Bank Pulse: Business borrowing conditions normalise

The impact of the pandemic on Eurozone business finances has been profound. Luckily the recovery has been quick as well. Demand for bank loans is likely to decelerate further in 2022.

Where bank lending and the ECB’s Bank Lending Survey provide hard and soft data from the banking side on bank lending developments, the ECB’s Survey on Access to Finance of Enterprises (“SAFE”) provides a “soft” perspective from the other side. In addition, it gives a financial perspective on the rollercoaster ride for businesses over the past 1.5 years. The SAFE is run semi-annually, and the latest round was published this week, covering April to September. Importantly, the survey was concluded before Covid infections necessitated new measures in many countries.

SME turnover recovers, profits do not

Over the summer, SME turnover recovered: a net 15% of SMEs reported an increase (explanatory note: net percentage means the difference between the percentage of firms reporting an increase and that reporting a decrease). This increase comes after two survey rounds (covering summer 2020 and winter 2020-21) of strong decreases. The industrial and construction sectors are leading, while trade and especially services are lagging. Recovering turnover is one thing, but a return to profitability is another. Overall, profitability deteriorated further, with a net 6% of SMEs reporting a decline in profits. While that is much less bad than in the preceding two survey rounds, the weak profitability position is worrying, also given renewed measures now being taken. Both in terms of turnover and profit, Dutch, Belgian and German SMEs on average report better developments than their counterparts in France, Italy and especially Spain.

Most pressing problems

The trend towards normalisation is evident elsewhere too. When asked about their most pressing problem, 28% of SMEs (and 31% of large firms) report this to be the availability of skilled labour. Back in 2009, just 9% of SMEs (and 8% of large firms) thought labour shortages their biggest problem. The problem has been one of steadily increasing importance since then, briefly overtaken by the pandemic, but now back in full force. This is important to watch from a wages-feeding-into-inflation perspective.

7% of SMEs (and 5% of large firms) report access to finance as their biggest problem. This problem was temporarily elevated during preceding lockdowns, but is now back to pre-pandemic low levels. Reported demand for finance, in particular from banks, fell back across the Eurozone this summer, but mostly in Germany and the Netherlands.

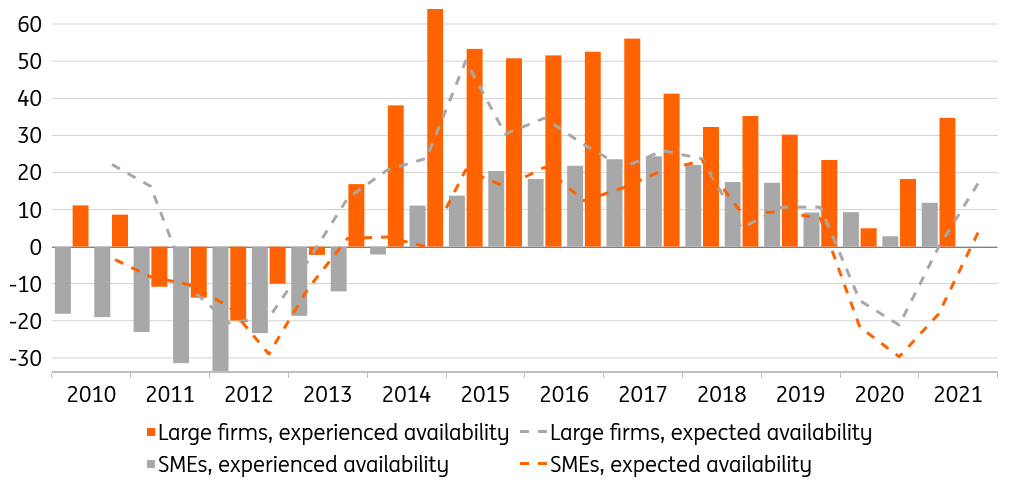

At the same time, reported availability of finance recovered towards pre-pandemic levels. During the first year of the pandemic, the deterioration in availability was concentrated in market-based financing such as bond and equity issuance, and in trade credit, while the availability of bank finance remained relatively unaffected (see chart). Comparing business expectations about bank finance availability with reality, 2020 clearly shows that business pessimism turned out to be mostly unfounded (see chart). The resilience of bank loan supply was helped by government support and guarantee schemes.

Eurozone historic and expected availability of bank finance

Looking forward, both large firms and, to a smaller extent, SMEs expect further improvements in the availability of bank finance (see chart). Firms expect market-based finance availability to improve the most, while they expect more modest improvements or (in the case of SMEs in some countries) even slight deteriorations in the availability of bank-based finance. Yet as noted before, market-based finance availability deteriorated much more than bank-based finance in 2020, which was a more consistently reliable factor throughout the pandemic. More generally, the disclaimer applies that expectations were surveyed before the deteroriating Covid situation.

Demand for bank loans to wane next year

As outlined in our Bank Sector Outlook 2022, over the course of 2022 we expect business demand for bank loans to further lose steam. As economic growth settles down, some businesses are struggling with debt overhang, while others have elevated cash buffers. Yet the progress of the pandemic and countermeasures over the coming winter months are major uncertainties.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article