Belgium: Waiting for elections in May

In 2018, Belgian economic growth remained below the eurozone average, which was partly due to weak household consumption growth. This year the economy is expected to make only modest progress, while the collapse of the government in December and the upcoming elections scheduled for May will limit any new economic policy initiatives

Moderate growth

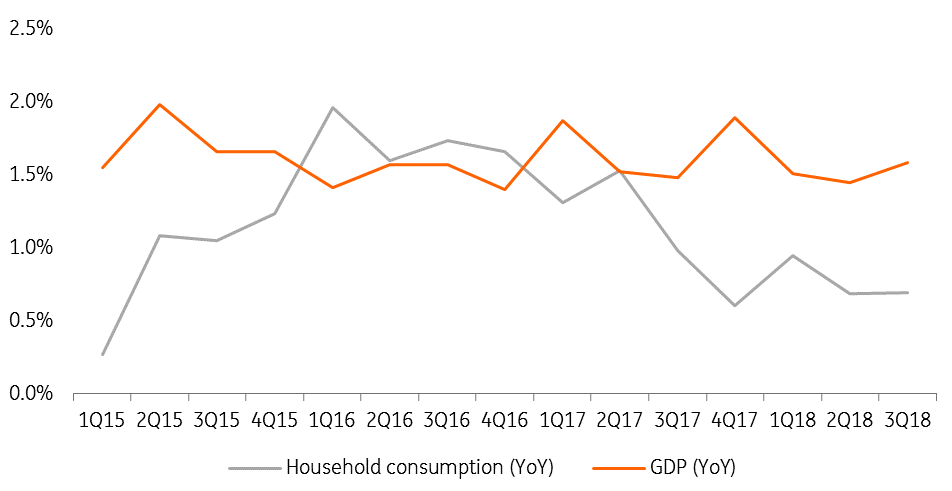

In 2018 economic growth reached 1.4%, which is well below the euro area as a whole (1.9%). One reason for this poor performance is the sluggish growth in household consumption. In the third quarter, it actually contracted by 0.2% quarter on quarter, probably on the back of higher oil prices sapping purchasing power. Even assuming a rebound in the fourth quarter, household consumption is expected to grow by only 0.8% for 2018 as a whole.

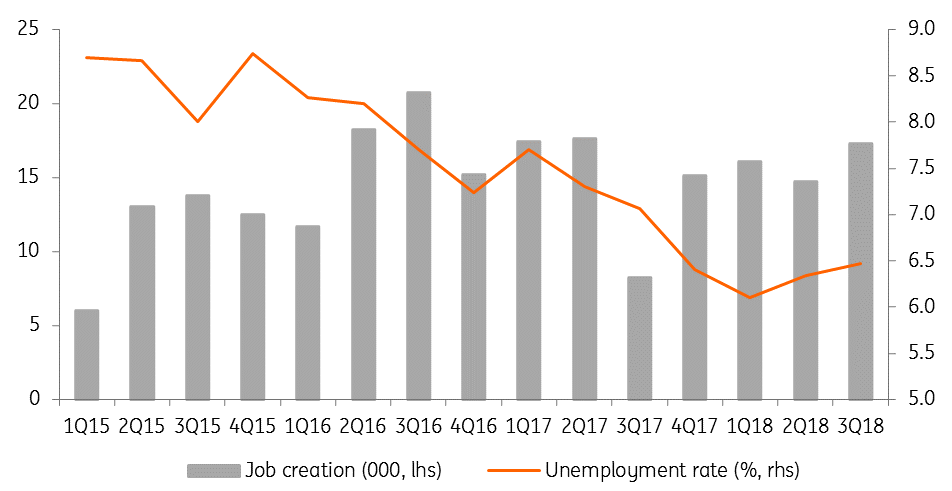

This is all the more surprising as the job market continues to perform well. For the third consecutive year, the Belgian economy has created nearly 60,000 net jobs in 2018. Given the moderate economic growth this is a good performance, and has reduced the unemployment rate to around 6.5%, a level that would normally support household confidence.

We see two explanations for household consumption growth weakness. First, even though in nominal terms household disposable income is progressing well (by around 2.5% YoY, thanks to jobs creation), this increase is almost entirely offset by price increases. In Belgium, inflation reached 2.2% in 2018 (with energy prices one of the culprits). There is therefore little room for a real increase in consumption. Second, households are no longer reducing savings to consume more. Bear in mind that between 2010 and 2017, the savings rate declined from 15% to 11.5% of disposable income. But since then, it has hardly moved.

The support of consumption for GDP is abating

Prudent forecasts

In 2019, we believe the recent indexation of wages and social benefits combined with jobs creation and lower energy costs should help maintain positive growth of household consumption, despite an uncertain general economic background. However, no strong rebound is expected.

Belgian foreign trade, which contributed significantly to economic growth in 2018, risks being affected this year by the weakening of economic growth in the eurozone, by the tensions in international trade (including between the US and the eurozone) and Brexit.

Taking these elements into account, we expect GDP growth to be limited to 1.3% this year and in 2020. It should also be noted that this scenario takes the Belgian political context into account and, in particular, the fact that new economic policy initiatives will be rare in 2019.

Job creation allowed a strong decrease in the unemployment rate

The long road to elections

Just before Christmas, the Belgian king accepted the resignation of prime minister Charles Michel and the Belgian government. But given that parliament has not been dissolved, the minority government remains in place as a caretaker government and will stay until a new government is in place after the federal elections in five months.

The majority of parties prefer to keep this date and not call early elections so, in the meantime, we shouldn't expect much in terms of economic policy as the government can't take on any initiatives and would have difficulty finding a majority for any propositions anyway.

After the elections, the caretaker government will have to stay in place until a new majority is found, which is likely to take some time. Bear in mind it took 541 days after the 2010 elections to form a new government, and in 2014 it took 4.5 months.

Following the latest polls, various coalitions are possible, and no party would be unavoidable at the federal level. However, the only coalition that could win a majority in both the federal parliament and the Flemish and Walloon parliaments would be the N-VA, the liberals and the socialists. That said, after previous federal and regional elections, the N-VA and the French-speaking socialist party have refused to work in the same government.

Therefore, it is highly likely that the majorities will not be symmetrical between federal and regional levels. Therefore, this will require longer negotiations and diminish the effectiveness of economic policy afterwards. A new state reform could also be the price to pay for having a government at the federal level.

As a consequence, a caretaker federal government will remain in place for most of 2019 without any real economic policy initiatives. But, at the same time, the regional governments are still in place and are often formed faster than the federal government after elections. This situation should not necessarily jeopardise the state of public finances but, admittedly, savings measures decided by the previous government will not now come into force in 2019.

Based solely on the measures that had been voted, the central bank expects a deterioration of the budget deficit, from -0.8% of GDP in 2018 to -1.6% of GDP this year. This deterioration, which does not meet the objectives of the European Commission, would nevertheless allow the debt ratio to fall slightly from 102.3% in 2018 to 101.4% of GDP in 2019.

The Belgian economy will be dependent mainly on the global and European economic context, especially in 2019. But given that no significant growth acceleration is expected anytime soon, Belgian economic activity is likely to suffer.

The Belgian economy in a nutshell (% YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 January 2019

ING’s Eurozone Quarterly: Tiptoeing around the ‘r’ word This bundle contains 13 Articles