Bank of Thailand likely to maintain its hawkish rhetoric

The central bank's easing cycle may have ended but there are no compelling reasons for the policy interest rate to rise anytime soon

The Bank of Thailand Monetary Policy Committee meets tomorrow on November 8. We now share the consensus view that there will be no change to monetary policy this year, or indeed through 2018. Recent strong activity data, especially firmer industrial production growth suggesting that export recovery is finally stimulating manufacturing, led us to revise our BoT policy forecast, which until a month ago was in a consensus minority of a 25bp rate cut before end-2017.

We have also recently revised our GDP growth forecast for this year to 3.7% from 3.5% (cons: 3.5%, BoT: 3.8%). An on-hold policy decision means all the action will be in the policy statement for what it says about the future direction of interest rates.

Recent statements have been generally hawkish and we do not expect the upcoming one to be any different.

However, these statements haven’t been convincing enough that the next move in the policy rate, currently 1.50%, will be up. Not in the medium-term, at least. Growth has been picking up, but in a disproportionate recovery, hopes of export strength broadening to domestic spending remain in vain.

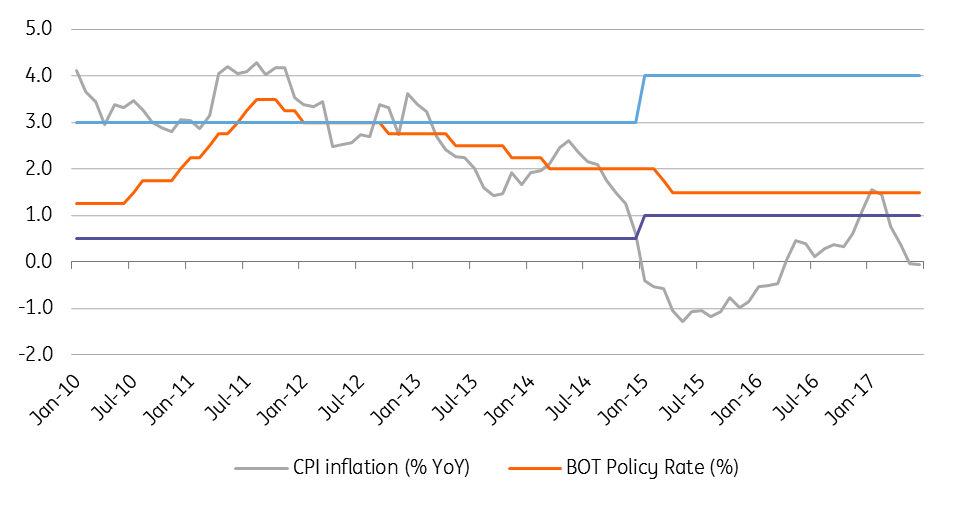

Inflation remains well below the Bank's target

Thailand isn’t an outlier in the prevalent global trend of accelerating growth without stoking inflation. The BoT recently cut its inflation forecasts to 0.6% from 0.8% for 2017 and to 1.2% from 1.6% for 2018.

There is no spending-driven price pressure while the strong Thai Baht (THB) has kept imported inflation (where oil-related factors have a key role to play) at bay. With this, the BoT’s 1-4% inflation target remains a far cry. The BoT has been under pressure from the government to curb THB appreciation to preserve the export-led recovery.

End of the one-way downtrend in USD/THB

After strong appreciation against the USD earlier this year, the THB has been under a stable-to-mild-depreciation trend since September that will likely see 33.0 to be the solid support level for USD/THB in the near-term. Our end-2017 USD/THB forecast is 33.50 (spot 33.2, consensus: 33.3).

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).