Bank Pulse: Eurozone bank rates now definitely on the rise

The era of ultra-low bank lending rates has ended. Rising rates and tightening loan approval criteria are adding to economic headwinds in the months ahead

It was only a matter of time before banks passed on rising rates to customers

With the fundamentally changed monetary policy outlook and rising market rates, it was only a question of time before banks would start to pass on rising rates to their customers. Still, month-on-month rate changes can be erratic and do not immediately signal a trend change. Today’s ECB data on March bank lending rates however show that banks have been increasing lending rates for both households and businesses for three months in a row now. Rate increases have continued in March, the most recent available month, and have thus defied the war in Ukraine. So we can now establish with some certainty that the era of ultra-low bank lending rates ended in 2021. We have now entered a new era of rising bank rates, though the pace is very gentle so far.Fqu

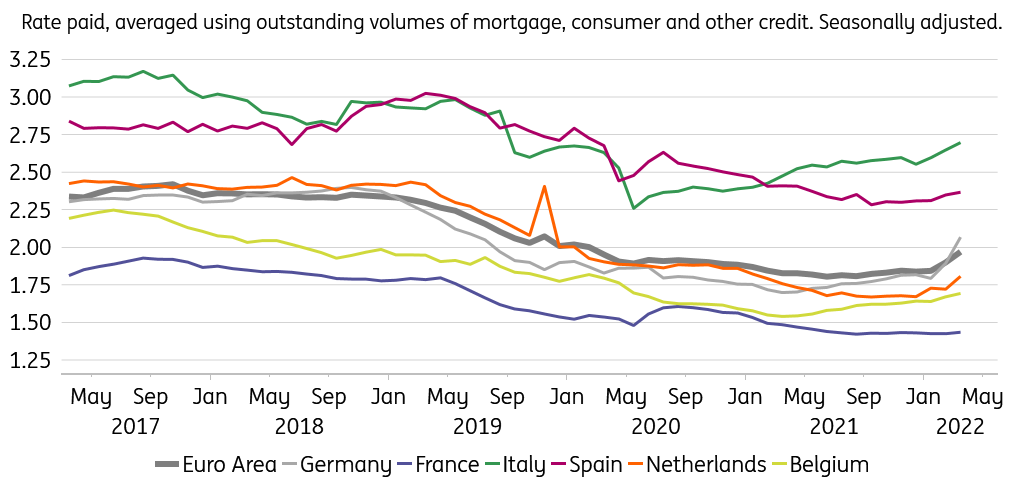

Across the eurozone, households on average borrowed against 1.96% in March (taking the volume-weighted average of mortgage, consumer and other credit). This is up from 1.79% last December. The less than 20bp rise over three months is small, as banks continued to allow their interest margin to deteriorate. At the same time, rates have already risen to levels last seen two years ago. The rate rise was most marked and acute in Germany (see chart). Italian households had already been used to slowly but steadily rising rates since mid-2020, and borrowing is the most expensive for them among the eurozone’s largest economies – as it has been for most of the past 20 years. French households appear insulated from rate rises so far, though that situation is unlikely to last.

Average household borrowing rates (%)

Households did not borrow any less because of higher rates – March net borrowing volume almost matched February's and remained close to the peak of July last year, which in turn marked the highest monthly net borrowing since September 2007. A limited amount of front-loading may be occurring in anticipation of higher rates, and in any case, we expect rising rates to have some cooling effect on mortgage borrowing throughout the eurozone for the remainder of this year. Indeed the most recent ECB’s Bank Lending Survey showed that banks are expecting mortgage demand to weaken in the second quarter.

Bank lending rates for businesses also rose for the third consecutive month, reaching 1.64% in March (focusing on loans with a maturity of over one year, and adjusted for seasonal fluctuations), up from 1.36% in December. This is in fact the highest rate since May 2019. Again Germany stands out for the speed and size of rate increases: German businesses borrowed against 1.77% in March, while back in November they only paid 1.26%. Dutch borrowers faced a similarly-sized hike. French businesses, in contrast, faced a rate increase of only 8bp in the first quarter.

March business borrowing shows no impact yet from rising rates, nor from increased caution as a consequence of the war in Ukraine. In fact, the eurozone net borrowing volume, at €20bn, was slightly higher than in February, driven mostly by continued strong borrowing demand in Germany and France. Yet borrowing demand does not necessarily reflect economic resilience, it may also include inventory financing needs linked to supply chain disruptions or input price hikes.

While eurozone bank lending rates are now unmistakably on the rise, lending volumes have not yet responded. With further rate increases in the offing and significant tightening of loan approval criteria foreseen by banks, financing conditions are likely to become less favourable in the months ahead. Combined with economic uncertainty, a weakening in bank lending volumes is likely.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more