Negative rates to continue clouding the banking outlook in 2021

Eurozone banks will suffer from the negative rates environment in 2021, due to the monetary stance of the ECB. The vulnerability of banks to negative rates depends on their loan book composition including interest rate reset periods and their funding mix. Deposit rates have a natural lower bound, which makes them less attractive in a negative rates space

The Covid-19 crisis has resulted in a substantial weakening of the economic outlook in the eurozone with the European Central Bank responding with an extensive set of new measures in 2020. The low rates environment is by no means new, with the 3-month Euribor dipping below 1% in 2009 due to aggressive ECB reference rate cuts and slipping into negative territory in 2015 following the negative ECB deposit rate in 2014. As a consequence of the accommodative monetary policy stance, the 3-month Euribor has dropped below the ECB deposit rate, with the overnight index swap contracts pricing in an ECB rate cut in the next 12 months.

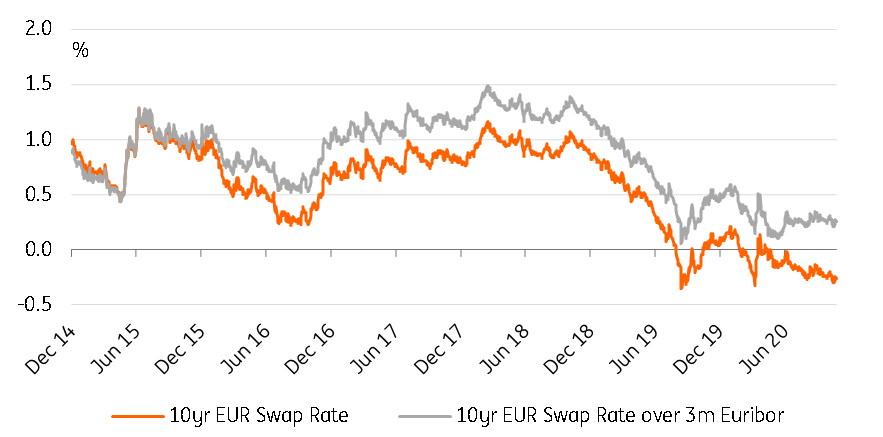

The 10-year EUR swap rate is hovering around -25 basis points and the low level paints a dark picture of the European rates outlook with markets expecting short rates to stay, on average, at negative levels for the next decade. The swap curve has flattened in the past years and the difference between the 10yr swap rate and 3m Euribor has shrank by 50bp since end-2014.

Swap curve has flattened since 2014

The low or lately even negative rates environment will continue to take its toll on European banks and their revenue-generating possibilities. Low or even negative rates pressure the margins banks can realise on their interest-bearing assets.

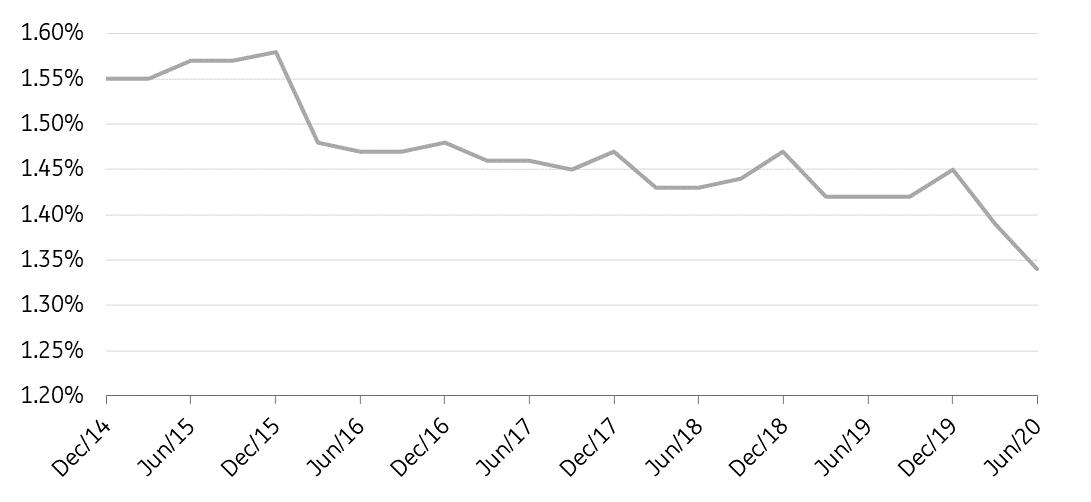

Net interest margin development for EU banks

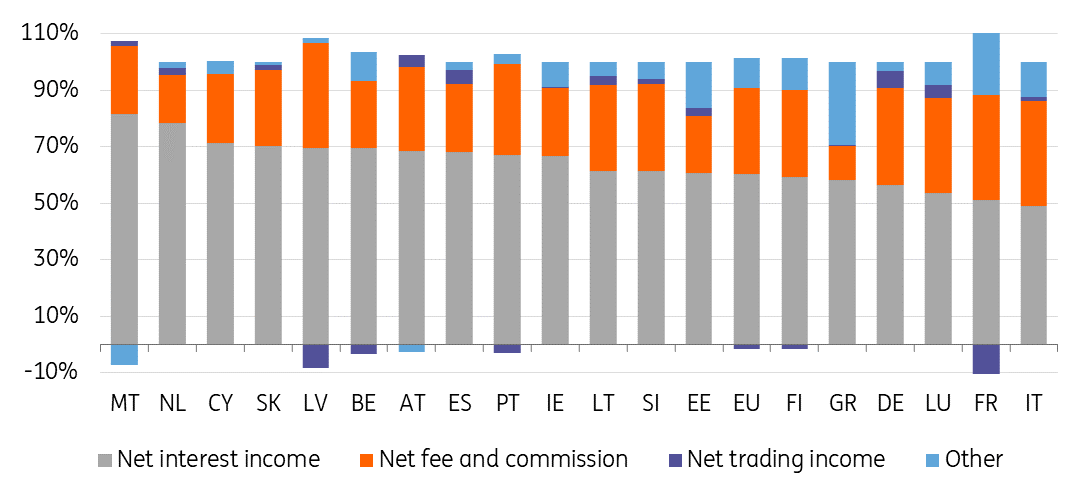

That said, the effect is not similar for everybody. While the share of net interest income of total revenues has remained relatively stable over time for EU banks, country differences are substantial.

EU banks: Revenue split since 2014

For banks in the Netherlands, Belgium, Austria or Spain the importance of net interest income as a total revenue driver is more significant than for banks in Italy, France or Germany. The difference is likely driven by the latter banks’ higher exposure to insurance and asset management businesses.

Importance of net interest income as a revenue driver per country

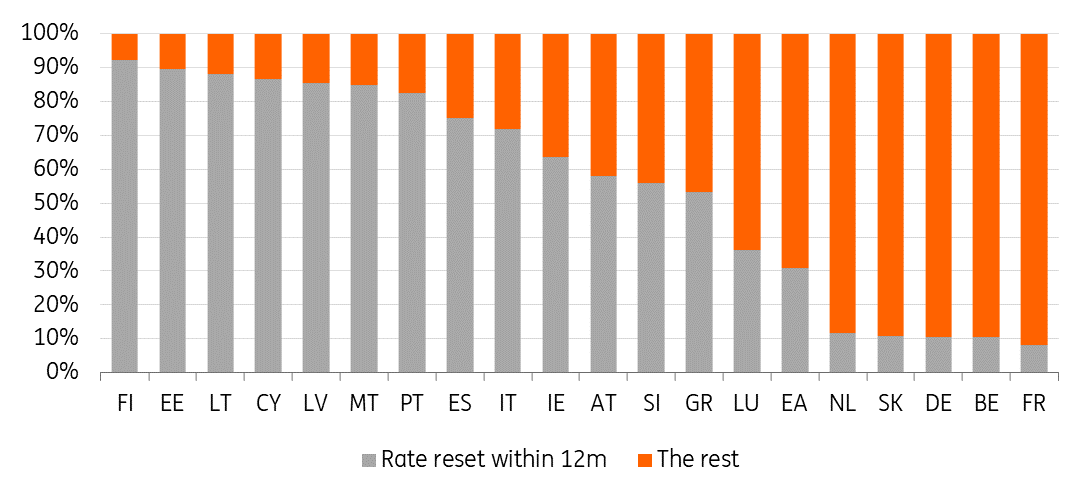

Furthermore, banks which have granted more loans tied to short-term rates as opposed to longer rates may be more sensitive to any changes in interest rates. Loan books with a larger share of long-term interest rate fixing periods instead are less sensitive to changes in rates.

Banks in France, Belgium, Germany and the Netherlands are among those with the largest shares of household loans with the next rate reset in more than a year's time. Instead, banks in Finland, Spain and Italy are among those with a relatively higher share of household loans with the next interest rate reset within the upcoming 12 months.

Euro area periphery is also among those with a higher share of short-term household loans than the eurozone average.

Household loans’ interest rate setting period

For corporates, the ECB instead reports maturity 'buckets' - splitting loans by loan maturities.

The share of corporate loans with a maturity of more than five years is among the highest in Germany, France, Finland and Austria. Italy and Spain are among countries that are positioned above the eurozone average in terms of the share of corporate loans with maturities below five years.

The statistics point towards German and French banks to be among the best positioned for a scenario with a longer period of low rates in terms of their loan books and also taking into account the relatively low importance of net interest income to their revenues. Banks in Spain and Italy are instead among those with a higher share of shorter loans on their books, with Spanish banks more reliant on net interest income than their Italian counterparts.

In addition to the effects on loan books, low rates make it more painful for banks to reinvest their maturing bond portfolios.

Maturity of non-financial corporate loans

The funding mix

The loan book split is only part of the rates sensitivity picture; the funding mix is another important driver. Banks take part in maturity transformation by attracting short-term funding (mainly deposits) and granting longer-term loans, resulting in a shorter duration of their liabilities than their assets. Thus, their liabilities are likely to react faster to changes in rates than their assets.

Most banks’ household and corporate businesses are, to a substantial part, deposit funded with the EU average of the loan to deposit ratio at 116%. Banks in the eurozone periphery have lower than average loan to deposit ratios with their loan books being particularly financed via deposits. The same can be said for Belgium and Austria.

Banks in Finland, Germany and the Netherlands have loan to deposit ratios which are higher than the EU average as these banks rely more heavily on other types of funding including bonds.

Loan to deposit ratios by country

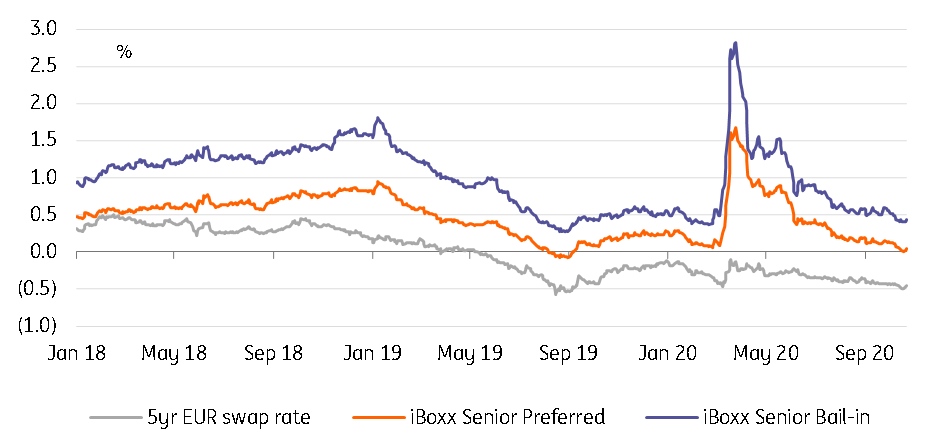

Generally, deposits are considered a solid and sticky funding source limiting banks’ exposure to volatile funding markets. However, in the current market environment with declining rates and senior bond yields, a larger share of bond market funding could actually act as a benefit for banks. Banks with higher loan to deposit ratios could benefit faster from lower funding costs as bond yields do not have a similar lower bound as deposit rates and bond yields are likely to fall in an environment of declining rates.

Bank bond yield development

Deposit rates have a more natural lower bound than bond yields. Even if negative deposit rates are getting more common for wholesale clients and also lately for larger retail accounts, imposing them on smaller retail clients is still something that has been considered a no go area for most banks. The share of household deposits of the total deposits is substantial especially in countries such as Greece, Germany, Belgium and Italy, while corporate deposits play a somewhat larger role in the Netherlands and France.

Share of Households of total household and NFC deposits

In the eurozone, 85% of household deposits are either overnight or redeemable with a notice of less than three months. Belgium, Finland and Italy especially have a high share of very short-term household deposits, while Greece, Austria and France have some more deposits with either a maturity of less than two years (GR, AT) or above 2 years (FR).

While we expect household deposits to remain one of the main funding sources for banks, the negative rates environment is likely to limit growth in this segment in certain areas.

Household deposits split

The share of overnight deposits for corporates is high

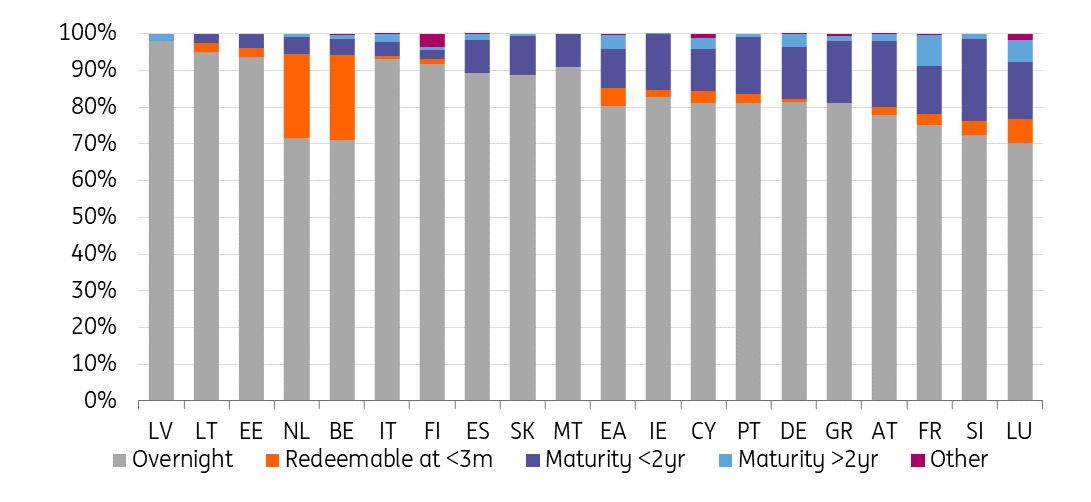

Also for corporate deposits, the share of overnight deposits is high with the eurozone average at 80%.

From a funding angle, we consider banks in the Netherlands, Spain and Italy to be the best positioned to weather low or negative rates, with high loan to deposit ratios and relatively short deposit interest rate-setting periods

The Benelux countries have the highest shares of overnight deposits and deposits with a notice period of less than three months. Corporate deposits are somewhat longer in countries such as France, Austria, Greece and Germany. From a funding angle, we consider banks in the Netherlands, Spain and Italy to be the best positioned to weather low or negative rates, with high loan to deposit ratios and relatively short deposit interest rate-setting periods. Of these countries, Spain and Italy stand to benefit the most from the ECB targeted longer-term refinancing operations as compared to their bond market funding pricing.

Corporate deposit split

Net interest margins

Net interest margins have been under pressure for the whole sector within the EU tightening towards 1.3%, 20bp lower compared with September 2014 or 10bp lower than in September 2018. As a comparison, since September 2018 the 10-year EUR swap rate has declined by 125bp and since September 2014 by 140bp.

The net interest margin decline has been particularly faster than the EU average in Greece, Spain and Italy. Banks in these countries have relatively low loan to deposit ratios. In addition, they are less reliant on bond market funding than core banks. Furthermore, Italian and Spanish banks, in particular, have perhaps on average shorter interest rate resetting periods and shorter average maturities on their lending books. These factors may allow for lower rates dripping through at a quicker speed on the asset side with the liabilities side being perhaps slightly stickier, despite the obvious help from the TLTRO funding operation.

We consider these banks to continue to be especially sensitive to further declines in interest rates. One mitigating factor for banks is the other side-effect of low rates policies. Low rates support loan quality, and for banks such as these with larger relative NPL stocks, this is especially important.

Net interest margin and change since September 2018

The changes in the net interest margins have instead been smaller (or for some even positive) for among others, banks in Germany, Belgium, Finland and the Netherlands. The net interest margins in these countries are already quite compressed. In addition, with the exception of Belgium, banks in these countries have high loan to deposit ratios with a larger focus on market funding including bond markets.

With the exception of Finland, banks have relatively long term loan books slowing down the effects of declining interest rates. Net interest income is a very important revenue driver for banks in Belgium and the Netherlands, while banks in Finland and Germany have a larger share of other types of income.

We consider banks in these countries may be more vulnerable to flattening yield curves (excluding here any effects from interest rate hedging policies). That said, the effect of low rates may come through more slowly into their revenues, and eventually the longer the low or negative rates remain, the larger part of their longer-term books are being repriced at lower levels, locking in these low rates for a long time to come.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Banks Outlook 2021Download

Download article

30 October 2020

Banks Outlook 2021 This bundle contains 9 Articles