Bank of Canada preview: Pausing, but still in pole position for tightening

We expect the BoC 9 June meeting to be quite uneventful and to have a contained market impact. The Bank’s concerns about a slower recovery should be offset by the fast vaccination campaign in Canada. We expect more tapering at the July meeting, which should allow CAD to trade below 1.20 in the summer

Fast vaccination roll-out keeps the outlook bright

While the pandemic continues to pose major challenges for Canada – a third wave of infections prompted renewed Covid containment measures in April – the economic outlook for the second half of the year is undoubtedly brightening. As such the Bank of Canada remains on track to taper its asset purchases again in July, conclude the QE programme at year-end, and then raise interest rates in the second half of 2022.

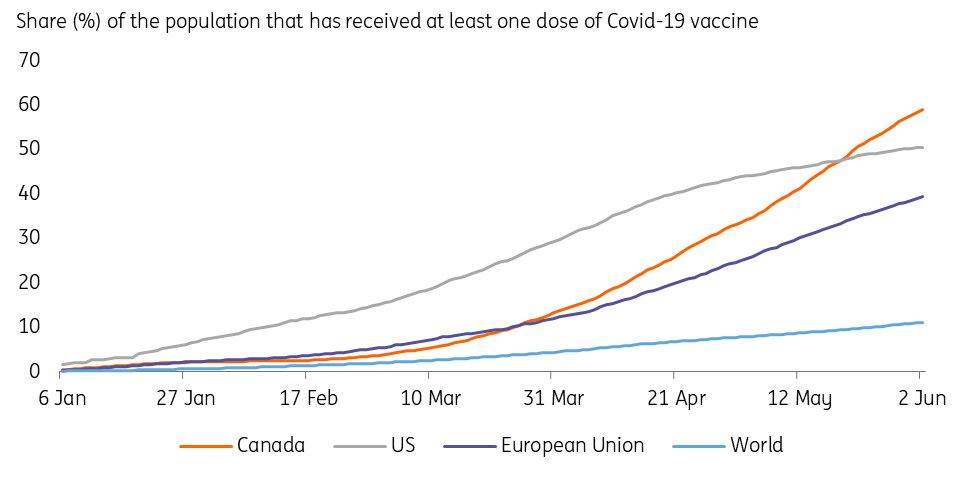

Admittedly 1Q GDP was a touch softer than expected and April and May activity data will be hampered by the constraints from Covid containment, but things are changing rapidly. The vaccination programme has been astonishingly successful over the past two months. The proportion of people having received at least one dose of the Covid vaccine has surged from below 15% at the beginning of April to overtaking that of the US at 60% today. This has been the result of the Canadian government’s strategy to delay second doses hoping that the immunization provided by first doses will allow to contain hospitalizations.

The number of Covid cases is indeed dropping fast in response and we expect the bulk of the recently imposed restrictions to be eased just ahead of the summer vacation season. This should allow a broad re-opening of the service sector, which should rebound sharply and complement the vigorous growth experienced in the manufacturing, construction and commodity sectors.

Employment has also stalled recently, but again we suspect the strong growth outlook means that both all of the lost GDP output and jobs will be fully recovered in the third quarter. This vigorous growth story, supported by additional fiscal support, together with supply constraints implies rising inflation pressures. Already the headline rate is at 3.4% and rising while core rates are at or around 2%.

A quiet June meeting, but BoC on track to taper again in July

We do not expect this policy meeting to deliver any substantial surprise for markets. After shifting to a hawkish bias at the April meeting, the data flow in Canada has on balance been neutral for rate expectations. The table below shows the key data releases between the April, June and July meetings.

That said, with the economic damage of the recent containment measures still to be fully addressed, there is hardly any rush on the side of the BoC to double down on its hawkish message just yet. We expect a reiteration of the message included in the April policy announcement: forward guidance for the first hike in late 2022 and the Bank remains ready to adjust the pace of asset purchases if economic conditions improve further.

We expect this upcoming meeting to pave the way for a third taper to C$2bn in July with it reduced to zero by year-end

We remain of the view that the BoC is going to be at the forefront of the global rate tightening cycle. They have already announced two QE tapers, firstly cutting weekly asset purchases from C$5bn to C$4bn last October and then reducing it to C$3bn in April. Even through a broadly unchanged policy message, we expect this upcoming meeting to pave the way for a third taper to C$2bn in July with it reduced to zero by year-end.

We anticipate that the BoC will indeed start lifting interest rates in 4Q22, but they will want to ensure it isn’t “one and done”. Instead this will be the start of a journey with the policy rate expected at 0.5% for end-2022 and 1.25% for end-2023.

CAD: We expect to see levels below 1.20 this summer

The Canadian dollar failed to break below the 1.20 level as the rally that started after the BoC April meeting stalled in May. While an improved momentum for the USD has been a major factor in putting a floor below USD/CAD, evidence from CFTC data (chart below) suggest that a quite overstretched net-long positioning on the loonie contributed to curb CAD gains. We expect to see evidence in positioning data over the coming weeks that some long-squeezing has indeed occurred in CAD.

However, we think USD/CAD downside momentum can gather more pace in the summer, as we expect the Bank of Canada to announce another C$1bn-per-week worth of tapering in July. This should further widen the policy divergence between the hawkish BoC and the dovish Fed, which – as it translates into a real-rate advantage for CAD over USD – should continue to favour downside bets in USD/CAD.

We think that the June meeting will not have major market implications as the BoC looks unlikely to materially deviate from the recent policy tone. However, we don’t think the Bank will do much at this meeting to downplay the prospects of another round of tapering in July, so CAD may exit the rate announcement next week with a bit of extra support.

Markets are already fully pricing in a 25bp rate hike in 2022, but signs of a faster unwinding of asset purchases may keep fuelling expectations that a hike may come earlier next year, which should further improve CAD's rate profile and allow USD/CAD to trade below 1.20 in the third quarter.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article