Belgium: A year later, the stand-off continues

Political negotiations remain at an impasse a year after the government resigned in Belgium. This hasn't seemed to have had a massive impact on the economy for now, mainly supported by household consumption… but for how long?

Political deadlock

Belgium has been with a caretaker government for more than a year and without a majority in parliament. Following the elections, the political negotiations have not led to a new majority at the federal level, so the caretaker government is still in place. To be sure, regional governments have been set up, but their fiscal power remains modest. As a result, economic policy is on hold.

At this stage, three scenarios remain possible: first, a broad coalition excluding extremist or nationalist parties could be formed. Secondly, a coalition of Flemish nationalists and French-speaking socialists (the largest parties in the North and South of the country) associated with other parties could also be possible, even if at this stage, those parties are not ready to work together. Third, a return to elections is still possible. In any case, no scenario offers a clear direction for economic policy in the coming years. Given the state of progress of the discussions, it is very unlikely that Belgium will end 2019 with a federal government.

Economic resilience

Given the weak global economic context and the political crisis, domestic demand is proving to be surprisingly resilient and has helped to offset the weak performance of international trade.

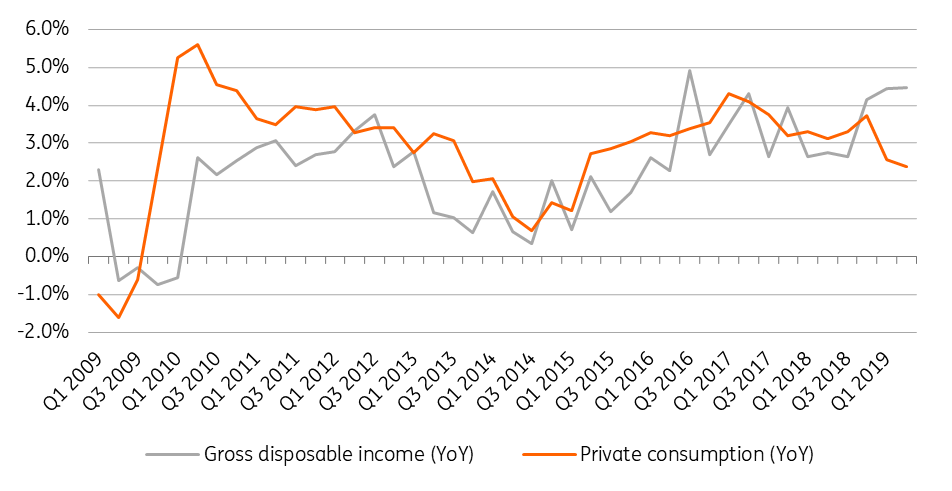

An acceleration in household consumption expenditure is even observed, after being atone for long. In the third quarter of 2019, private consumption rose by 1.5% year-on-year, in a context where households confidence remained stable and their intentions to buy durable goods even increased. This can be explained by the recent acceleration in household disposable income.

Driven mainly by relatively dynamic employment growth (+70,000 jobs in 2018, +48,000 jobs in the first three quarters of this year), nominal income rose by almost 4%. Knowing that at the same time inflation has fallen sharply (see below), this leaves room for an increase in real disposable income that has been sufficient to both significantly increase the savings rate and stimulate household consumption.

Disposable income is sufficiently solid to improve consumption and the saving ratio

For 2020, we remain cautious

On the one hand, the global economic growth that is expected to be rather low in 2020 will continue to weigh on activity exposed to international trade, even if a possible trade agreement between China and the United States will give some relief to exporters. On the other hand, it is unlikely that the Belgian economy will continue to create as many jobs as over the last years. Indeed, economic dynamics do not justify it.

At the same time, the lack of skilled workers will become increasingly acute. According to the ECB's SAFE survey on SME financing, the lack of skilled staff is by far the most pressing problem facing Belgian SMEs. Finally, when a federal government takes office (considering that it will take place in 2020...), the fiscal reality it will face requires it to take a series of cost-saving measures to correct the budget trajectory. This will have a negative impact on economic growth.

Job creation remains strong in the private and the public sector (thousand jobs)

Public finance problem

Indeed, the state of public finances will require the next federal government to embark on a relatively large fiscal consolidation exercise. The absence of a government for the past year de facto implied the extension of the budget in force in 2018. Therefore, no further effort has been made, while a structural correction of 0.6 percentage points of GDP is requested by the European Commission.

In addition, the regional governments set up in 2019 all expect their (regional) deficits to increase in 2020, in order to finance new policies or investments. Without a federal government to coordinate budgets, the fiscal slippage may be significant once the figures are consolidated. This is all the more the case since, in the federal parliament, alternative majorities are formed to free up additional budgets for specific problems. Without coordination, these practices can have a significant long-term impact on the budget. At this stage, we fear that Belgium's budget deficit will indeed increase to 2.0% in 2020.

Fortunately, this should not compromise the reduction of the debt ratio, which should fall below 100% in 2020. But without a government, the situation will only get worse.

Debt ratio continues to decline despite the budget deterioration (% of GDP)

Very moderate inflation

After a long period of inflation above the European average, inflation in Belgium has fallen sharply. In November, it was only 0.4%, while at the beginning of 2019, it was still close to 2%. However, this figure remains highly dependent on energy prices and therefore on oil prices. Indeed, core inflation remains broadly stable at around 1.5%. The same should be true in 2020.

To conclude, the year 2020 looks bleak. The external economic context, which is crucial for the dynamics of activity in Belgium, could improve temporarily thanks to a trade agreement between China and the United States. But at the same time, economic activity is expected to remain modest in Belgium's main trading partners (Germany, France, the Netherlands) and domestic demand is likely to suffer both from a slowdown in the labour market and from savings measures on the budget.

After growing by 1.3% in 2019, we expect economic activity to grow by 0.7% in 2020.

The Belgian economy in a nutshell (% YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 December 2019

ING’s Eurozone Quarterly: Is this recovery for real? This bundle contains 13 Articles