Belgium: Same challenges, but more serious

Belgium was one of the countries most affected by the pandemic and is facing two other problems more than others: inflation and (public) debt

Decent recovery

At first glance, the Belgian economy is doing much better after the major shock of 2020. After two quarters of very dynamic growth (respectively +1.7% and +2.0% quarter-on-quarter non-annualised in the second and third quarters of last year), the Belgian economy ended the year with respectable growth of 0.5% (which is close to potential growth). It should be noted that the last quarter of 2021 was marked by new restrictions on activity, mainly in the hospitality sector, due to the pandemic. Supply problems are also affecting the construction and industrial sectors in many countries. However, according to a preliminary estimate, the Belgian manufacturing sector grew strongly in the last quarter, by 3.3%. This is probably linked to the activity of the pharmaceutical sector, as some Covid vaccines are produced at the Pfizer site in Belgium.

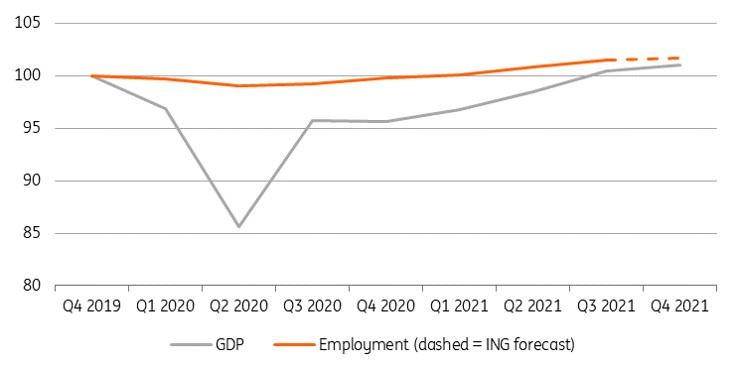

Employment has been extremely level thanks to support measures

GDP and employment index (2019 Q4 = 100)

Solid labour market

In terms of employment, most indicators remain in the green: total employment is already above its pre-crisis level and the unemployment rate has fallen to 5.8%. However, it should be noted that almost 200,000 workers were still using Covid temporary unemployment in December 2021, which still represents 45,000 full-time employees or 0.9% of total employment. Some sectors, such as travel agencies or event management, are particularly affected. The end of the support measures (2Q 2022 a priori) could therefore cause a shock to the labour market if the sectors in question still face a lack of demand. Nevertheless, there are still plenty of jobs available and the lack of labour remains, together with supply problems, the main constraint to business activity. Consequently, the macroeconomic damage in terms of employment should remain limited.

Given the international developments (better control of the pandemic, improvement in supply problems in the second half of the year, etc) we think that the recovery should continue this year, despite a turbulent start.

Broad-based inflation

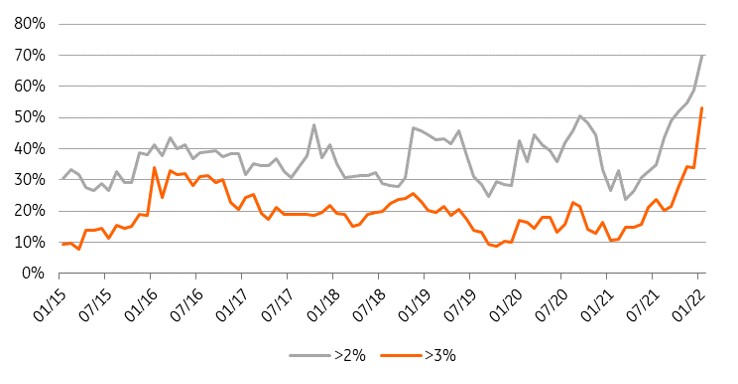

However, in a recent speech, IMF director Kristalina Georgieva indicated that the world economy faces three challenges in 2022: Covid-19, inflation and a mountain of debt. This particularly applies to Belgium. Leaving the Covid issue aside, we have to admit that inflation in Belgium is at a recent high: 7.6% in January according to the national definition, and even 8.5% based on the HICP. This very high figure is obviously linked to the prices of natural gas (up 154% over one year) and electricity (+71%), but it should be pointed out that 70% of the goods and services in the price index have already seen an inflation rate of more than 2% and more than 50% of the index has an inflation rate of more than 3%. So it is no longer just an energy problem. Moreover, any inflationary surge is not without consequence in Belgium because of the automatic wage indexation mechanism. While the European Central Bank is wondering about a possible future rise in wages in the eurozone, wages will probably rise by more than 4.5% in the private sector this year just because of this mechanism. Belgium will probably be one of the countries where the risk of a wage-price spiral is the highest.

Share of consumer price index with inflation above X%

A looming problem

The other concern relates to public finances and the evolution of debt. According to forecasts from the European Commission, Belgium will be the worst performer in the eurozone in terms of its primary surplus/deficit over the period 2022-2023. We agree with this forecast, in the absence of any new policy. The crisis has created large deficits, but no one in government (be it at the federal or the regional level in Belgium) wants to take responsibility for putting the brakes on public spending. High inflation, which also inflates GDP, should slow down debt dynamics this year. But afterwards, the high level of debt in the context of an uncontrolled deficit could become the number one issue for authorities in 2023. Everything will obviously depend on the efforts required by the European fiscal rules (suspended since the Covid crisis). If a major effort has to be made, it will be politically difficult, with one year to go before the elections (2024), to make major cuts in spending, despite the fact that here, too, Belgium is leading the European pack. An increase in taxation, therefore, seems unavoidable. The problem of public finances could, from 2023 onwards, become a brake on economic growth.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 February 2022

Eurozone Quarterly: Leaving the pandemic behind This bundle contains 11 Articles