Bank of England set for 25bp hike barring further turmoil

Despite encouraging signs that inflationary pressures are easing, we think the Bank of England will probably opt for one final 25bp hike on Thursday if it can, though that's undoubtedly contingent on what happens in financial markets. Remember that the BoE has set a much lower bar for pausing hikes than the likes of the Fed and ECB

Inflation data has been encouraging though we think the BoE will want to see more

Last month the Bank of England signalled it might finally be done with tightening, or at least that it was close. The Bank said it would monitor indicators of “inflation persistence”, which is code for being less swayed by month-to-month swings in single data points and is trying instead to get a sense of overall price-setting behaviour.

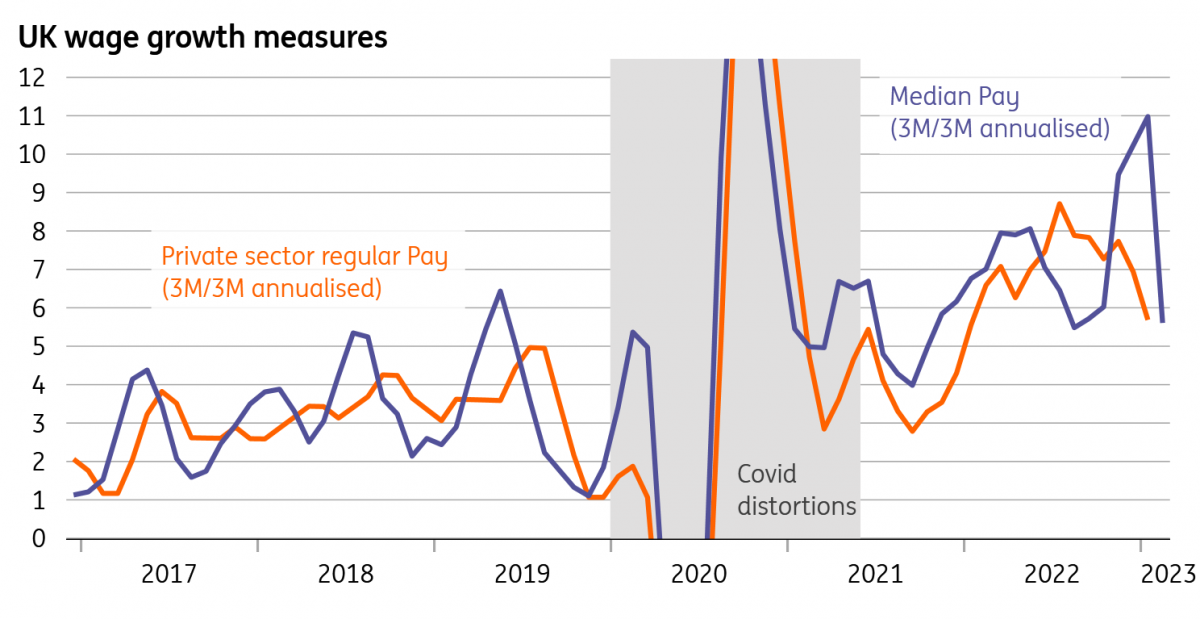

Policymakers did indicate that the burden of proof was on seeing signs that inflation was firmly easing before stopping tightening. And by and large, that is what the data has shown since the February meeting. Wage growth, according to the latest official three-month annualised figures, may finally be slowing, though it’s early days. The Bank’s own Decision Maker survey, which we know policymakers put a lot of emphasis on, has shown that firms expect to make less aggressive price increases in coming months. Perhaps most importantly, core services inflation took a nose-dive in January – though we’ll have to wait and see whether this is replicated in the most recent data due a day before the BoE decision is announced.

In short, there are encouraging signs that inflation is genuinely starting to ease. Not only are improved supply chains and lower consumer demand keeping a lid on goods price inflation, but lower gas prices should help take the pressure off the service sector, too. Until the recent turmoil in financial markets, we weren’t convinced all of this would be enough to stop the Bank from implementing one final 25bp hike, but assuming the trends continue, the committee should be eminently comfortable with pausing by the May meeting.

UK wage growth appears to be finally easing

This week's decision is on a knife edge

We’re still narrowly leaning towards a hike this week, though clearly, a lot can change in the days leading up to the meeting. One thing that’s clear from recent communications is that the bar for pausing rate hikes is much lower at the BoE than at the European Central Bank. Policymakers have been clear that most of the impact of past hikes is still to hit, which is partly a function of the low prevalence of variable rate mortgages in the UK.

On the flip side, last September/October’s UK market volatility after the ‘mini budget' saw the BoE use targeted measures to address financial stability issues. The purpose of those measures was not just to get to the root cause of the problem, but also to allow monetary policy to remain focused on tackling inflation. The result was the Bank was buying government bonds (albeit temporarily) while simultaneously promising bold interest rate hikes.

A calmer financial market backdrop would keep a 25bp hike on the table

We suspect that the philosophy of at least trying to separate inflation fighting and financial stability still prevails today, and this was also a line adopted by ECB President Christine Lagarde in her most recent press conference.

In short, the meeting is on a knife edge and to a large extent it will come down to whether stability in financial markets starts to return. A calmer financial market backdrop would keep a 25bp hike on the table. Further volatility could easily see a ‘no change’ decision, with non-committal guidance that further hikes could be enacted if the situation changes.

Either way, expect the committee to remain heavily divided. We could easily have a scenario whereby external MPC member Catherine Mann votes for a 50bp hike this week, while the doves, including Silvana Tenreyro and Swati Dhingra vote for no change, or perhaps even a rate cut. As in past meetings, we expect the ‘centrist’ five to six members (including Governor Andrew Bailey) to vote largely together.

Liquidity and volatility in sterling rates is much less concerning than during the mini budget debacle

End of cycle dynamics to accelerate gilt yield drop to 3%

The pick-up in gilt volatility has not been as spectacular as that of treasuries and bunds this past week. The reason is twofold. First, the UK is perceived to be better insulated to banking troubles hitting other jurisdictions, especially the US. Secondly, markets had already integrated the BoE’s message that this cycle is nearing its end. Taken together, we think the drop in gilt yields ‘in sympathy’ with its peer is justified, although it can be expected that more stable market conditions in the coming days would also help retrace the recent drop in yields. Overall, the recent crisis reinforces our view that 10Y gilt yields are headed to 3% by late-2023/early 2024.

The pick-up in gilt volatility has not been as spectacular as that of treasuries and bunds

As in every bout of market volatility, questions are legitimately being asked about the sustainability of quantitative tightening. It is true that, as the spring budget confirmed, FY 2023-24 will result in a £200bn draw on private investors. We are confident that this extra demand will materialise but, combined with the progressive reshuffling of gilt holdings, this will likely come with periods of instability. That being said, gilts have been comparably stable in recent weeks: less volatile than treasuries and bunds, and much less than during the mini-budget debacle last year. This justifies our call for the BoE staying the course, for now.

FX: BoE not a major factor in the short term

Our base case for a 25bp rate hike by the BoE would come as a hawkish surprise given market pricing is leaning more in favour of a hold, but market conditions suggest that would not be enough by itself to trigger a GBP rally. We have seen the pound perform better than the euro during recent turbulence in the banking sector despite having a generally higher beta to risk sentiment. One way of looking at this is that investors may see the UK banking sector as less vulnerable than the eurozone. This theory could be put to the test this week as stress to AT1 bondholders after the UBS-Credit Suisse deal seems to be weighing on UK institutions’ shares.

GBP/USD remains a pure risk sentiment story: the ability of central banks and regulators to calm markets is what will determine whether the pair can test the January 1.2450 highs. EUR/GBP was largely driven by ECB-BoE policy divergence before the banking turmoil and will for now be driven by incoming news about the resilience of the respective financial systems. Once the dust settles, we think the BoE’s earlier pause compared to the ECB will ultimately favour a gradual EUR/GBP rally to the 0.9000 area.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article