Bank Outlook 2023: Another bumper year for bank bond supply

Looking into 2023, financials' bond supply is likely to face another strong year. In volatile market conditions, the funding split is likely to remain geared towards tighter spread funding alternatives including covered and preferred senior, and once the market conditions improve, loss absorption eligible paper will see more activity

2022 was a strong supply year

Financials bond supply has reached €437bn year-to-date in 2022, ahead of €348bn in 2021 YTD. There are several reasons for the active presence of banks in the new issuance market. The European Central Bank’s third Targeted Longer-Term Refinancing Operation (TLTRO-III) funding operation is reaching its maturity, and banks are looking into refinancing part of these balances. Worries over the economic outlook together with the jump in inflation and interest rates have led banks to lock in still relatively attractive yield levels for longer-term funding.

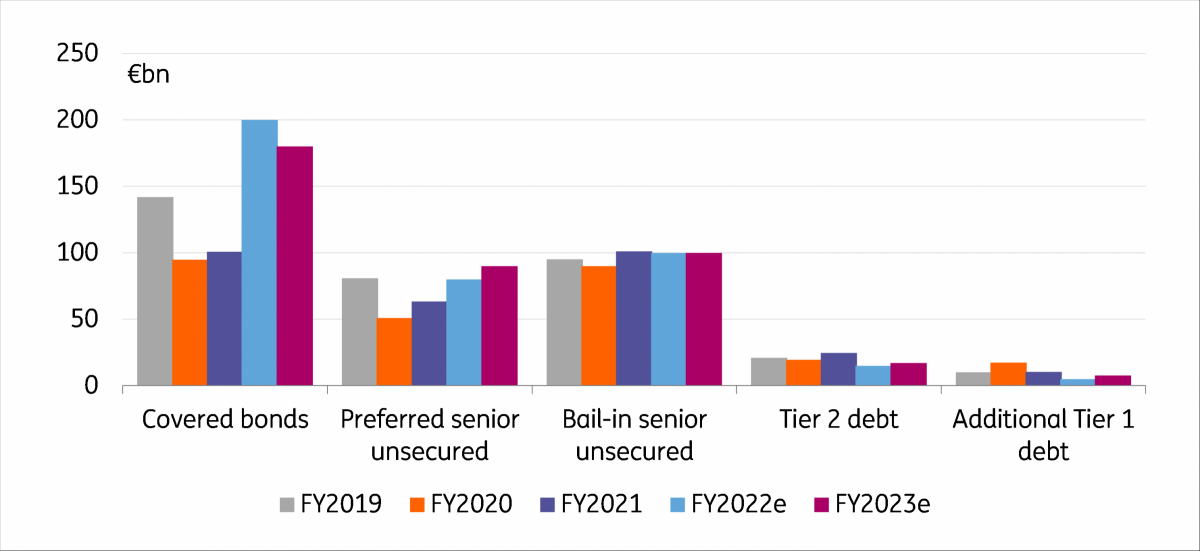

The increase is especially driven by bank funding products, while capital issuance has been pressured by the volatile market conditions. Bank bond supply in 2022 runs clearly ahead of 2021 with the YTD print at €374bn, more than €110bn ahead of the €266bn realised at the same time in the previous year. Bank net supply turned positive at the end of the year.

The massive moves in the funding costs have resulted in banks sticking to the cheapest funding products: the covered bond supply at €192bn is the main driver for the jump in bank bond issuance. Of the unsecured debt products, preferred senior debt at €69bn is €16bn ahead of 2021, while bail-in senior at €93bn is in line with 2021. The market moves have limited the most subordinated debt (T2 and AT1) issuance which is €11bn behind 2021 and unlikely to reach last year’s levels this year. Financial services are down from last year, while insurance supply has been relatively stable YoY.

Bank bond supply

The ECB moves to tame the TLTRO programme

Bank funding has in recent years relied heavily on central bank funding. The third Targeted Longer-Term Refinancing Operation (TLTRO-III) is reaching maturity with €1,490bn of its outstanding balances maturing in the course of 2023. Some of the funds will be paid back prior to maturity. The ECB announced changes to the terms of the TLTRO-III programme in its October meeting, meaning that the costs of the programme for banks will increase.

From 23 November 2022 and until maturity or early repayment date, the TLTRO interest rate will be indexed to the average applicable key ECB interest rates over this period. The change means that the cost of the TLTRO tranches for banks that have met the lending benchmarks will move to at least 1.5% after 23 November (to the level of the deposit rate as of 2 November), but the level for the remainder of any tranche will most likely be higher than this as the ECB continues to hike rates. Until 23 November banks can enjoy the very attractive rates based on the average during the life of the tranche until that date. The ECB also offers banks additional voluntary early repayment dates.

The change in the funding programme means that not all banks are in a similar position. Banks that have increased their longer-term funding due to the programme will have more difficulties paying them back early as opposed to those names that have utilised the funding more in an opportunistic fashion in shorter-term commitments.

While the cost of the operation will become higher for banks, the levels compare attractively with bond market yields

While the cost of the operation will become higher for banks, the levels compare still relatively attractively with bond market yields due to the substantial repricing of underlying interest rates this year. Most covered instruments trade with yields closer to 2.8% in the 2024 maturity bucket, while preferred senior is quoted even at higher yield levels than this (around >3.6%). Thus, while the ECB has changed the conditions, we don’t foresee the change to result in massive early repayments for banks that use the operations for funding. Instead, these banks are likely to consider the benefits of retaining more liquidity, especially considering the substantial volatility in the financial markets and worries over the economic outlook.

For banks that have drawn funds more opportunistically, the question is less straightforward. While you can continue depositing the funds back at the deposit rate to the ECB, the TLTRO drawings have a negative impact on for example MREL or leverage ratio metrics. That said, the costs of holding on to the funds do not seem surmountable to us, at least for now. Paying back early would decrease liquidity buffers at the time of substantial stress in the financial markets. Some banks will drive down these buffers to pay back early while others may choose to wait. Massive early repayments still this year are, for these reasons, perhaps less likely in our view.

Average yields for bonds maturing in 2024

TLTRO-III programme redemptions to drive down liquidity ratios

The maturing TLTRO will pressure bank liquidity metrics in 2023. To pay back the TLTRO funds banks can utilise existing (liquidity) resources, issue new debt or increase deposits among others. Using existing liquidity is likely the first method to look at.

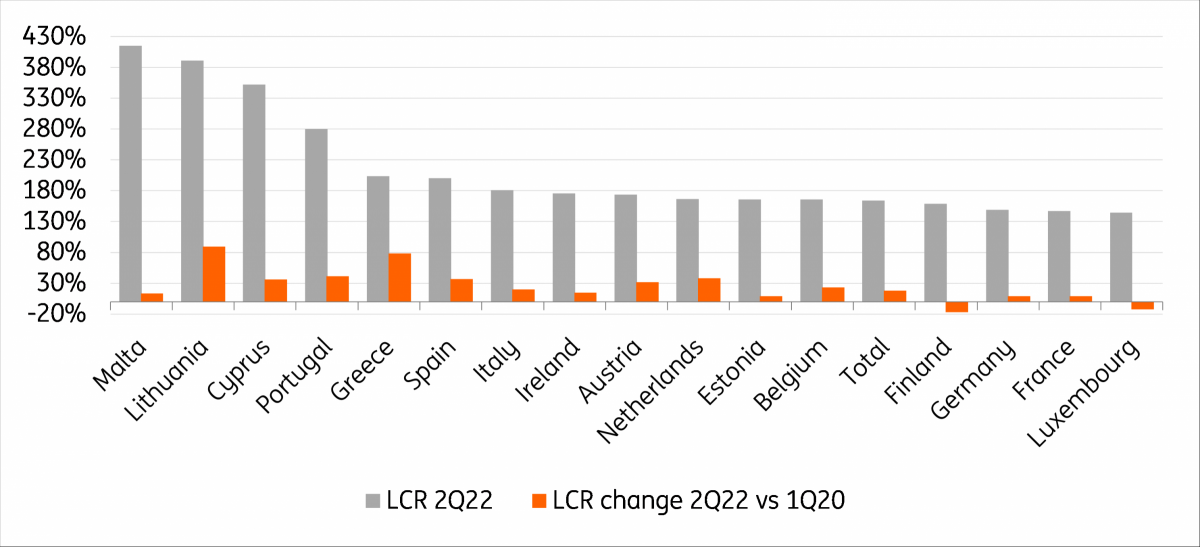

111 significant institutions under the Single Supervisory Mechanism had a liquidity coverage ratio (LCR) of 164.4% in 2Q22, down from 173.5% in 4Q21. In 1Q20, ie, before the allotment of the largest tranche in the TLTRO-III programme, the LCR ratio was 146.6%. The numbers point to a substantial improvement in the liquidity position of banks. The sample of banks with the LCR data is not identical to banks that have utilised the TLTRO operations. We consider that it provides a good general understanding of the position of banks using TLTRO funds.

LCR ratios by country

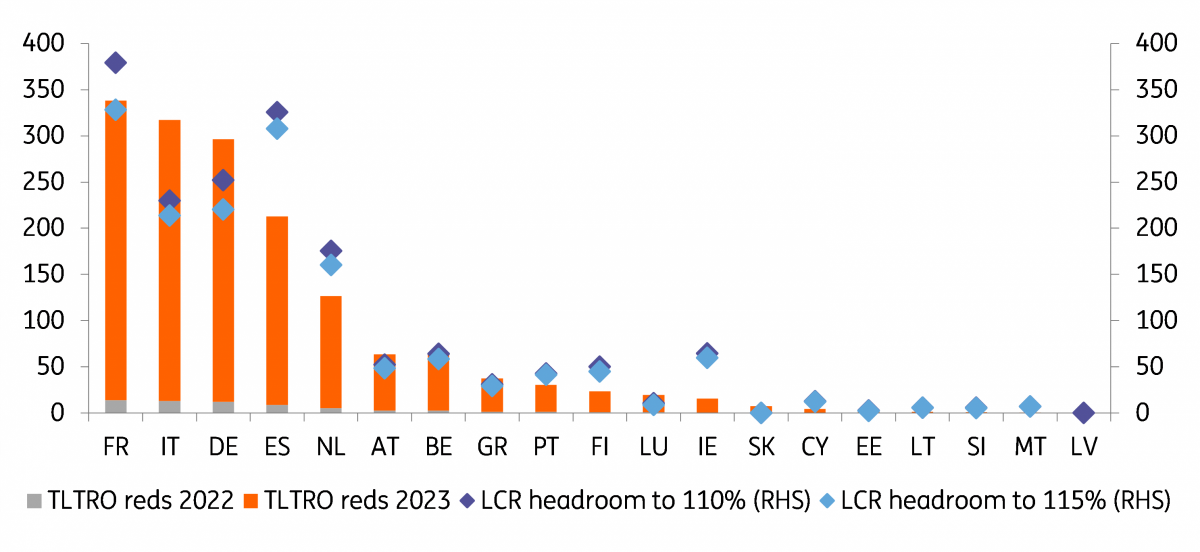

If banks were to retain at least a 110% (or alternatively 115%) LCR level, the headroom with the current buffers would amount to some +€1,700bn (+€1,500bn) for this group of banks. We consider that due to the particularities of different banking systems, it seems more likely that the “normal” level of the LCR could be different for different banks. If comparing for example with the LCR level in 1Q20, ie, before the large TLTRO allotments, in 2Q22 these banks exhibited some €570bn headroom on top of the 2Q20 LCR ratio, other things being equal.

The TLTRO-III maturities in 2022 and 2023 amount to €63bn and €1,490bn, respectively. Part of the funds are likely to be paid back with the excess liquidity balances. The differences across countries are large. Comparing the LTRO drawings and liquidity across countries, we note that the larger LTRO users, especially Italian and German banks, would feel the pressure to find other funding solutions outside existing liquidity reserves.

TLTRO redemptions in 2022-2023 vs LCR headroom to 1Q20 levels

Another large supply year ahead for banks

While the TLTRO redemptions cannot be completely refinanced with existing liquidity balances, part of the problem may be fixed by other factors. As the outlook for lending growth has taken a considerable turn towards weaker conditions, part of the funding solution may well come from a more modest lending-driven funding need. Furthermore, we expect that banks will try and seek to decrease their loan-to-deposit ratios, by especially increasing deposits in their funding palette.

For 2023 we forecast a total of €465bn in financials supply

For 2023 we forecast a total €465bn in financials supply, of which €215bn in unsecured format. Net bank bond supply is set to increase to around €95bn with lower bond redemptions. Covered bond supply will see a slight decrease from 2022 to €180bn in 2023. Bank senior supply is likely to edge higher to €190bn in 2023. Our estimates incorporate an assumption that the split between preferred and bail-in senior debt sees a slight tilt higher in preferred senior debt versus bail-in senior debt. Covered and to a lesser extent also preferred senior debt are used for TLTRO refinancing.

For the bulk of banks, the minimum requirements for own funds and eligible liabilities (MREL) remain another considerable issuance driver in 2023. In addition to any potential (although perhaps not very strong) lending or RWA growth, redemptions drive MREL issuance in 2023. Furthermore, some banks have not yet met their full MREL requirements set for the beginning of 2024.

According to the Single Resolution Board (SRB), as of 1Q22, the aggregate MREL shortfall for resolution entities to their 2024 MREL targets amounted to €36.7bn including the combined buffer requirement, corresponding to some 0.5% of RWA. The largest share of the shortfall was in smaller non-Pillar 1 banks. On a country basis, the largest shortfalls were in Greece (€11.6bn), followed by Italy (€7.9bn), Spain (€4.3bn) and Portugal (€3.9bn). Pointing towards challenges in reaching the targets, in 1Q22 the MREL eligible issuance of Greek and Portuguese banks was zero. We don’t think the situation has since then greatly improved due to the difficult market conditions. For smaller banks to be able to meet their MREL requirements, an improvement in the funding conditions is a necessity.

Financials supply estimates

Call those bonds

While we contemplate there to be some pent-up supply in bank capital, the issuance remains very much driven by refinancing and market conditions. We have pencilled in a small negative for bank capital net supply. We consider for Tier 2 paper the likelihood of calls to be relatively high, especially for larger banks.

Higher refinancing costs may have a larger impact on AT1 paper instead. The number of AT1 bonds callable in 2023 is not huge, but it includes several lower-rated banks that may struggle with refinancing unless market conditions improve. While most of the calls are in the second half of the year, which is also when we expect market conditions to improve, two banks have their first AT1 call dates in 1H23 and one bank has another chance to call its AT1 in April. We consider these deals to exhibit higher extension risk in volatile market conditions. Most AT1 calls are, however, only in the second half of 2023, which is when we also expect to see the spread conditions normalise.

Life after the TLTRO-III

The ECB has made it clear that it prefers that banks start to pay back TLTRO funds. Spiking spread and yield levels have made it more difficult for banks to obtain funding at attractive levels. Larger, stronger-rated banks are better positioned to obtain funding, while smaller, lower-rated banks are likely looking at more challenging funding conditions.

If the market conditions remain challenging going into June 2023, when the fourth tranche matures, the ECB may feel forced to provide an opportunity for banks to roll their remaining LTROs at maturity but at (considerably) less attractive conditions. This would be to support access to (long enough) funding for the weaker parts of the banking system in an environment of higher spreads and higher yield levels. In the case of not-so-generous terms, the stigma may well make a comeback to central bank funding.

Conclusion

Financial bond supply is likely to see another bumper year in 2023. The bulk of the TLTRO-III funding programme matures in the course of 2023, driving bank supply. Not all TLTRO drawings will be refinanced via bond markets. Instead, banks will utilise their excessive liquidity buffers for the purpose together with changes in loan-to-deposit ratios. Covered and senior supply remains on high levels, although edging somewhat down YoY. Bank capital issuance is supported by redemptions. While volatile market conditions may make it more difficult for (smaller) banks to refinance the upcoming AT1 calls especially in 1H23, we expect most banks to refinance and call their notes in 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Bank Outlook 2023Download

Download article

1 November 2022

Banks Outlook: The major challenges and opportunities for 2023 This bundle contains 8 Articles