Bank of Canada at the peak

A 25bp rate hike from the Bank of Canada with a pause declared given expectations of a stalling economy and sharply lower inflation. While suggesting they could hike further if required, we expect the next move to be a cut. CAD is understandably weaker after the release, but the medium-term outlook remains constructive

At a peak and then a pause before a cut

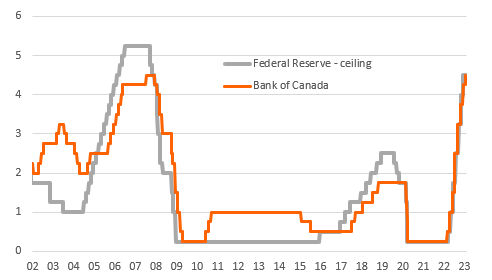

As widely expected, the Bank of Canada raised the overnight rate 25bp to 4.5%. We had suspected that this would be the last hike of the cycle and this has seemingly been agreed by officials. The accompanying statement indicated that “if economic developments evolve broadly in line with the MPR outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases".

They mention the tight labour market and “persistent excess demand” as justification for the latest move, but acknowledge "there is growing evidence that restrictive monetary policy is slowing activity". They expect the economy to "stall" through mid-2023 with full year growth of around 1% while "inflation is projected to come down significantly this year", hitting the 2% target in 2024.

The BoCs tate that they remain “prepared to increase the policy rate further if needed”, with service sector inflation cited as the main concern. But given Canada's high household debt exposure and greater vulnerability to rising interest rates via the mortgage market structure we think the economy and inflation could slow more rapidly than the BoC is currently projecting. Consequently, we think the next move will in fact be an interest rate cut with the potential first easing coming as soon as late in the third quarter.

Bank of Canada versus Federal Reserve policy rates (%)

CAD: Negative reaction, also in USD

Markets interpreted the BoC announcement as a dovish surprise, not because the pricing suggested more tightening, but because of the quite explicit reference to rates being kept at this level open up some room for earlier/more rate cut speculation.

Interestingly, the FX reaction spilled over into USD, which weakened as markets saw a higher risk that the Fed will follow the BoC with a dovish hike next week. This helped keep the USD/CAD jump somewhat contained.

In the near term the USD/CAD bias may shifting to moderately bullish in light of today’s BoC decision and the Federal Open Market Committee risk event next week. However, the longer-term profile for USD/CAD looks likely to stay downward-sloping as USD declines across the board and CAD may benefit from improved risk sentiment. We target 1.27-1.28 by this summer.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article