Bank Pulse: Covered bond supply breaks records

Bank bond supply has seen a massive start to the year driven by record-breaking covered bond supply. The unsecured bank bond supply remains in line with last year. We raise our covered bond estimates for 2022 but keep our unsecured estimates intact, for now

Active start to the year for bank bond issuance despite volatile market conditions

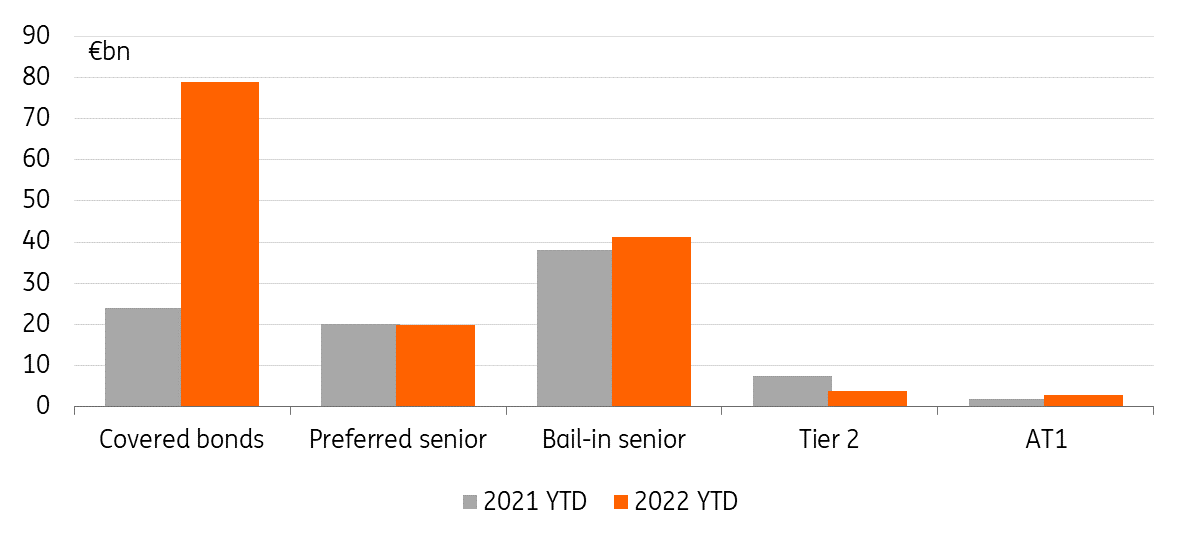

Banks have been extremely active in the funding markets in the first quarter of this year. On a year-to-date basis, euro-denominated bank bond supply stands at €146bn compared to just €91bn at the same time last year. The main (or practically only) reason for the substantial increase in total bank bond supply is covered bonds. Issuance in unsecured bond products has been more limited. A combination of inflation fears and geopolitical risks have guaranteed volatile market conditions this year, keeping many banks focused on safer alternatives.

Covered bond supply looks rather astonishing

Covered bond issuance has been breaking records, which you can read more about here. In 1Q22, banks have printed €79bn in covered bonds including sub-benchmark sized bonds, up from €24bn at this time in 2021. In addition to the potential impact from inflation and geopolitical risks, concern about an end to ECB support measures, including the covered bond purchase programme (CBPP3) and the targeted longer-term refinancing programme (TLTRO-III), could be playing a role here.

Non-European banks such as Canadians have been particularly active. In the eurozone, both German and French banks have delivered a clear increase but Italian and Spanish banks are behind where they were last year. This supports expectations that banks in core and semi-core countries are more likely to be active in paying back part of the TLTRO-III drawings in June this year once the additional special interest rate period ends. Periphery banks, on the other hand, may be more inclined to sit on their funds a tad longer. Note that in March 2022 only €1.8bn of TLTRO-III funds was paid back. We expect June 2022 repayments to be the largest to date, and probably one of the largest repayments over the entire operation.

Bank bond supply across bond products

Bail-in senior supply takes the lead in unsecured space

In the unsecured space, bail-in senior issuance reached €41bn in 1Q this year, just ahead of €38bn in 1Q21. French and Swedish banks, in particular, have been more active in bail-in senior this year, while the issuance from US and German banks lags last year. Preferred senior debt supply, meanwhile, remained stable at €20bn.

Banks have been somewhat less active in regulatory capital issuance with the combined Additional Tier 1 (AT1) and Tier 2 capital print now at c.€7bn, down from €9bn in 1Q21. Issuing capital is very reliant on market conditions. The first (and only) AT1 deals were priced only in late March.

Unsecured issuance supports banks’ loss absorption capacity and their ability to meet their Minimum Requirements for Own Funds and Eligible Liabilities (MREL). MREL requirements for eurozone banks became binding as of 1 January. Banks were already well-positioned for this. New issuance for MREL is thus especially driven by redemptions and balance sheet or RWA growth.

We hike our supply forecast for 2022

We have made some changes to our bank supply estimates for the full year 2022 to account for the active first quarter. We have increased our EUR covered bond supply forecast to €125bn (or €130bn including non-benchmark sized issues). We expect the covered issuance spree to slow down from here after the extraordinarily strong supply seen during the first quarter of this year. In unsecured bank debt, we keep our estimates intact. We are forecasting a total of €225bn in unsecured issuance for the year. Having said that, with actual supply corresponding to some 30% of our full-year estimate, we would have to see a clear shift in the funding composition from secured towards unsecured alternatives in the latter part of the year for our forecasts to materialise.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article