Bank of Canada hits the peak

The BoC is set to raise rates one last time on Wednesday with a 25bp hike, taking the overnight rate to 4.5%. Economic activity is slowing and inflation is coming down and what is likely to be characterised as a pause for assessment is set to mark the peak for rates. Rate cuts will be on the agenda later in 2023. The initial CAD reaction may be rather contained

| 4.50% |

Interest rate level expected on Wednesday |

BoC set to hike one last time

At a speech on 12 December, Governor Tiff Macklem warned that “if inflation sticks, much higher interest rates will be required to restore price stability”, adding that the “greater risk” is not raising interest rates enough rather than doing too much. Since then inflation numbers have remained elevated with headline CPI at 6.8% and core rates at 5% while the economy added 104k jobs in December, well ahead of the 5k consensus.

However, the outlook is darkening with the housing market coming under real pressure from the rise in mortgage rates. Highly indebted households are, in general, feeling the effects of higher borrowing costs and this is set to weigh heavily on consumer spending this year. Meanwhile, the BoC’s own business conditions survey suggests recessionary forces are building as future sales growth expectations drop to the levels seen during the worst point of the pandemic.

Rate cuts will be on the agenda in late 2023

Consequently, after initially hiking by 25bp before going in 50bp stages and even a 100bp hike along the way, we expect a reversion to a 25bp incremental move on Wednesday. We don’t expect too much in the way of explicit forward guidance from the BoC, but they will emphasise data dependency and an ongoing commitment to achieving the 2% inflation target.

Unfortunately, we expect the economic data to continue softening in response to tighter monetary conditions, lower commodity prices and a weakening US economy. Inflation pressures globally are subsiding and we expect to see interest rate cuts come into the BoC’s thinking from late third quarter onwards.

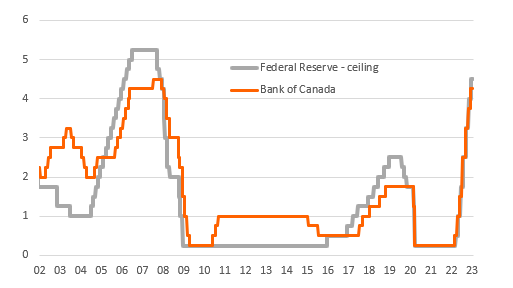

Bank of Canada overnight rate versus US Fed funds target rate (%)

CAD: BoC not a key driver now

Despite the strong jobs market and high inflation backdrop, markets are not fully pricing in a 25bp hike this week. At the time of writing, the OIS curve embeds a 75% implied probability of a hike. However, 25bp of tightening is fully priced in for the March meeting, meaning that the BoC is widely expected to hike at the next occasion should it decide to hold this week.

This means that the market reaction should not be very different if the BoC either: a) hikes by 25bp and signals that rates may have peaked; b) holds rates but signals another hike may be on the cards. Ultimately, barring a very dovish outcome (no hike and claiming that rates have peaked) or a very hawkish one (hike and signal more hikes), the impact on CAD may prove rather short-lived.

Beyond the near term, a BoC-Fed rate gap of -50bp (if the Fed hikes to 5.0%) does limit the downside potential of USD/CAD. However, there is a chance that the Fed cuts rates more aggressively in the second half of the year, and that is when USD/CAD could stabilise on a more solid downward path. Until then, it is possible that CAD may lag other commodity currencies such as AUD and NZD as it can only partly benefit from China’s improved growth story and suffers from domestic and US negative growth re-rating.

A test of 1.3000 in the coming weeks is surely possible in USD/CAD, but would likely be due to either more idiosyncratic USD weakness or rising oil prices.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more