Belgium: Just not fast enough

For Belgium, 2017 was another recovery year which is definitively satisfactory but things could be much better. Yet, we don't see any signs of strong acceleration in the near future

It could be better

The Belgian economy is sound, with positive growth in all sectors including solid job creation, growing household disposable income and company profit margins with high confidence levels. But despite all these positive elements, some disappointment remains.

The current growth level stands clearly below its long-term average, while activity used to grow fast in a recovery period. Moreover, GDP grew by 3.2% in The Netherlands, 2.2% in Germany and even 1.8% in France over the same period, which means the Belgian economy performed worse than its neighbours and that is quite unusual. Finally, the GDP evolution was not in line with the (most better) evolution of soft data.

In the first quarter of this year, nothing seems to have changed: Belgian economic activity grew by 0.4% compared to the previous quarter and 1.6% year-on-year. Without any detail of the GDP components, it's difficult to explain why growth was, once again, so moderate. That said, with other Eurozone countries feeling some slowdown since the beginning of 2018, activity in the Belgian export sector could have been hit.

The Belgian economy performed worse than Netherlands, Germany and even France and that is quite unusual

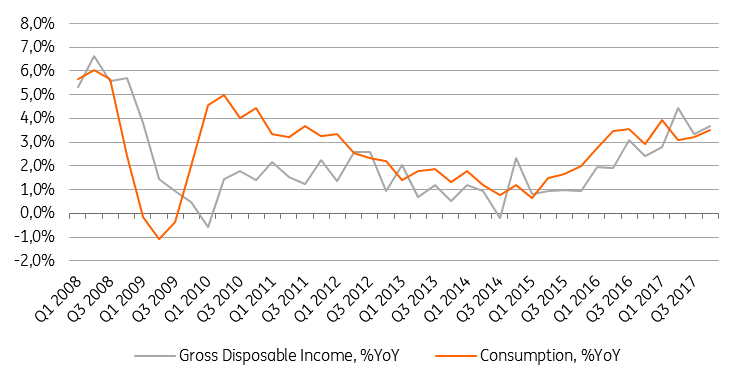

More importantly, while Belgium has always been considered as a country of savers, the positive growth of private consumption has been supported between 2010 and 2016 by a decrease of the saving ratio (from 14.9% in 2010 to 11.3% last year), falling below the Eurozone average. As job creation has boosted disposable income since 2017, it seems that households preferred to keep their consumption moderate to save more. That’s probably quite sound from a financial stability point of view, but the price to pay is softer domestic demand. Indeed, private consumption has, in 2017, shown some signs of weakness. The Q1 GDP number maybe reflects some further weakness from that side of the economy.

Private consumption now grows at the same pace as disposable income, stabilising saving ratio

No strong acceleration ahead

The key question is if any strong acceleration is likely in the coming quarters? At this stage, the answer seems to be no.

First, the general sentiment about the economic situation in the Eurozone is more mixed than last year, and even if activity accelerated in the two coming quarters, we had to revise downward our full-year GDP growth forecast for the Eurozone. As a small open economy, Belgium will have some difficulties to boost its activity in a weaker global economic context. Secondly, higher oil prices have probably started to affect real disposable income, and as a consequence, any stronger recovery of private consumption could be somewhat postponed.

To be sure, we are far from expecting a recession. Even if most economic indicators have levelled off recently, they remain consistent with an activity expansion. In particular, the very high degree of capacity utilisation in the industry sector suggests that further investments could support domestic demand. All in all, economic growth is likely to remain in a 0.4% - 0.6% range in the coming quarters. But on the back of the first quarter figure and these expectations, we fear that 2.0% GDP growth for Belgium is, once again, out of reach, unless an unexpected positive shock sets in.

Oil price driven inflation

Headline inflation currently fluctuates around 1.5%. Its recent slight increase is mainly due to higher oil prices, affecting the cost of transport and the energy cost of housing. On top of that, there was also higher food price inflation, but this can be temporary as it depends on weather conditions. As a consequence, contrary to what headline inflation tends to show, the underlying dynamic of prices is probably decelerating. As an example, the inflation of services has decreased from 1.9% in March to 1.3% in April.

Looking ahead, moderate growth will probably not push inflation any higher which means oil price dynamics will mainly influence it. We, therefore, expect a full year inflation of 1.7% in 2018. In this context, an automatic wage indexation could happen in August, compensating households’ disposable income for inflation, but increasing companies’ labour cost by the same proportion.

Budget balance still in doubt

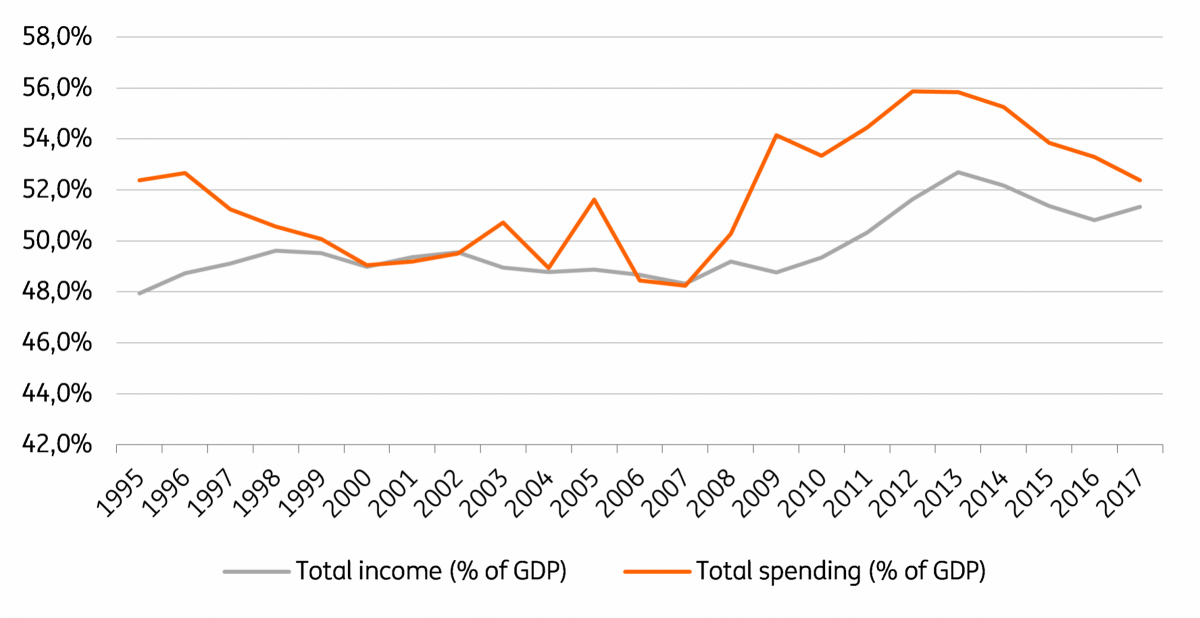

The deficit reduction from -2.5% of GDP in 2016 to -1.0% of GDP in 2017 came as a good surprise. It seems that tax revenues combined with a decrease in total expenditures (from 53.3% of GDP to 52.4%) allowed the deficit to be reduced by more than expected. To be sure, public finances also benefited from the interest charge reduction thanks to the decreasing implicit rate on the total public debt.

Public deficit declined thanks to a strong spending reduction

Despite this good news, reaching a budget balance in 2019, as previously expected, remains doubtful.

One possible explanation for this is the necessity of taking additional structural measures to reach this target, while local elections this year and federal, regional and European elections next year make political consensus more difficult. Moreover, one has to remember that the cost of ageing increases each year and without any new measure, the public finances are structurally deteriorating. In its stability program, the government has further delayed significant structural deficit reduction until 2020, when a new government will take the helm.

In the short run, we don’t consider this as a big problem as the effort made in the past and the further positive economic growth allow the debt/GDP ratio to decrease. It could already decrease below the psychological threshold of 100% next year.

To conclude, we say the Belgian economy is doing well, but compared to what it was able to deliver in the past in terms of growth and inflation, it could be much better.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 May 2018

ING’s Eurozone Quarterly: A slower cruising speed This bundle contains 12 Articles