Bank Pulse: More eurozone bank lending in April against higher rates

Eurozone bank net lending was solid in April despite rising rates. The mechanics of bank balance sheets implies that lending rates will continue to rise faster than deposit rates in the near future

Eurozone bank lending continues to perform well

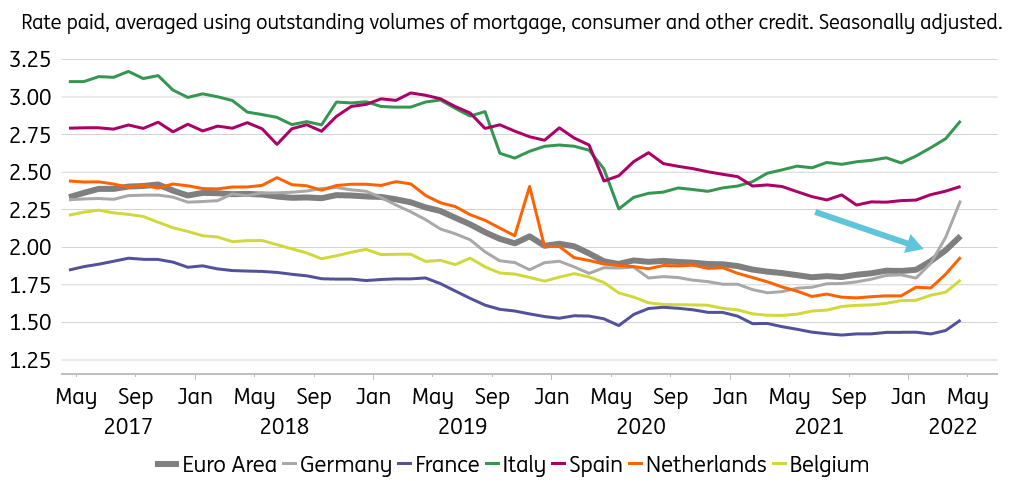

Eurozone net bank lending to households and businesses continued to perform strongly in April. Lending to households was virtually unchanged from previous months. Only lending to French households weakened somewhat. We are likely still looking at some front-loading of borrowing and refinancing, locking in low rates while they are still around. Because rates for households keep rising. The average eurozone borrowing rate for households (based on a volume-weighted average of mortgage, consumer and other types of credit) reached 2.08% in April, up 10bp from 1.98% in March. The all-time low was 1.80% back in June last year.

This increase still seems minor, but we have already reached the highest rate since mid-2019 (see chart below). And importantly, there is more in the pipeline. The ECB-reported rates we look at here are recorded when a loan actually materialises on banks’ balance sheets. For mortgages in particular, this concludes a process which takes weeks, sometimes several months. The rates households are offered today typically have risen further already, yet these higher rates will show up in ECB-reported rates with a delay.

So far, the rate rise has been most marked and acute in Germany (50bp since January, see chart). Italian households have been used to slowly but steadily rising rates since mid-2020 already, and borrowing remains the most expensive for them among the eurozone’s largest economies – as it has been for most of the past 20 years. Rates for French households are now also starting to pick up.

Average household borrowing rates (%)

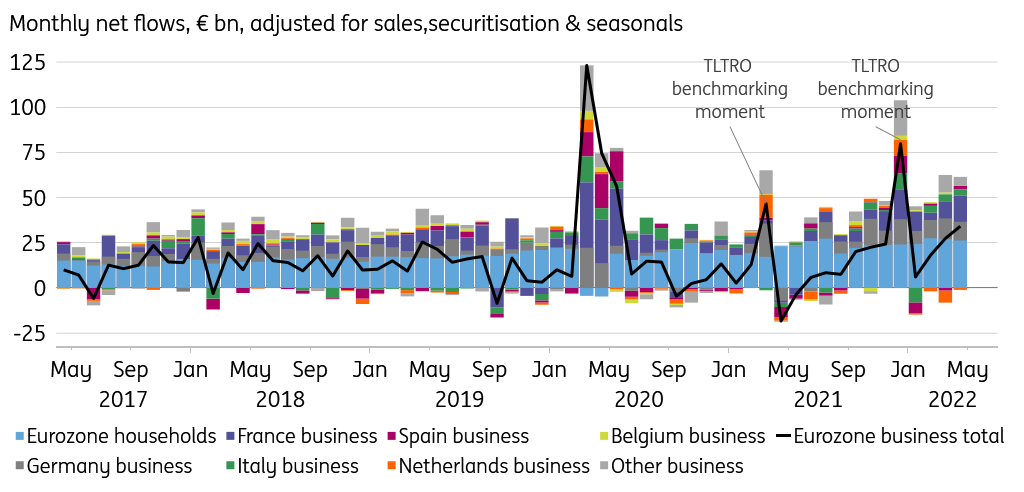

Bank lending to businesses was solid in April too. Borrowing by businesses in Germany and Italy remains stable. French businesses even expanded their borrowing. Post-lockdown catch-up demand and good prospects in tourism and other services sectors, for example, may weigh against uncertainty and headwinds in industry. Unfortunately, lending data on borrowing by sector are not yet available. Borrowing rates have risen by 20bp since the start of this year, though this masks steeper rises in some specific segments and countries.

Eurozone bank lending to households and non-financial businesses

April bank deposit inflows remained steady, continuing the gently declining trend that has been visible since mid-2020. Deposit remuneration has risen much less than bank lending rates so far, up only 3bp in April compared to January. It’s inevitable that bank deposit rates will rise much more slowly than lending rates. Bank lending rate increases apply to new loans only. Rates on outstanding fixed-rate loans remain unchanged until the rate resets, which, especially in the case of mortgages, can take several years. Hence rate rises seep through into banks’ lending portfolios only slowly. Deposit rate increases, on the other hand, tend to apply to the majority of deposits immediately – fixed deposits exempted, which are a minor part of deposits for most banks.

This duration difference between bank assets and liabilities allowed banks to pass through lower rates to their depositors very gradually when the ECB started to charge a negative deposit rate in 2014 – it took years for savings rates to reach and breach zero for retail depositors especially. But now that market rates are rising again, the very same mechanism works in the other direction to the disadvantage of savers: provided that banks want to protect their interest margin, they have to go slow on deposit rate hikes.

Bank lending rates will continue to rise

Eurozone bank lending rates have been rising this year, and there is more to come. Deposit rate increases are bound to significantly lag behind this. Lending volumes have held up so far. But with further rate increases in the offing, and significant tightening of loan approval criteria foreseen by banks, financing conditions are likely to become less favourable in the months ahead. Combined with economic uncertainty, a weakening in bank lending volumes is likely.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article