Belgium: Labour intensive growth

In 2018, we expect Belgian economic growth to accelerate further amid a broader Eurozone recovery

Domestic demand drives growth

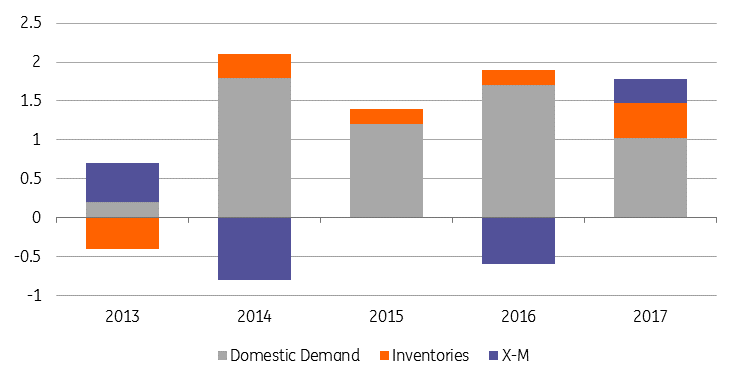

With 1.8% GDP growth, 2017 can be considered a positive year for the Belgian economy. Domestic demand is mainly responsible for that figure, as it has been for the last four years. To be sure, its contribution to GDP growth was slightly below the level of previous years (Fig. 1), but we believe this was due to temporary factors: a lack of confidence amongst businesses in the middle of the year (it has been restored since then) and the fact that rising disposable income did not translate into more household spending. Fortunately, the positive contribution of both net external trade and inventories compensated for the somewhat weaker domestic demand.

This year, we expect a further acceleration of Belgian economic activity. First, domestic demand is expected to pick up speed, supported by high consumer and business confidence, but also by the delayed impact of job creation over the last two years (see below) and the expected further improvement of the labour market. Second, taking the high degree of openness of the Belgian economy into account, it is likely to benefit significantly from the strong activity in the Euro area. That’s why we expect 2.1% GDP growth in 2018.

Contribution to GDP growth

Employment growth is strong

Looking at the job market, 2017 has been even more positive than 2016. No less than 67,000 net jobs were created last year (63,000 in 2016). More importantly, three-quarters of these jobs were created in the private sector. It is also remarkable that total employment in the industry sector stabilised in 2017 after a very long decline. In fact, current economic growth (still below its long-term average) seems to be quite labour intensive: following the historical link between economic growth and employment, GDP growth last year should have equated to about 40,000 new jobs, or only two-thirds of what was effectively created. This also allowed the unemployment rate to fall to around 7.3% in 2017.

Employment growth is stronger than expected

Labour mismatch

Surprisingly, the biggest problem in the short term for the Belgian economy and for the labour market in particular could be the lack of qualified workers. Saying this is quite strange, knowing that more than 500,000 people are officially looking for a job, but the mismatch of qualifications is a well-known reality of the Belgian labour market. Many companies are already expressing difficulty in finding appropriately qualified jobseekers. That’s also why, despite stronger economic growth, we expect job creation to be limited to a range of 40,000 to 50,000 this year. To be sure, this number is far from poor.

The current improvement of the Belgian economy is helping the government to reduce the public deficit. Better-than-expected growth combined with the measures taken by the government over the last three years, suggest the deficit fell from 2.6% in 2016 to around 1.2% last year. That said, balancing the budget will require another substantial fiscal adjustment in the years ahead, which might be difficult with general elections coming in 2019. But considering the expected nominal GDP growth and the public deficit trajectory, the debt ratio could fall below the 100% of GDP threshold in 2019.

While inflation slowed down from its 3.0% peak in March 2017 to 2.1% in December, it remains above the Eurozone average though core inflation remains more subdued. The lasting gap between Belgium and the Eurozone can probably be explained by both a lack of competition in some sectors and the wage indexation process. This process safeguards the purchasing power of households, but at the price of a certain deterioration of Belgian firms’ competitiveness. Still, the negative impact should remain limited in the short run.

What then could possibly go wrong for the Belgian economy in 2018? Apart from an external shock impacting confidence, external trade or the financing of the economy, the political situation requires some attention. Indeed, local elections this year and more importantly, federal and regional elections in 2019, increase somewhat the tensions inside the current majorities (both federal and regional). The government is also under pressure by the opposition due to its management of the refugee crisis. Early elections aren't on the cards at this stage, but considering the coming deadlines, the political backdrop is likely to be shakier than it was over the last years.

The Belgian economy in a nutshell (%YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 January 2018

ING’s Eurozone Quarterly: All systems go This bundle contains 13 Articles