Bank Pulse: Full Basel reforms to further increase European banks’ capital requirements

European banks will have to face 13.7% higher minimum capital requirements by 2028. This follows a monitoring exercise by the European Banking Authority regarding the full implementation of the final Basel III reforms in the EU. But banks are already prepared and the capital shortfalls are limited

Bank capital requirements would increase by 13.7% by 2028

The EBA has just published its monitoring exercise of the full implementation of the final Basel III reforms in the EU as compared with the full application of the current CRR/CRD IV. The report assesses the impact on 99 banks split into two groups (40 large and internationally active and 59 small banks) and one subgroup (G-SIIs) based on their size.

The report finds that the banking sector would see an average increase of 13.7% in the required minimum level of Tier 1 capital by 2028 as compared with the CRR/CRD IV. The aggregate capital requirement would increase to €866.1bn from €762bn. The impact has been reduced when compared with previous exercises. The effect would be bigger for the large and internationally active banks (+14.4%), where the G-SIIs would carry a heavier burden of +22.7%. Smaller Group 2 banks would be less impacted and see their minimum requirements increase by 8.1% in the case of full implementation.

For G-SIIs the higher capital requirements would be notably driven by the introduction of the output floor. This would solely increase the minimum capital requirement by 7.4%. In addition, the minimum capital to be held for operational risk would increase by 6.1% by 2028. The impact of the output floor would be less for smaller banks at +2.2%. More important for them are the changes in the standardised (+6.8%) and the internal ratings-based (+3.6%) approaches for measuring credit risk.

| €3.1bn |

The T1 capital shortfall |

Leverage based requirements would become less constraining

The higher risk-based capital requirements would contribute to making leverage-based requirements less constraining. According to the EBA, the number of banks constrained by the leverage ratio will halve from 32 under CRR/CRD IV to 15 under the full implementation of Basel III. Only for the G-SIIs group, the revised leverage ratio would increase the minimum T1 capital requirement (+0.7%) due to the G-SII surcharge.

The baseline impact presented above excludes the impact of three G-SIIs that have used, according to the EBA, “overly conservative data for market risk” in the new FRTB framework. Including the impact from these would result in the minimum capital requirement to increase by 23.3% for G-SII’s as compared with the 22.7% baseline. The difference is driven by a 2.9% higher market risk requirement as compared with just 0.1% higher in the baseline.

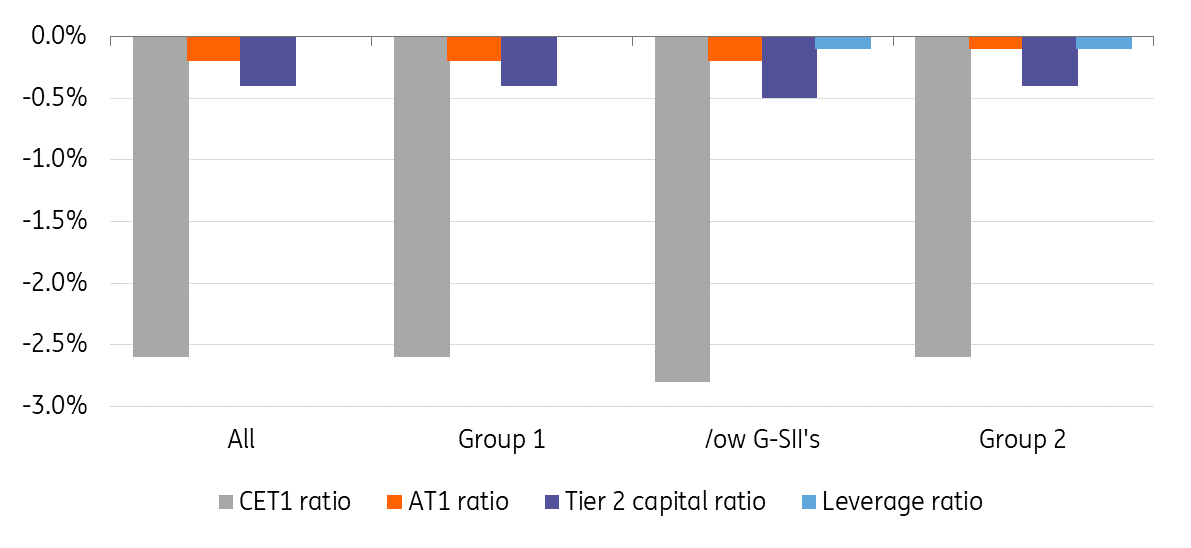

The impact on capital ratios of fully loaded Basel III reforms

Compared with current fully loaded CRR/CRD IV by 2028

Banks would need to raise more capital and extend their debt maturities

The full application of Basel III when compared with the fully loaded CRR/CRD IV rules would result in EU banks showing 260bp lower CET ratios, resulting in a CET1 capital gap of €0.7bn. The very small CET1 gap is only found in the group made up of smaller banks.

The Tier 1 shortfall for all banks would amount to €3.1bn. This would include €1.6bn for G-SIIs for the higher risk-based capital requirements. Smaller banks would instead need another €1.3bn due to the higher risk-based requirements and an additional €0.2bn due to the higher leverage-based requirements.

The shortfall of total capital for all banks would increase to €7.3bn, of which €5.3bn for G-SIIs. The relatively limited capital shortfalls reflect, in our view, banks being well prepared for the upcoming changes.

Finally, the report shows that to comply with the NSFR banks would need to raise another €8.1bn in longer-term funding, split between groups 1 (€5.6bn) and 2 (€2.4bn) with no shortfall found for the G-SIIs. We consider the funding shortfall as limited for the whole sector.

Chart pack

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

BankPulseDownload

Download article

30 September 2021

Sustainability: here comes the hard part This bundle contains 8 Articles