In our view, that is quite a statement from the largest beer brewer in the world. However, if we look at the numbers we also see why it makes sense. According to Statista, the global beverage market was valued at US$1.5t in 2019 and beer accounted for the largest chunk of the total, some 40%. While Hard Seltzers currently account for less than 1% of the market, the strong growth rate of this subsegment explains why it is included.

Different categories within the alcoholic beverage market

The beer category is growing below the market average

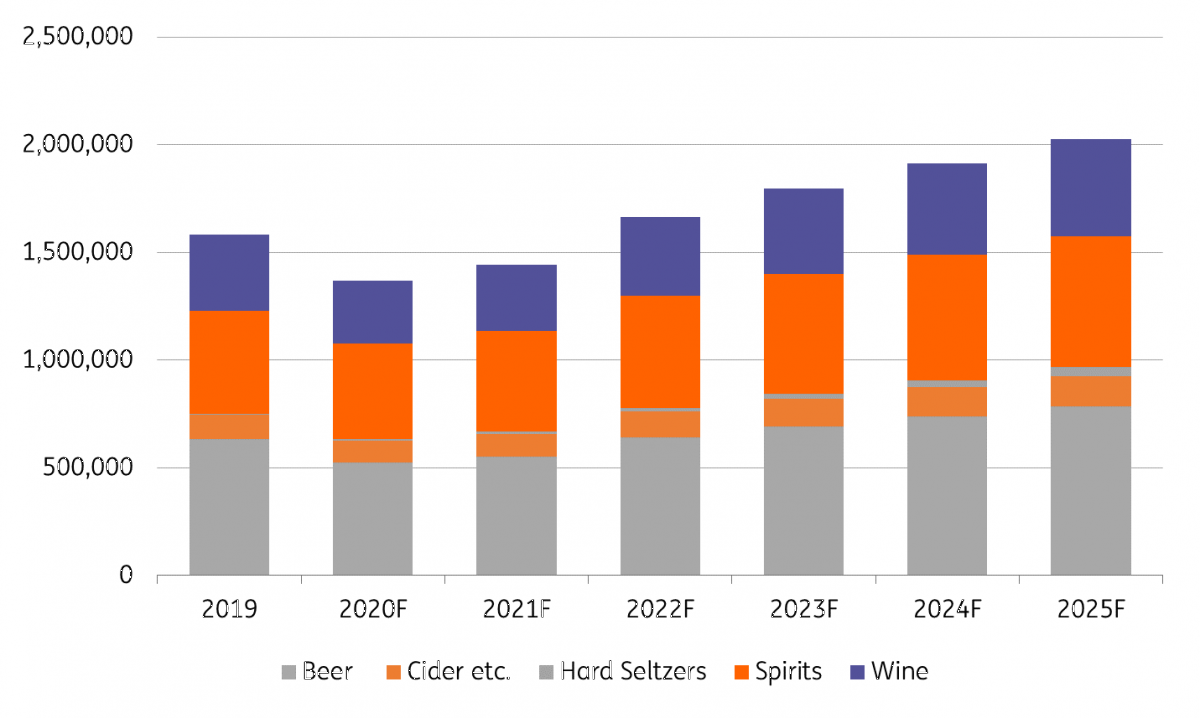

The compound average growth rate (CAGR) for the sector between 2019-2025 is estimated at 3.6%. Within the segment, we see that Beer underperforms the market with a 3% CAGR over that period. Hard Seltzer, as mentioned, is still small but growing rapidly at 34%, albeit this is from a very low absolute base number. If you want to learn more about Hard Seltzers, we dedicated an article to the category here. Another subsegment that is growing faster than the market is Ciders. The graph below shows how the different categories are expected to develop over the period 2019-2025. The dips in 2020 and 2021 are explained by lower sales due to lockdowns globally in order to contain the pandemic.

Expected growth of categories within the alcoholic beverage market

As the consumer demand changes, so should companies

In our view, the key drivers for growth in the global alcoholic beverage market are related to changing consumer preferences and changes in demographics. We identify the following key trends:

- Premiumisation: The rising middle class in emerging markets shows an increased demand for premium beverages. This trend is supported by an acceleration in the rate that consumers are moving to big cities, where beer consumption is higher. The United Nations forecasts that 58.3% of the global population will reside in urban areas by 2025. The rate of urbanisation is greater in emerging markets.

- Health and well-being: A second trend we identify is related to health and well-being. People are looking for healthier alternatives and moderating alcohol consumption. Although beer does benefit from demand for organic products, the sugar debate is driving demand for healthier alternatives. This automatically leads to an overlap between categories.

- Indulgence: At the other end of the spectrum, we see a counter-reaction to health and well-being – indulgence. This is also supported by a growing awareness of what we consume. Taking the time to consume in a mindful way and partly as a counter-reaction to the health and well-being trend, we also see more indulgence. The thinking behind this is that drinking an occasional beer of good quality is not necessarily incongruous with a healthy lifestyle. The craft beer category and locally produced beers are the brewers’ response to this.

All in all it makes sense that beer companies will look for growth in adjacent categories that are pushing the growing market to stay aligned with consumer preferences.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).