Bank of Canada: Getting ready to hike

In a hawkish shift, the Bank of Canada has decided to end its QE asset purchases immediately and has brought forward its guidance on the first rate hike to mid-2022. With the economy growing strongly, creating jobs and experiencing more sustained inflation, there is the real prospect of 100bp of rate hikes next year, and CAD should remain broadly supported

QE ended and earlier rate hikes signalled

Ahead of the meeting, the expectation was for the Bank of Canada to taper its weekly asset purchases from C$2tn to C$1tn and indicate that they would likely be concluded in December. Instead, we got a decidedly more hawkish outcome with a decision to end QE immediately and forward guidance on the timing of a likely rate hike moved from the second half of 2022 to "the middle quarters" of 2022.

The accompanying statement is very upbeat on both global and domestic economic prospects. Canadian GDP growth is forecast at 5% this year, 4.25% in 2022 and 3.75% in 2023, which is above the economists’ consensus of 5%, 4% and 2.4%, respectively. The BoC expects growth to be supported by strong consumer demand, business investment and a robust US growth story that will boost exports. Remember, too, that the energy sector makes up around 10% of the Canadian economy and the surge in prices will stimulate more drilling.

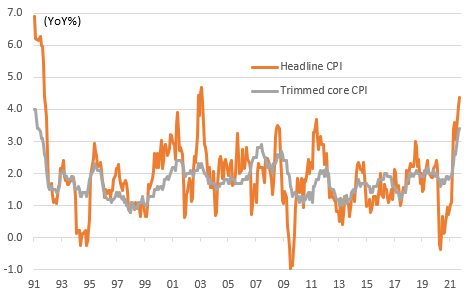

Canada inflation measures (YoY%)

Inflation "stronger and more persistent"

The Bank is also more wary on inflation. September CPI came in at an 18-year high of 4.3% year-on-year, while the core trimmed measure is at a 30-year high, with the statement acknowledging that inflation pressures have been "stronger and more persistent than expected". The BoC highlights labour shortages in key sectors and manufacturing shortages and transportation bottlenecks, with rising energy costs set to further fan the flames.

BoC Governor Tiff Macklem has already admitted that supply chain strains and production bottlenecks “are not easing as quickly as we expected” which means that inflation is “probably going to take a little longer to come back down”.

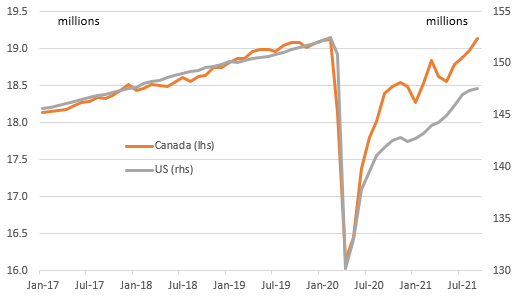

Employment: Canadian jobs market has outperformed the US's with all jobs lost now recovered

100bp for 2022?

We had been looking for two 25bp rates hikes in the second half of 2022, but with three hikes fully priced before today's hawkish shift in commentary, we are going to have to adjust our forecast. Significantly, employment is already at an all-time high, with 900 more people in work in September 2021 than in February 2020 while business surveys suggest a strong appetite to continue hiring. The problem is finding suitable staff.

In an environment of vibrant demand, this runs the risk that wage inflation builds and contributes to more prolonged price inflation in the economy. Consequently, the risks appear to be increasingly skewed towards the Bank of Canada hiking interest rates by a full percentage point in 2022.

CAD: Cementing its role as a popular bullish bet

USD/CAD dropped sharply following the BoC announcement, as the combination of ending QE and bringing forward the timing for a hike to “sometime in the middle quarters of 2022” pushed tightening expectations significantly higher. At the time of writing, the implied probability of a January 25bp rate hike is around 80%, with five rate hikes in total priced in for the next 12 months.

We doubt rate expectations can reasonably get more hawkish than this, but the Canadian dollar has now clearly cemented its role as a very attractive bullish bet, standing on the good side of the energy story and counting on an imminent tightening cycle. We’ll be monitoring positioning indicators closely to see whether the loonie is seeing some overcrowding of speculative buyers.

Looking at CAD’s outlook for the rest of 2021, our view is that we’d likely need to see some deterioration in market sentiment or witness a correction in oil prices for USD/CAD to stage a sustained rebound. That’s because we do not expect the forthcoming data-flow in Canada to be detrimental to the loonie or to cause a significant re-pricing of rate expectations.

We are currently targeting 1.23 in USD/CAD as a year-end forecast, but given the faster-than-expected move by the BoC and seasonal USD weakness in December, we see downside risks (i.e. USD/CAD closer to 1.20) to our scenario.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article