Bank of England: Three things to watch this week

Policymakers are likely to reiterate their fairly relaxed attitude to the rise in gilt yields when they meet this week. However we may see some tentative pushback against the idea of multiple rate hikes over the next two-to-three years, as markets are beginning to factor in

A cautiously upbeat tone on the economic outlook

Back in February, the Bank of England unveiled a set of forecasts that could be described as ‘cautiously optimistic’, and there’s little to suggest that message will change this month.

The vaccine programme is poised to more-or-less double in pace over the next week, following a delivery of 10m additional AstraZeneca doses. That will potentially enable all adults to receive a first dose by early June, which bodes well for the April and May stages of the reopening plan (the ambition to essentially end social distancing in June is more uncertain).

Meanwhile, the extension of various support schemes in the latest budget should help limit the rise in unemployment this year. While we think the Bank’s view could turn out to be a little over-optimistic (they expect the economy to return to pre-virus levels around the turn of the year), it does suggest very little need to look at negative rates or a significant extension in the quantitative easing scheme later this year (a small boost is possible depending on market conditions). Indeed, with a couple of exceptions, we still sense limited enthusiasm among policymakers to pursue further rate cuts.

A message to markets: Don't get ahead of yourselves on rate hikes

This cautiously upbeat outlook has also led the Bank of England to take a relaxed attitude towards the recent rise in yields over recent weeks. Governor Andrew Bailey has said this simply reflects stronger optimism. Unlike the European Central Bank, that suggests the BoE will offer little pushback against these moves at the meeting this week.

Having said that, the rise in yields came in tandem with a marked change in the way markets are looking at future rate prospects. There's a view (shared by us) that the window to introduce negative rates has probably closed, unless downside risks in the form of vaccine-resistant Covid strains firmly materialise.

The rise in long-dated GBP rates will not meet strong resistance from the BoE, but the re-pricing at the front-end will

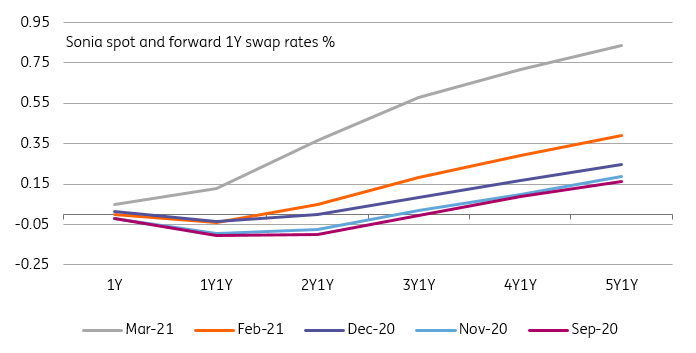

The end result is a Sonia swap curve that is pricing over 50bp of hikes from the BoE within three years. Governor Bailey has already, tentatively, tried to temper front-end rates’ optimism, though to no avail so far. He recently offered a ’note of realism’ that the economy is starting from a ‘lower level of activity’. A similar warning is likely at this meeting, in order not to trip up the recovery in its first, uncertain, steps.

Ultimately, we don't expect to see rate hikes before 2023, though remember the Bank has hinted that it's tempted to begin reducing its pool of bonds accumulated through various rounds of QE, at an early point in the next tightening cycle.

What does all of this mean for rates markets? The backdrop of the current rates re-pricing matters of course. At its root, both economic optimism and investors falling out of love with long-dated bonds are trends that started in the US. If the relevance of the former is more debatable for the UK (we expect less of a lasting inflation boost), the latter is highly contagious from one market to the next. Investors tend to form their view of the riskiness of bond markets on a global basis, and gilts have been far from immune.

If recent comments are any guide, the rise in long-dated GBP rates will not meet strong resistance from the BoE, but the re-pricing at the front-end will get more attention. The end result is an even steeper curve.

Sonia swaps: goodbye cuts, hello hikes

The Bank’s new ‘green’ mandate

The biggest change since the Bank’s February meeting is that it has a new mandate, which formally requires it to “reflect the importance of environmental sustainability and the transition to net-zero”. In practice, there are two probable routes the Bank could take here.

Firstly, policymakers have signalled changes to the corporate bond (CB) purchasing scheme. For reference, the Bank is no longer actively expanding its CB holdings, and is simply reinvesting to maintain a stock of £20bn. According to our Sector Team, the most obvious way of ‘greening’ the scheme would be to gradually target a greater proportion of reinvestments towards high-ESG scoring issuers (our team recently wrote in more detail how the ECB might achieve something similar).

However, this does come with a couple of potential logistical challenges. Firstly, our team would argue that, in the context of a fairly illiquid market, the central bank risks creating a substantial premium for green bonds, amplifying what is already a crowded trade. Secondly, the way ESG scores are formulated varies considerably between different providers, which may imply the Bank will need to formulate its own criteria for what does and doesn’t constitute eligibility.

Separately, the BoE could also look at adjusting its Term Funding Schemes to help incentivise green forms of lending. The most recent use of the scheme has been to offer cheap financing to Banks which increase lending to SMEs.

That all being said, we don’t expect to hear a great deal more on this topic at this meeting.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article