Bank Pulse: EBA opens discussion on potential recognition of ESG risks through capital requirements

The European Banking Authority's (EBAs) recent preliminary contemplations on the integration of ESG risks in the prudential framework make one thing clear: it firmly believes that environmental aspects should only lead to differences in capital treatment if they impact the risk profile of the underlying exposures

EBA feels capital requirements should be risk-based for ESG risks

Earlier this month, the European Banking Authority opened the floor to a discussion on the prudential treatment of environmental risks. This marks an important step in the debate in Europe about if and how environmental risks should be considered in the risk weight treatment of the assets on bank balance sheets. While the discussion paper published by the EBA is primarily meant to gather stakeholder feedback and draws no final conclusions, it does hint at some preliminary preferences on how to consider such risks. The EBA is expected to give its final advice on the matter to the European Commission by mid-2023 at the latest.

For instance, the EBA believes that, first and foremost, the prudential requirements should reflect the underlying risk profile of the exposures. As such, they should not have the purpose of incentivising credit institutions to increase demand for green assets and discourage demand for environmentally harmful assets, even though this may still be the consequential outcome. This is important, as it means that exposure to more polluting counterparties or assets should, in the EBA’s view, only be subject to a higher risk weight treatment if it can be substantiated that environmental considerations in fact do increase the risks of such exposures.

Against this backdrop, the EBA does underscore, however, that it is still uncertain about how environmental risk will impact financial risk over time. This is due to the possibly non-linear and forward-looking nature of environmental risks, as environmental risks will increase gradually over time, and may coincide with environmental shocks that cannot be predicted. It is therefore not clear whether the risk of the overall system will grow, leading to different assumptions on optimal capital levels, or whether environmental risks would prompt a reassessment of risk profiles, merely resulting in a reallocation of capital requirements, but neutral to the overall capital needs.

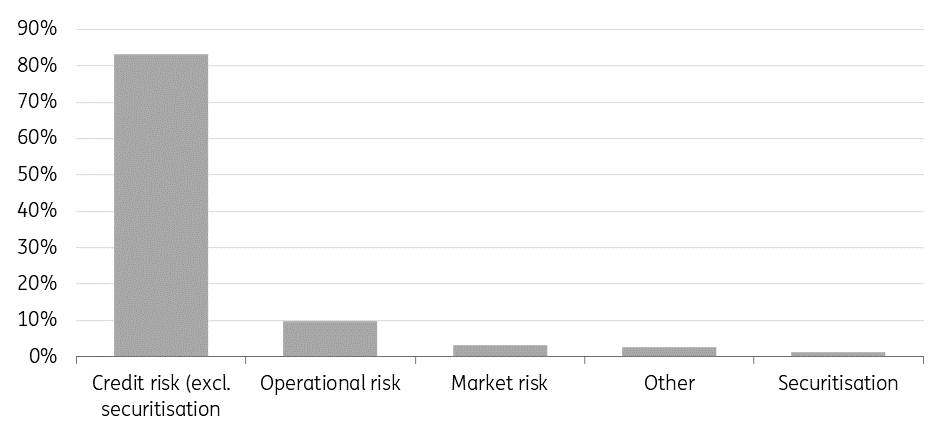

Furthermore, environmental risk drivers, such as physical and transition risks, should not be seen as a separate category of financial risk according to the EBA. They should rather be considered as a factor impacting traditional categories of financial risks, of which credit risk is most relevant for the own fund's requirements of banks. When it comes to the recognition of environmental risks though, the EBA seems to have a clear preference for (further) integration of such risks within the existing risk parameters, over the introduction of environmental risk-related adjustment factors.

RWA composition (EU/EEA) by risk type (credit institutions only)

The issue with adjustment factors according to the EBA

The EBA report explains that one potential way of introducing environmental-related adjustment factors in the prudential rules is by means of green supporting factors or brown penalising factors. In this case, the capital requirements of environmentally sustainable exposures can be reduced by means of lower risk weights or via a downward adjustment of the risk-weighted assets through an adjustment factor. Instead, the capital requirements of environmentally harmful activities can be increased through higher risk weights, or otherwise via an upward adjustment of the risk-weighted assets.

The EBA lists several pros and cons to such adjustments, from both a prudential perspective and public policy perspective. There is, for instance, a concern that adjustment factors could lead to a double counting of environmental risks if these are already factored into the risk weights through external ratings or bank internal models. Besides, adjustment factors may not be risk-sensitive and could lead to lower capital requirements for exposures that are not necessarily of lower risk.

The EBA also highlights a number of issues with certain specific forms of adjustment factors. To name an example: supporting factors for sustainability-linked loans could come with challenges regarding the determination of prudentially accepted sustainability targets for the borrower. For transition supporting factors, that help finance transition programmes, the EBA underscores the double counting risk if transition risks are already captured by the other Pillar 1 mechanisms.

The EBA, therefore, believes that a cautious stance on adjustment factors is warranted considering the applicable challenges. These include the identification of the risk profile of certain assets due to environmental risks, and the assessment that such risk drivers could not be captured by the prudential framework. From a prudential risk-based perspective, the EBA sees it as the most consistent way forward to clarify to what extent environmental risks are already grasped by the current prudential requirements and to assess ways of further integrating ESG drivers into the Pillar 1 requirements.

How environmental risks may already be captured

In its discussion paper, the EBA gives a broad range of examples of how environmental risks may be captured through some of the existing capital requirement mechanisms under the standardised approach and internal ratings-based approaches for credit, market and operational risks.

The standardised approach

Regarding the standardised approach, the EBA observes that environmental risks should (increasingly) be integrated into the external credit risk assessment, without further need to address such risks through the risk weight mapping tables. Credit institutions may also consider environmental aspects as an additional relevant condition to their own fund's calculations through their due diligence requirements. Last but not least, environmental risks could be recognised through the (re)valuation of collateral.

The latter is of particular relevance for immovable properties serving as collateral for residential and commercial mortgage loans. Under the standardised approach, the risk weights of these loans are related to the loan-to-value (LTV) ratios of the loans. To the extent that there is a positive relationship between the value of the property and its energy efficiency, this may (partially) be reflected in the prudential framework through the lower LTV levels and related lower risk weights of energy-efficient properties. Besides, there may also be a positive relationship between the energy efficiency of a loan and its credit performance. The EBA is nonetheless not certain that the valuation effect would sufficiently address the risk profiles of these exposures.

Internal rating based approaches

When it comes to the internal rating-based approaches, the EBA also discusses possible ways for the integration of environmental elements in the estimation process and the determination of its own fund requirements. This includes, for instance, during the establishment of the reference data set, used for the purpose of identifying historical defaults and realised credit losses. The EBA also sees opportunities to capture environmental risks in the development of a rating system, that should provide for the differentiation of risk and proper risk quantification (eg through the probability of default [PD] or loss given default [LGD] estimates). Think for instance of the use of expert-based qualitative variables. Also in the application of the rating system to the current portfolio and in the calculation of the own fund requirements, environmental risks could be addressed, for example via a further differentiation of the risk weight formula.

Tackling ESK risks through a new concentration limit

Environmental risks could also impact financial stability through the sectoral or geographical concentration of assets. As such, environmental shocks could affect multiple exposures at ones that are at first sight unrelated. Concentration risks are currently addressed through the large exposure (LEX) regime, which mitigates concentration risks associated with exposures to one single entity or a group of connected entities. The EBA would not be in favour of an overhaul of the LEX regime to make it more fit for environmental risks, even though additional reporting requirements could be helpful, such as on large exposures subject to environmental risks.

Instead, the EBA suggests that a new concentration limit could be introduced for clients significantly exposed to environmental risks. This could be in the form of a single limit on all or some environmental risks, for counterparties subject to high physical risks or high transition risks. The application of such a limit as a uniform Pilar 1 measure should help ensure a consistent approach by banks, even though its relationship with the Pillar 2 framework would have to be further considered. Besides, the EBA stresses that the limit should not hamper banks' ability to help counterparties finance the transition towards more sustainable activities. The EBA therefore emphasises that a new concentration limit should be carefully designed.

Conclusion

In its discussion paper on the role of environmental risks in the prudential framework, the EBA gives a broad range of examples of how the current prudential requirements may or could cover environmental risk drivers. As the purpose of the paper is to provide input to a further discussion on this topic, no clear conclusions are drawn yet on different capital treatments for certain exposures based on environmental risks. However, the EBA is vocal that the integration of ESG risks in capital requirements should first and foremost be risk-based. Whether green and brown supporting factors are the proper tool to use here, is uncertain according to the EBA. Furthermore, when it comes to tackling concentration risks arising from environmental shocks, the EBA seems to have a preference for the introduction of a new concentration limit for environmental risk over amending the existing large exposure regime.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

ESGDownload

Download article