Bank Outlook 2023: Higher rates, higher risks

The aggressive shift in the monetary policy stance of the European Central Bank (ECB) has led to a massive repricing of interest rates. While higher rates should be positive for bank revenue development, the impact is not the same for everyone

Most banks rely heavily on net interest income

The impact of higher rates on banks depends, among other things, on their business model and their reliance on interest-generating activities, as compared to fee businesses. In addition, the average interest rate fixing period of the bank’s loan book, the specific funding model, the composition of the investment portfolios, hedging arrangements and so forth impact the sensitivity. Higher rates have a positive impact on the net interest income (NII) of banks. While the impact of a revaluation of fixed-income portfolios is negative.

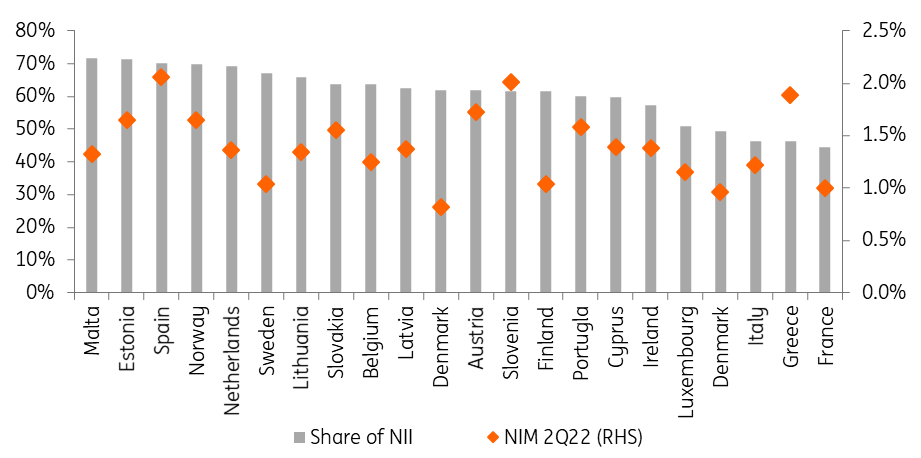

Importance of net interest income on revenues vs net interest margins

Banks that rely more heavily on NII instead of net fee and commission income as a source of income are likely to see a bigger impact on their revenues from changes in interest rates. In the second quarter of 2022, Spanish, Norwegian, Dutch, and Swedish banks were among those with the highest reliance on net interest income as a source of income.

Banks in France, Greece, Italy, and Germany were among those with the lowest reliance on NII. Italian, German, and French banks generate a larger share of their revenues from net fee and commission income. Additionally, Greek, Finnish, French and German banks have larger net trading revenues, which tend to exhibit more volatility over time.

According to a recent report by S&P, the impact of a parallel 200bp of higher interest rates has a positive impact on net interest income with Italian and Spanish banks, in particular, positively supported. The impact on the economic value of equity is negative for most banks. Only Spain is a positive outlier.

Impact of higher rates on banks

In the second quarter of the year, eurozone banks enjoyed net interest income growth of 7% quarter-on-quarter, supported by higher volumes and slightly higher net interest margins. While net interest margins have edged up almost across the board in the EU, the changes remain relatively limited in size. Austrian and Italian banks are among those showing larger increases, while Irish and Swedish banks saw their net interest margins decline slightly further.

Net interest margin vs QoQ change

Higher interest rates do not come through at the same time for all

European banks are very differently positioned in terms of the rate impact on their mortgage books due to the specifics of the housing and mortgage markets in different countries.

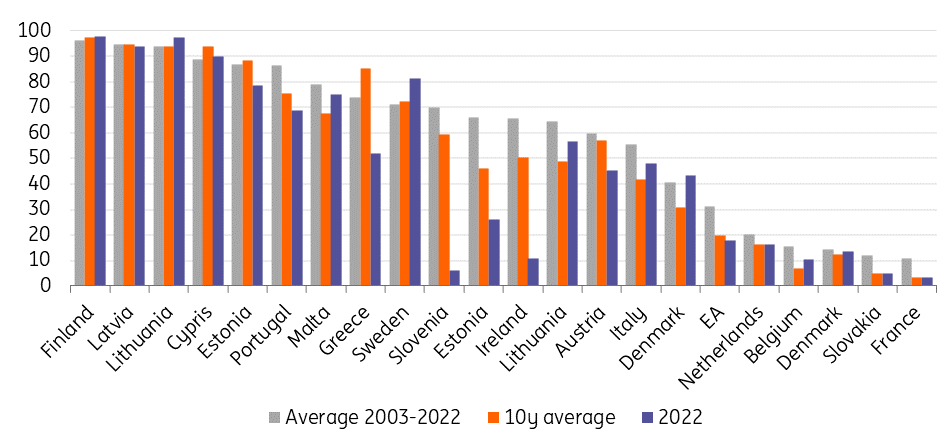

Banks in Finland, the Baltics and Sweden have a very high share of mortgages that are tied to shorter rates as shown in the high share of new production (80-98%) in August 2022 and in the historic comparison periods. Looking at the average levels since 2003, southern European countries, Ireland, and Austria wrote the bulk of their mortgages with floating rates. Since then, they have all seen a substantial shift lower in the share of floating rate mortgages in new mortgage production. Spain and Ireland in particular have seen almost a complete turnaround. For these countries, the outstanding balances keep the books geared towards shorter rates.

On the other hand, the bulk of mortgages in French, Belgian, German, or Dutch banks have been tied to longer rates in the past. This means that changes in market interest rates will take a longer time to get through to loan pricing.

Share of variable rate loans of new mortgage production (floating rate or initial rate fixing period of less than 1y)

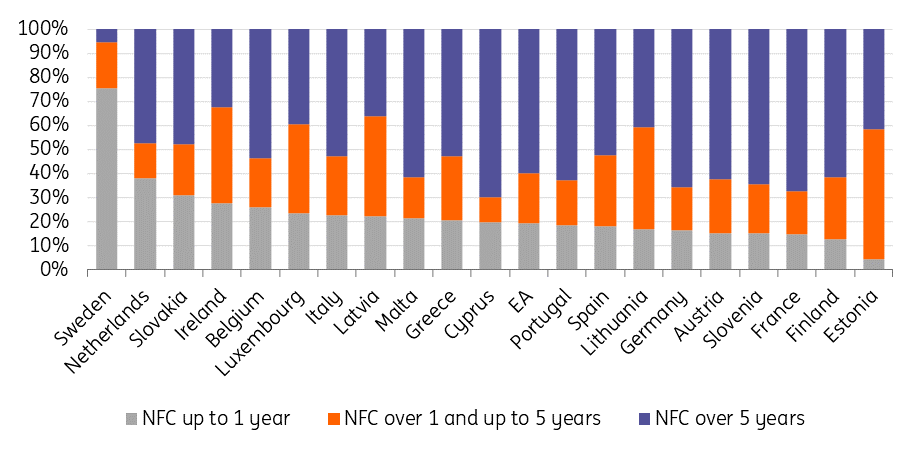

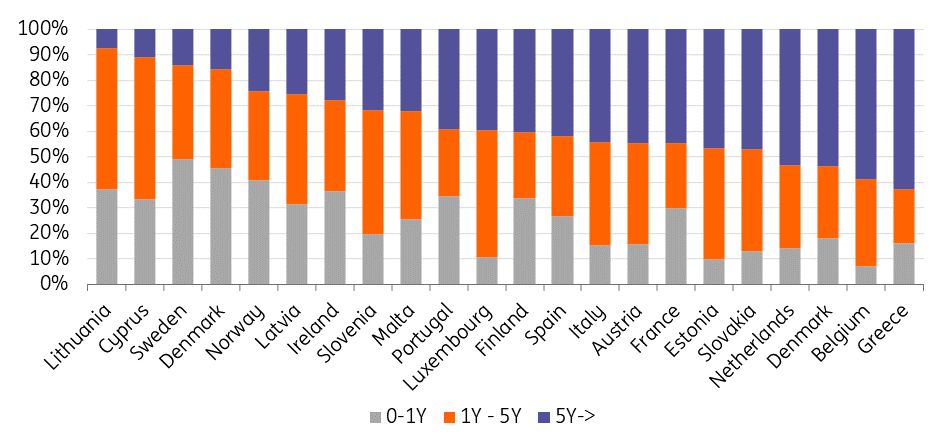

Swedish and Benelux banks with larger exposures to shorter corporate lending

The higher the share of shorter corporate loans or shorter fixing periods, the faster banks will see their corporate lending books repricing higher. Based on the ECB statistics, Swedish and Benelux (Belgium, the Netherlands, and Luxembourg) banks are more geared towards shorter corporate loans. This should support the banks’ NII generation as the rates will adjust higher at a quicker tempo. The other side of the same coin is that these corporates will face faster higher funding costs, and thus the risks in these books may also edge faster higher. This may show as higher credit costs along the way in these countries.

The longest corporate loans are in banks in Cyprus, France and Germany. With longer maturities, corporates do not need to refinance in the current uncertain environment. Those with fixed loans can continue enjoying relatively attractive funding rates, which should support the quality of these books.

Corporate lending split by country

Impact on other assets is mixed

Rising rates impact other bank assets besides loans. Among others for liquidity purposes, banks hold large balances of cash and debt instruments.

Higher deposit rates result in banks being better compensated for their cash balances. The fair value of debt securities is instead hit by higher market rates, but reinvesting can perhaps be done at higher yield levels than those of maturing bonds. Southern European banks, led by Italy, Portugal and Greece, hold larger shares of debt instruments. French, Spanish and Italian banks are among those with the smallest relative share of cash balances. Belgian, Greek, Austrian and German banks stand to benefit more from the repricing of their cash balances. The reduction in TLTRO-III drawings and excess liquidity in the banking system is likely to limit the benefit that eurozone banks can obtain from higher deposit rates on their liquidity balances.

Share of cash and debt securities of total assets

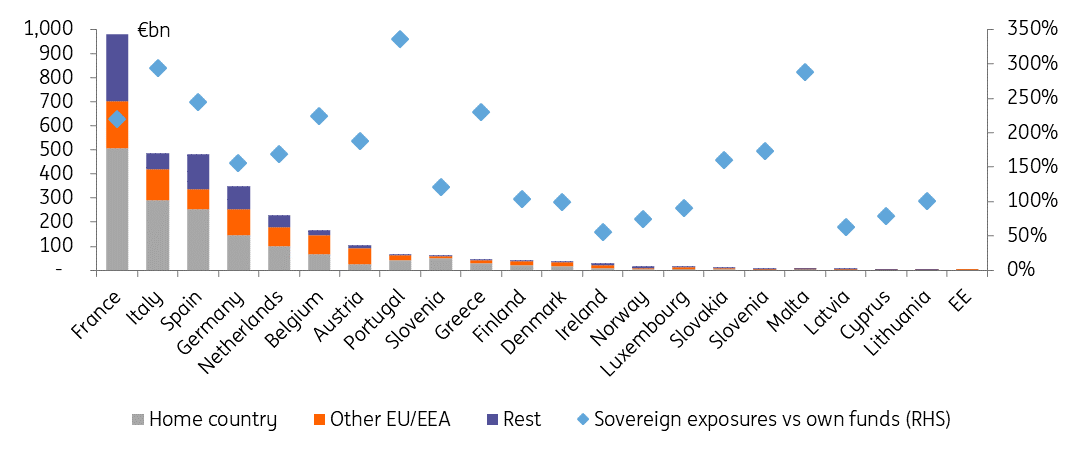

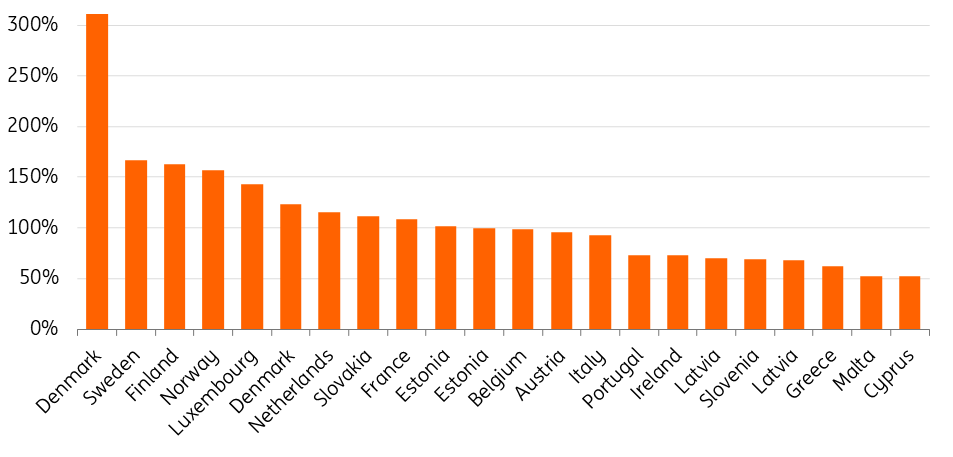

Sovereign exposures form a large part of the debt securities banks hold. French banks held €981bn of direct sovereign exposures, around half of which are French as of the second quarter. Italian banks have €487bn in sovereign exposure on their balance sheets, followed by Spanish banks at €484bn. Of the Italian exposure, a slightly higher share (60%) are home country securities versus 52% for Spain.

For Portuguese banks, sovereign exposures amount to more than 300% of their own funds. Italy (293%) and Spain (244%) also have high exposure, alongside Belgian and French (both 220%). Dutch and German banks have substantially smaller exposures to sovereigns at 169% and 156% of their own funds. Banks are required to hold high-quality bonds to meet liquidity coverage ratio requirements, which is one factor driving sovereign exposures.

Bank sovereign exposures

Greek, Belgian, German and Dutch banks hold longer bonds, on average, while Nordic banks have shorter maturities. Twenty-six percent of French sovereign exposures are longer than 10 years and altogether 45% longer than five years. Forty-four percent of Italian sovereign exposures are longer than five years, in line with Spain at 42%.

Due to the substantial home country exposures, bank fundamentals are directly impacted by any changes in the home country's sovereigns. Higher government bond yields mean that banks suffer from negative fair value changes in these positions. This impact is, however, partly limited by the accounting method used. The bulk of the instruments is accounted at amortised cost, meaning that changes in market values are not immediately reflected on bank financials. For Italy, 64% of the instruments are accounted at amortised cost, closely aligned with France and Spain (both at 63%). These risks should be reflected in the estimates for the economic value of equity.

It is good to remember that substantial sovereign debt holdings are not the only link between banks and the sovereign. Banks are usually very exposed to their home country's economy, making the two very interlinked. Bank senior unsecured bond ratings may also be capped based on the level of the home country rating.

Maturities of sovereign exposures

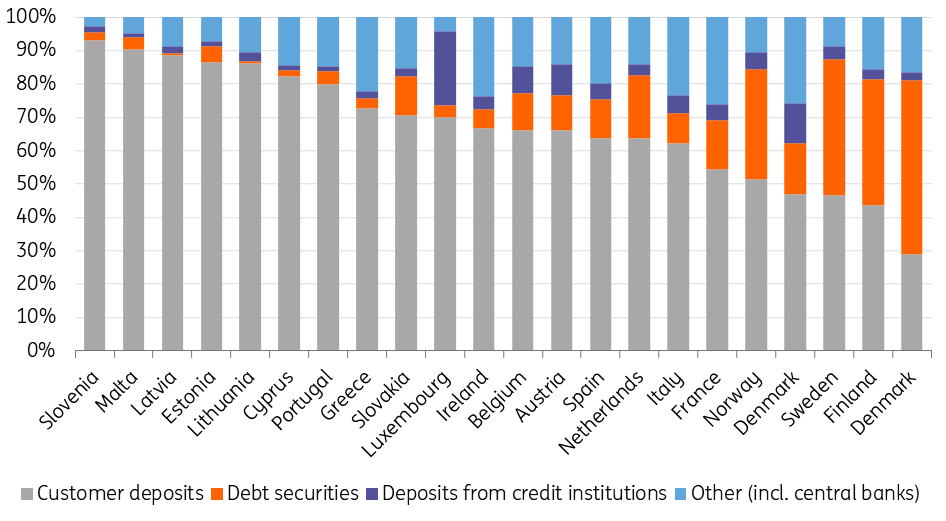

Deposit funding more attractive again

Customer deposits remain the main funding channel for most banking sectors with southern European banks, in particular, relying on deposits as the main funding channel for their lending. Nordic banks have traditionally relied heavily on other types of funding such as debt market financing. Dutch and German banks have relatively high loan-to-deposit ratios in a European comparison.

Loans-to-deposits ratios

Deposits provide banks with a relatively stable type of funding and they tend to reprice at a more modest pace than wholesale funding rates. In an environment with rising rates, lending rates generally rise faster than deposit rates. This supports the development of the net interest margins and net interest income. Banks with a larger share of deposit funding stand to benefit the most. Instead, banks that rely on wholesale markets for funding are looking at substantially higher funding costs with bank bond yields across the liability structure seeing a steep rise this year. A large part of bond market funding is done with a fixed coupon, but large banks are frequent bond issuers, meaning that the increase in funding costs will come through bond by bond when old bonds are refinanced at higher rates.

Bank funding differences

Conclusion

The move higher in underlying rates supports net interest income with higher net interest margins. Banks with a larger share of floating-rate loans in their books stand to benefit. We believe that, on balance, the net impact is positive, ie the revenue boost is enough to compensate for higher edging loan loss provisions. A deposit-driven funding model and a lower loan-to-deposit ratio are likely to be positive in an environment with rising rates. Banks that rely on bond markets for funding are looking at much higher funding costs for new bond issuance.

Banks with a larger share of their lending tied to shorter rates should stand to benefit from higher market rates. In case of a larger share of long interest rate fixing periods, banks will see the impact of higher market interest rates come through only over a longer timeframe.

Banks in Finland, the Baltics and Sweden have a very high share of mortgages that are tied to shorter rates, followed by southern European countries. By comparison, the bulk of mortgages in French, Belgian, German, or Dutch banks have been tied to longer rates in the past. Swedish and Benelux banks are more geared towards shorter corporate loans. The longest corporate loans are in banks in Cyprus, France and Germany. In general, we think southern European banks are more likely to be impacted quickly by higher rates than their peers in the Netherlands, France or Germany.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Bank Outlook 2023Download

Download article

1 November 2022

Banks Outlook: The major challenges and opportunities for 2023 This bundle contains 8 Articles