Bank of Russia cuts rates by 100bp, guides for more

The Bank of Russia aggressively cut the key rate from 5.50% to 4.50% today, and the guidance suggests that some scope for further cuts remains. Based on CBR communication and cross-country comparison, another 50 basis point cut is highly likely this year. If CPI continues to underperform the 4.0% target, the key rate may fall to 3.5-4.0% in 4Q20 or 2021

| 4.50% |

Russian key ratedown from 5.50% |

| As expected | |

CBR makes an aggressive cut and maintains dovish guidance

The Bank of Russia cut the key rate from 5.50% to 4.50%. This move is in line with the consensus forecast, though we were leaning towards the conservative side of the 50-100bp range, thinking that the CBR would prefer to make smaller cuts while maintaining significant room for further reductions.

The key rate guidance is slightly less aggressive than before, noting that the Bank of Russia "will consider the necessity of further key rate reduction at its upcoming meetings" after previously saying it "holds open the prospect of further key rate reduction at its upcoming meetings". In CBR language it means that the step of the next cut is hightly likely to be smaller and the so is the likelihood for an immediate cut at the next meeting.

Nevertheless, the content of the communique is still dovish, as the CBR mentions that:

- short-term pro-inflationary pressure related to market volatility and panic stockpiling is over

- CPI, currently at 3.1% year-on-year, will move higher due to base effects, but will be pressured by weak demand and the recent ruble appreciation; the GDP drop in 2Q20 may be deeper than initially expected (though annual GDP guidance is unchanged at -4-6%). Importantly, the CBR dropped the previous 3.8-4.8% YoY CPI expectation mentioned at the time of the previous decision

- there are significant risks of CPI underperforming the 4.0% target in 2021 due to the above-mentioned disinflationary factors.

Following the decision, the CBR governor reiterated a cautiously dovish signal, suggesting some scope for further rate cuts (though not necessarily at the very next meeting) with the key points being:

- Today's 100bp step is extraordinary and should not be taken as a new normal;

- CPI is headed towards the lower bound of the earlier CBR forecast of 3.8-4.8% at year-end 2020

- The CBR may slightly lower its estimate of the equilibrium rate range from the previous 6-7%, however, it is unlikely that the new estimate will be lower than 5%. We remain of the view that the actual rate can go below the equilibrium range when monetary policy is accomodative (which it is now).

Cross-country comparison confirms further downside to Russian key rate

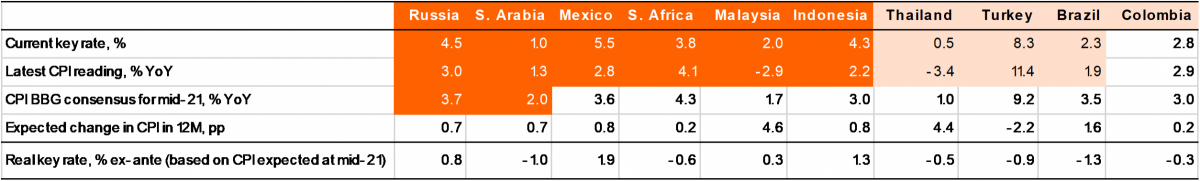

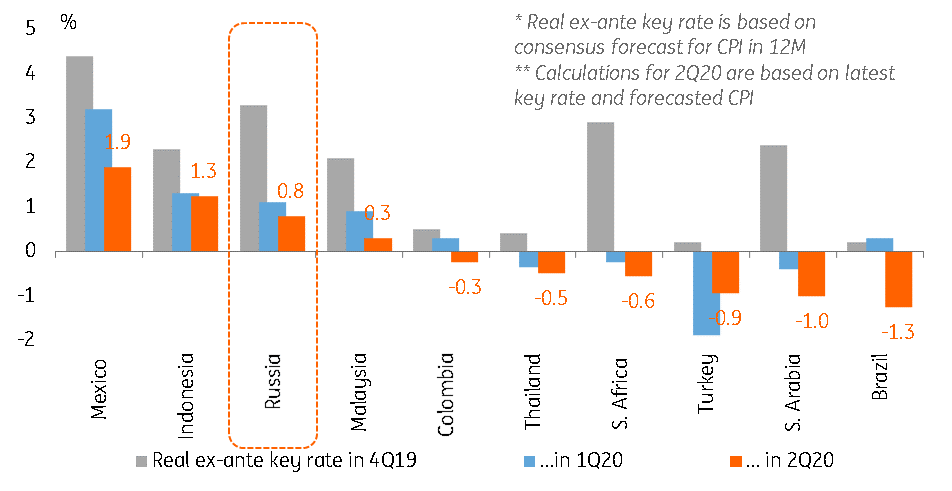

From the real rate perspective, the Bank of Russia's monetary policy approach has eased materially since the beginning of the year but based on cross-country comparison there is still around 0.5 percentage point downside to the current real rate without sacrificing Russia's relative attractiveness to portfolio investors and without the real rate turning negative (to which the CBR seems to be vocally averse).

- With CPI at mid-year 2021 expected at 3.5-4.0% by the market, the current real key rate in Russia is 0.5-1.0% (Figure 1). Given the recent CPI dynamics we do not exlude that inflationary expectations can go lower. As a reminder, at the time of the CBR's April decision, the 12-month CPI expectations were close to 5.0%.

- The current real rate is lower than the 1.0-1.5% seen ahead of the CBR's April decision and significantly lower than 3.0-3.5% at the beginning of the year. Still, with the real rate range for EM/commodity peers also down year-to-date, Russia remains in the upper half of the comparative range, which is now between Brazil's -1.3% and Mexico's +1.9% (Figure 2). For now, the downward real rate trend remains uniform among Russia's peers with Turkey being the only exception.

Figure 1: Real key rate by country

Figure 2: Russian real rate is down but still comparatively elevated

Adjusting the key rate outlook

Today's decision and the overall tone of the CBR communication suggests that there is further room for a cut in the key rate, supported by a weak economic performance, below target CPI, and the example of Russia's emerging market peers. While previously we saw the key rate floor at 4.0-4.5% for 2020-21, this view is too conservative. A further cut of 50bp from the current 4.5% level now seems to be the base case for 2020, but additional cuts are also possible for 4Q20 and 2021 if CPI shows signs of sustained underperformance to the targeted 4.0%.

For now, we assume 3.7% YoY CPI growth in 2021, although this forecast is highly uncertain given the still-volatile external markets, as well as the local economic performance and fiscal response. The announced fiscal stimulus for 2020 has so far been modest, at 3.5% GDP, but it may have to be increased if household income, consumption (data for April-May to be released later today), and approval ratings remain under pressure.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article